Finance: Cash Discounts and Terms in Credit Memos

In previous versions of MYOB Acumatica, users had no way to specify the due date in credit memos that were created in the system. As a result, the credit memos that appeared in AR aging reports had due dates that were the same as the report aging date or the document date, depending on the preferences settings. Credit memos could not be used in cash flow forecasting on the Cash Flow Forecast (CA658000) form. Also, users could not specify a cash discount for a credit memo. As a result, if an original invoice with a cash discount was reversed, the created credit memo did not have the cash discount that the invoice had.

To address these issues, in MYOB Acumatica 2024.1.1, administrators can enable the use of credit terms for credit memos, and users can create credit memos with cash discounts.

The following sections describe the UI changes and changes in document processing that have been made to support this functionality.

Changes to the Accounts Receivable Preferences Form

The following UI changes have been made on the General tab of the Accounts Receivable Preferences (AR101000) form:

- In the Data Entry Settings section, the Use Credit Terms in Credit Memos check box (see Item 1 in the following screenshot) has been added. If this check box is selected, users can specify credit terms for credit memos created on the Invoices and Memos (AR301000) form. These credit memos may be subject to cash discounts.

- In the VAT Recalculation Settings section, the Automatically Release Credit Memos box has been renamed to Automatically Release Tax Adjustments (Item 2). The Credit Memo Description box has been renamed to Tax Adjustment Description (Item 3), because now credit memos and debit memos can be generated to adjust taxes if early payments are made.

Changes to the Invoices and Memos Form

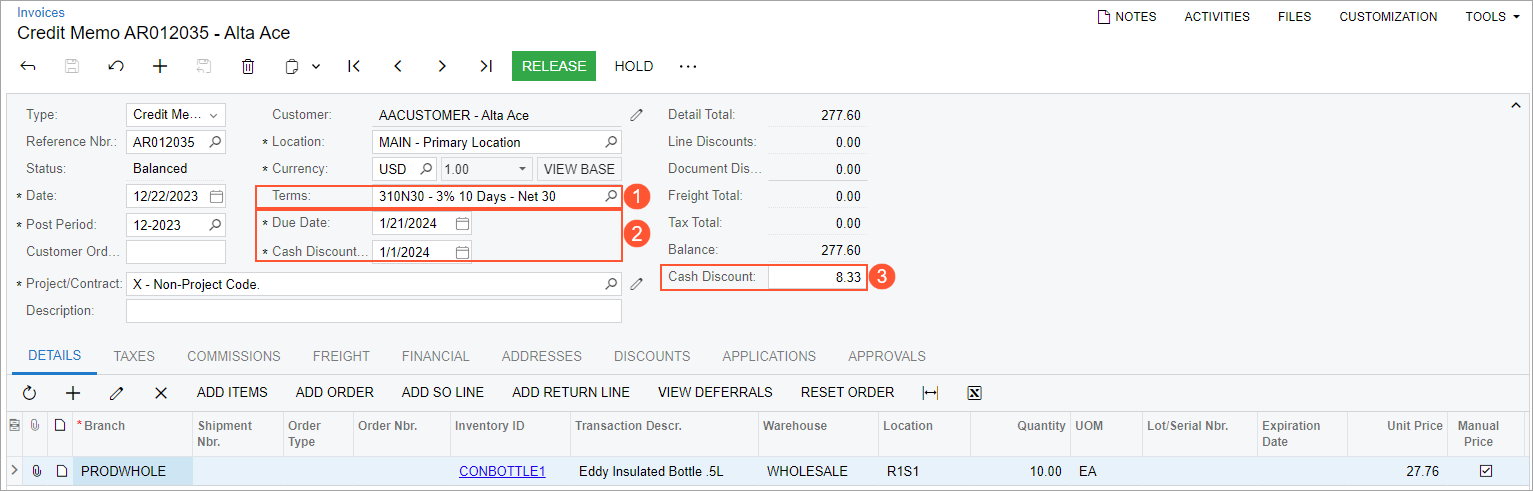

If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences (AR101000) form, a user will see the following changes for a document with the Credit Memo type selected in the Summary area of the Invoices and Memos (AR301000) form:

- The Terms box (see Item 1 in the screenshot below) becomes

available. By default, the system inserts the credit terms assigned to the customer, if

any, on the Customers (AR303000) form, but the user can

override this setting (or clear the box; this setting is optional).

If the Terms box is empty (that is, no credit terms are specified for the credit memo), the system will clear the Due Date and Cash Discount Date boxes, set the Cash Discount box to 0.00, and make these three boxes unavailable.

- The Due Date and Cash Discount Date boxes (Item 2) become available if credit terms are specified for a credit memo. As is the case with invoices, the system calculates the dates in these boxes based on the selected credit terms and the document date.

- The Cash Discount box (Item 3) becomes available. If credit terms with a cash discount are selected in the Terms box, this box displays the cash discount calculated by the system, which will be applied if the document is paid before the Cash Discount Date.

When the user creates a credit memo whether or not the credit terms have a cash discount, they can select the Pay by Line check box for this credit memo. By default, the state of the Pay by Line check box is copied from the customer's settings. If the new credit memo has a cash discount and has the Pay by Line check box selected, the cash discount is distributed equally between the document lines. The distributed value of each line is saved in the database as the cash discount balance.

On the Financial tab of the Invoices and Memos form, the Cash Discount Info section appears for a credit memo (as shown in the following screenshot) if all of the following conditions are met:

- The credit memo has credit terms specified in the Terms box.

- The credit memo has a nonzero cash discount specified in the Cash Discount box.

- The credit memo has a tax applied for which Reduces Taxable Amount on Early Payment is selected in the Cash Discount box on the Taxes (TX205000) form.

The following screenshot illustrates a credit memo with the Cash Discount Info section filled in.

Changes to the Invoices Form

If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences (AR101000) form, the following changes occur for a sales document with the Credit Memo type on the Invoices (SO303000) form:

- The Terms box (see Item 1 in the screenshot below) becomes

available. By default, the system inserts the credit terms assigned to the customer (if

any) on the Customers (AR303000) form, but the user can

override this setting (or clear the box; this setting is optional).

If the Terms box is empty, the system will clear the Due Date and Cash Discount Date boxes, set the Cash Discount box to 0.00, and make these three boxes unavailable.

- The Due Date and Cash Discount Date boxes (Item 2) become available. As is the case with sales invoices, the system calculates the dates in these boxes based on the selected credit terms and the document date.

- The Cash Discount box (Item 3) becomes available. If credit terms with a cash discount are selected in the Terms box, this box displays the cash discount calculated by the system, which will be applied if the document is paid before the Cash Discount Date.

Changes to the Payments and Applications Form

On the Payments and Applications (AR302000) form, if a user creates a refund or a payment and selects a credit memo on the Documents to Apply tab, the system calculates the Amount Paid and Cash Discount Taken and shows these amounts in the line, as shown in the following screenshot.

If the user overrides these amounts, the system checks whether the cash discount entered by the user exceeds the cash discount balance. If it does, the system displays an error message.

If a credit memo applied to a payment has no terms specified or has credit terms without a cash discount, the Cash Discount and Cash Discount Balance columns always contain 0.

If a credit memo is selected on the Payments and Applications form and an invoice or debit memo is applied to it on the Documents to Apply tab, the system calculates the Amount Paid value. The Cash Discount Taken column contains 0 by default, even if the invoice or debit memo has a cash discount. The user can override the Cash Discount Taken amount, which causes the recalculation of the amount paid. The following screenshot shows the two column values for the row.

If the user clicks Auto Apply on the table toolbar of the Documents to Apply tab, and the list of documents contains a credit memo with a cash discount, this cash discount is considered if the cash discount balance is not null and the document's application date is within the cash discount period. The system fills in the Cash Discount Taken column, as shown in the following screenshot.

On the Application History tab of the Payments and Applications form, the following UI changes have been introduced:

- The VAT Adjustment column (see Item 1 in the following screenshot) has been renamed to Subject to Tax Adjustment.

- The VAT Credit Memo column (Item 2) has been renamed to Tax Adjustment.

Changes to the Auto-Apply Payments Form

On the Auto-Apply Payments (AR506000) form, when the user selects the Apply Credit Memos check box of the Selection area, the system includes credit memos in the list of payments that can be applied to invoices. If the automatically applied credit memo has a cash discount, this cash discount is taken into account if the cash discount balance is not null and the document's application date is within the cash discount period.

Changes to the Cash Flow Forecast Form

On the Cash Flow Forecast (CA401000) form and the Cash Flow Forecast (CA658000) report, the system includes credit memo amounts as follows:

- A credit memo with credit terms is shown in the column whose date is the same as the Due Date of the credit memo. If the Due Date is earlier than the Start Date specified in the Selection area, the credit memo is included in the column whose date is the same as the Start Date.

- A credit memo without credit terms has a Due Date that is the same as the document date. The calculated Due Date is shown in the same way as it is for credit memos with credit terms.

The following screenshot illustrates the total balance ($214.55) of all credit memos of AACUSTOMER shown in the 2024-01-21 column.

Changes to the Generate VAT Credit Memos Form

The Generate VAT Credit Memos (AR504500) form has been renamed to Generate AR Tax Adjustments. This form is now used for the generation of both debit memos and credit memos. The following UI changes (also shown in the screenshot below) have been made to the form:

- The Consolidate Credit Memos by Customer check box has been

renamed to Consolidate Tax Adjustments by Customer (see Item 1 in

the screenshot below). If this check box is selected, the system will create one debit

memo for multiple credit memos or one credit memo for multiple invoices and debit memos,

as it is described below. If the table contains multiple documents (any combination of

invoices, debit memos, and credit memos) for the same customer, when the user clicks

Process All on the form toolbar, the system will create the

following documents:

- One credit memo for the selected invoices and debit memos

- One debit memo for the selected credit memos

- The Credit Memo Date box has been renamed to Tax Adjustment Date (Item 2).

The system also includes in the list of documents shown in the table credit memos that were refunded in full within the cash discount period and that have a value-added tax (VAT) reduced based on the cash discount. Credit memos without credit terms are not included in the list of documents because these credit memos have cash discounts of 0.

For each credit memo that the user includes in processing, the system creates a debit memo. If the Consolidate Tax Adjustments by Customer check box is selected, one debit memo will be created for all selected credit memos. In the debit memo, by default, the system inserts the credit terms copied from the customer's settings into the Terms box of the Invoices and Memos (AR301000) form. If the credit terms are configured with a cash discount, this setting will be ignored, and the debit memo will be created without the cash discount. That is, it will have the following settings:

- A Cash Discount Date that is the same as the Due Date

- A Cash Discount of 0

For the created VAT credit memos and VAT debit memos, the system uses the description specified in the Tax Adjustment Description box on the Accounts Receivable Preferences (AR101000) form.

Changes to the Journal Vouchers Form

On the Journal Vouchers (GL304000) form, suppose that a user adds a new line to the table. In the Tran Code column, if the user selects a transaction code that has AR in the Module column and Credit Memo in the Module Tran. Type column of the lookup table, the system does the following:

- If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences (AR101000) form, inserts the credit terms from the customer's settings in the Terms column and makes the Terms, Due Date, Cash Discount Date, and Cash Discount columns available. The user can override the credit terms or clear any of the columns.

- If the Use Credit Terms in Credit Memos check box is cleared on the Accounts Receivable Preferences form, leaves the Terms column empty and makes the Terms, Due Date, Cash Discount Date, and Cash Discount columns unavailable.

Changes to the Process Bank Transactions Form

On the Process Bank Transactions (CA306000) form, a user can now select a Disbursement bank transaction and link it to a credit memo with a cash discount on the Create Payment tab. When a user processes the records on this form, the system will create an AR refund and apply it to the credit memo. If the application date is within the cash discount period of the credit memo, the cash discount will be applied.

Credit memos with cash discounts are shown on the Match to Invoices tab of the form. Users can use this tab to match credit memos to Receipt bank transactions. This is required if the company receives payments for invoices and credit memos together and the total amount of the invoices exceeds the total amount of the credit memos.

Changes to the Generate Payments Form

On the Generate Payments (AR511000) form, if a credit memo appears in the table and is processed when the user clicks Process or Process All, the credit memo is applied to a payment with a cash discount if the credit memo has a cash discount balance and the payment date is within the cash discount period.

Changes to the Release AR Retainage Form

On the Release AR Retainage (AR510000) form, when the system creates a retainage credit memo, it fills in the credit terms as follows:

- If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences (AR101000) form, the credit terms are copied from the customer's settings.

- If the Use Credit Terms in Credit Memos check box is cleared, no credit terms are specified.

Other UI Changes

The following UI changes have also been implemented to ensure consistency between AR and AP forms:

- On the Checks and Payments (AP302000) form, the following UI

elements on the Application History tab have been updated:

- The VAT Adj. hidden column has been renamed to Tax Adjustment.

- The VAT Adjustment column has been renamed to Subject to Tax Adjustment.

- On the Accounts Payable Preferences (AP101000) form, the VAT Adjustment Description box on the General tab has been renamed to Tax Adjustment Description.

- The Generate VAT Adjustments (AP504500) form has been renamed to Generate AP Tax Adjustments. In the Selection area of this form, the

following UI elements have been updated:

- The Consolidate VAT Adjustments by Vendor check box has been renamed to Consolidate Tax Adjustments by Vendor.

- The VAT Adjustment Date box has been renamed to Tax Adjustment Date.

Changes to the Insertion of Credit Memo Settings

When a user creates a credit memo on the Invoices and Memos (AR301000) form by copying an existing credit memo, the system inserts the settings as follows:

- If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences (AR101000) form, the Terms value on the Invoices and Memos form is copied from the original document, if terms have been specified; otherwise, the Terms value is copied from the customer's settings. The values in the Cash Discount Date, Due Date, and Cash Discount boxes are calculated based on these terms. All these boxes are available.

- If the Use Credit Terms in Credit Memos check box is cleared on the Accounts Receivable Preferences form, the Terms, Cash Discount Date, and Due Date boxes are empty on the Invoices and Memos form, and the Cash Discount box contains 0.00. All these boxes are unavailable.

When the user creates a credit memo by reversing an invoice or debit memo, the system inserts the settings as follows:

- If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences form, the Terms, Cash Discount Date, Due Date, and Cash Discount settings of the Invoices and Memos form are copied from the original document, and these boxes are available.

- If the Use Credit Terms in Credit Memos check box is cleared on the Accounts Receivable Preferences form, the Terms, Cash Discount Date, and Due Date boxes of the Invoices and Memos form are empty, and the Cash Discount box contains 0.00. All these boxes are unavailable.

Changes to the Processing of Sales Orders

On the Sales Orders (SO301000) form, the following changes to the processing of sales orders have been introduced, depending on the settings of the order type:

- If on the Order Types (SO201000) form, the

AR Document Type box contains Credit Memo, the system

fills in the credit terms for a new sales order of this type on the

Financial tab of the Sales Orders

form as follows:

- If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences (AR101000) form, the system inserts the default credit terms (if any) copied from the customer's settings; these terms can be overridden by the user.

- If the Use Credit Terms in Credit Memos check box is cleared, the Terms box on the Financial tab of the Sales Orders form is empty and unavailable for editing.

If a user prints a sales order of this type by using the Sales Order (SO641010) report, the credit terms of this sales order are shown in the printed report. The due date and cash discount date are not printed.

- If on the Order Types form, the AR Document

Type box contains Invoice/Credit Memo for this order type, the system

allows lines with a positive and negative quantity in the sales order. Also, a sales

invoice or credit memo (depending on the sign of the order total) can be created for the

sales order on the Invoices (SO303000) form. If a

sales invoice is created for a sales order, the credit terms are copied from the sales

order to the sales invoice. If a sales credit memo is created, the system fills in the

credit terms as follows:

- If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences form, credit terms are copied from the sales order.

- If the Use Credit Terms in Credit Memos check box is cleared, the Terms box of the Summary area of the Invoices form is empty in the credit memo. That is, the credit terms in the sales order are ignored by the system.

Changes to the Processing of Dunning Letters

Credit memos are listed in dunning letters with their full amount, even if they have cash discounts. In other words, a cash discount does not reduce the amount of a credit memo included in a dunning letter.

When a dunning letter is printed on the Print/Release Dunning Letters (AR522000) form, the system populates the due date of each listed credit memo as follows:

- If the credit memo has no credit terms, the Due Date column is always empty.

- If the credit memo has credit terms, the Due Date column shows Current if the document is not overdue or the due date if the document is overdue.

If the user clicks View Dunning Letter on the table toolbar of the Print/Release Dunning Letters form, the Dunning Letter (AR306000) form is opened. In the table of this form, the system populates the due date of each listed credit memo as follows:

- If the credit memo has no credit terms, the Due Date column is always empty.

- If the credit memo has credit terms, the Due Date column shows the document's due date.

Changes to the Processing of Customer Statements

Credit memos that have been created on the Invoices and Memos (AR301000) form are listed in customer statements with their full amount, even if they have cash discounts. In other words, a cash discount does not reduce the amount of a credit memo included in a customer statement.

When a customer statement is printed on the Print Statements (AR503500) form, the due date is printed for credit memos with credit terms. For credit memos without credit terms, the due date is not printed.

Depending on the state of the Age Credits check box on the Accounts Receivable Preferences (AR101000) form, credit memos are included in statement buckets as follows:

- If Age Credits is selected, credit memos with credit terms are

included in the bucket related to the due date if Age Based On is

set to Due Date on the Statement Cycles (AR202800) form

or related to the document date if Age Based On is set to

Document Date.

Credit memos without credit terms are included in the bucket related to the document date.

- If Age Credits is cleared, whether or not credit memos have credit terms, the system defines the bucket by deducting amounts from the aging bucket amounts starting from the rightmost column. The remaining amount is shown in the Current bucket if the customer's balance is negative.

Changes to the Calculation of Salesperson Commissions

On the Calculate Commissions (AR505500) form, the cash discount taken of a credit memo is excluded from commission calculation when the system calculates the commission amount if all of the following conditions are met:

- On the Accounts Receivable Preferences (AR101000) form, Salesperson Commission By is set to Payment.

- The credit memo has a cash discount and has been applied to a payment within the cash discount period.

- The credit memo contains lines with a salesperson specified for whom commission has been configured.

Suppose that the commission percent is 2%, a $1,000 credit memo with a $30 cash discount is fully paid, the Paid Amount is $970, and the Cash Discount Taken is $30. In this case, the amount deducted from the commission is calculated as $970 * 2% = $19.40.

Changes to the Billing Processes

If the Use Credit Terms in Credit Memos check box is selected on the Accounts Receivable Preferences (AR101000) form, credit memos will be generated with credit terms copied from the customer record. This rule is applied to the processes that the user runs on the following forms:

- Customer Contracts (CT301000)

- Bill Expense Claims (EP502000)

- Run Service Order Billing (FS500600)

- Run Appointment Billing (FS500100)

When the user runs the billing process on the Run Project Billing (PM503000) form, credit memos are generated with credit terms copied from the project record if specified; otherwise, they will be copied from the customer record.

Changes to the AR Aging Reports

Credit memos with credit terms specified are displayed in the following AR aging reports as described:

- AR Aging (AR631000), AR Aging MC (AR631100), AR Aging by Project (AR631200), AR Aged Period-Sensitive (AR630500), AR Aged Period-Sensitive by Project (AR630600): Regardless of the status of the

Age Credits check box on the Accounts Receivable Preferences (AR101000) form, the system shows the due date in

the Due Date column of the report. The system determines the aging

bucket in either of the following ways:

- If the Age Credits check box is selected, the date that the system will use to determine the aging bucket (the Current column or one of the Past Due columns) is determined based on the customer's statement cycle settings on the Statement Cycles (AR202800) form. If the Age Based On box contains Due Date, the system will use the due date. If the Age Based On box contains Document Date, the system will use the document date.

- If the Age Credits check box is cleared, the system will use

the Age as of Date report parameter on the applicable report

form to determine the aging bucket.

For the AR Aged Period-Sensitive and AR Aged Period-Sensitive by Project reports, the end date of the Financial Period parameter will be used to determine the appropriate aging bucket.

- AR Coming Due (AR631500) and AR Coming Due MC (AR631600): Regardless of the status of the Age Credits check box on the Accounts Receivable Preferences form, the system shows the due date in the Due Date column. The system determines the aging bucket in either of the following ways:

- If the Age Credits check box is selected, the date that the system will use to determine the aging bucket (the Past Due column or one of the Coming Due columns) is defined based on the customer's statement cycle settings on the Statement Cycles (AR202800) form. If the Age Based On box contains Due Date, the system will use the due date. If the Age Based On box contains Document Date, the system will use the document date.

- If the Age Credits check box is cleared, the system will use the Age as of Date report parameter on the applicable report form to determine the aging bucket.