Projects and Construction: Expense Refunds to Corporate Credit Cards

Employees can pay for expenses either with their own money or by using a corporate credit card. By using corporate credit cards, employees can categorize and track the expenses in MYOB Acumatica, including the expenses related to a project. For example, while in the field, the workers of a construction company or professional service provider can buy something that they want to charge to a project and pay for it with a corporate card.

In previous versions of MYOB Acumatica, users could not process a refund of expenses that had been paid with the corporate card. MYOB Acumatica 2024.1.1 provides support for negative expense receipts paid with corporate cards. With this support, an employee enters and processes a negative expense receipt to make a full or partial refund to the corporate card. A company accountant will later match the expense documents to card statement records to reconcile the balance of the card with the balance of the corresponding GL account.

Entry of a Negative Expense Receipt

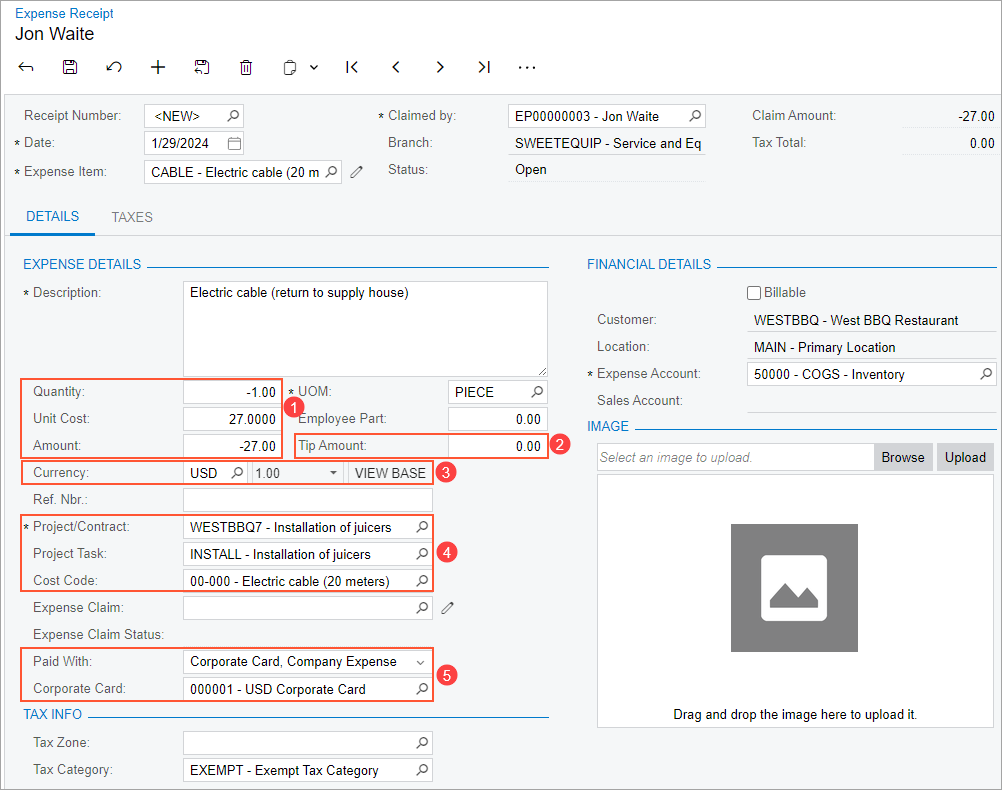

To process a refund to a corporate card, a user creates an expense receipt on the Expense Receipts (EP301010) form and specifies the following information on the Details tab:

- Amount: A negative amount, which is the amount to be returned to

the corporate card, expressed as a negative value. (See Item 1 in the screenshot

below.)

The user can do one of the following:

- Enter a negative amount in the Amount box.

- Enter a negative quantity in the Quantity box and a positive unit cost. The system will calculate a negative amount in this case.

Note:If the expense receipt is subject to taxes, the system calculates a negative tax amount for a negative expense receipt. - Tip Amount: The amount of nontaxable tips that has been previously included in the amount paid with the corporate card, expressed as a negative value (Item 2).

- Currency: The currency of the refund, which can be the card currency or a foreign currency (Item 3).

- Project/Contract, Project Task, and Cost Code: The project, project task, and cost code that have been specified in the expense receipt for which the refund is being created (Item 4).

- Paid With: Corporate Card, Company Expense, which indicates that the refund will be performed to the company's card (Item 5).

- Corporate Card: The number of the corporate card to which the refund should be performed (Item 5).

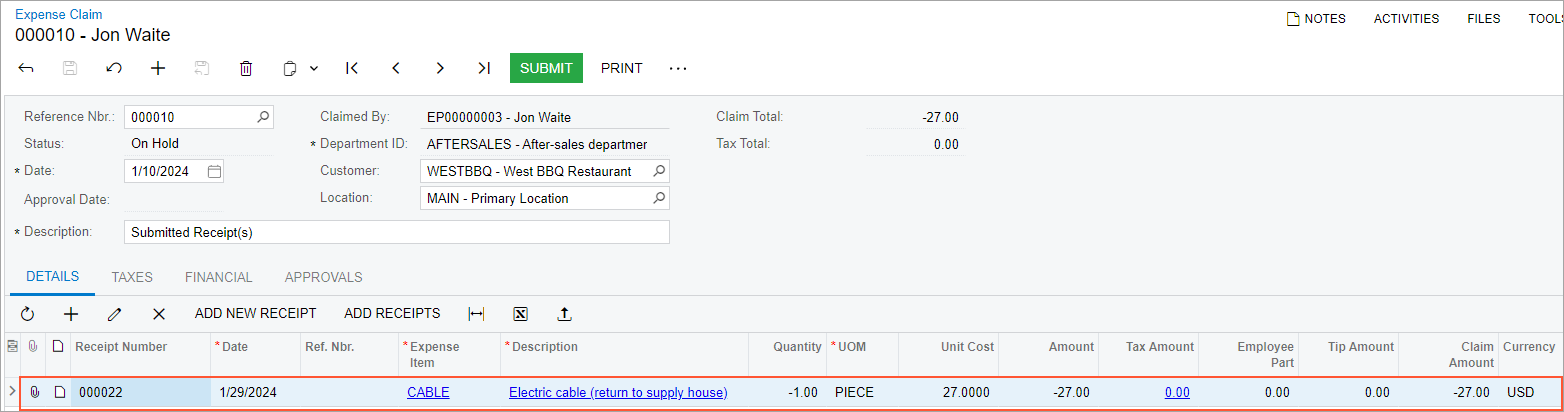

After the expense receipt has been created and saved, the user creates an expense claim for this expense receipt by doing either of the following:

- Clicking Claim on the form toolbar of the Expense Receipts form. The system creates an expense claim on the

Expense Claims (EP301030) form and adds the expense

receipt line to it, as shown in the following screenshot.

Figure 2. Expense claim with the negative expense receipt line

- Adding a line with this expense receipt to an existing expense claim on the Expense Claims form. (The expense claim can include both positive and negative expense lines.)

When the user submits and releases the expense claim, the system generates one AP document or multiple AP documents, depending on the state of the Post Summarized Company Expenses by Corporate Cards check box on the Time and Expenses Preferences (EP101000) form:

- If the check box is selected, the system will group into one document all lines with Corporate Card, Company Expenses in the Paid With column and with the same receipt date, receipt reference number, corporate card, and tax calculation mode.

- If the check box is cleared, the system will create a separate AP document for each line that is paid with a corporate card.

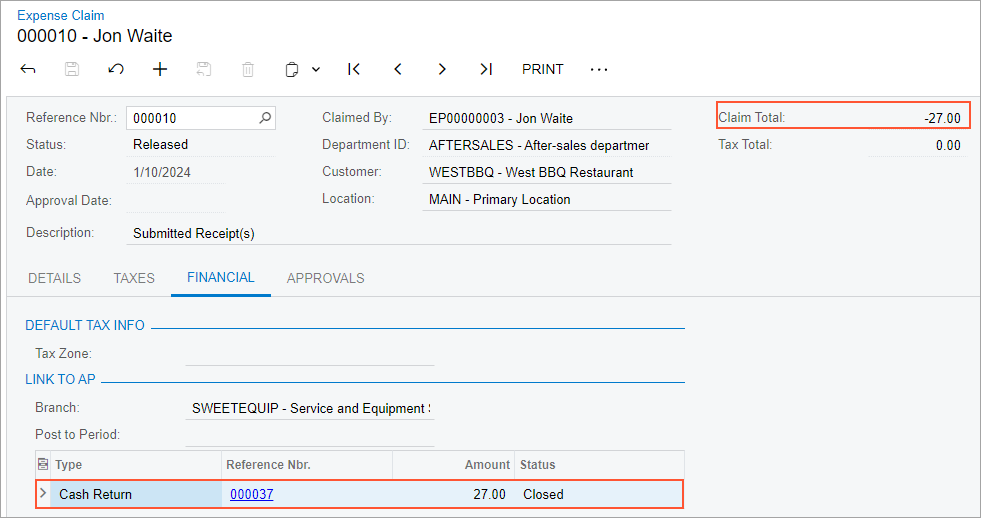

The type of the generated AP document depends on the sign of the total amount for the lines with Corporate Card, Company Expenses in the Paid With column:

- If the total claim amount for the lines is negative, the system generates a cash return

on the Cash Purchases (AP304000) form, as shown in the

following screenshot.

Figure 3. A cash return created on release of an expense claim

- If the total claim amount for the lines is positive or 0, the system generates a cash purchase on the Cash Purchases form.

On release of the cash return, the system generates and releases a batch of GL transactions that debits the corporate card account and credits the expense account. If the cash return has project information specified, on the release of the GL transaction, the system also generates a project transaction to update the actual values in the cost budget line of the project that has the same project budget key. (The project budget key consists of the project, project task, account group, and inventory item, as well as the cost code, if applicable).

For more information about processing expense returns to corporate credit cards, see Processing Expense Returns to Corporate Cards.

Reconciliation of Bank Statements

When an accountant performs the reconciliation of bank statements, the following rules apply to the documents related to corporate card refunds:

- On the Process Bank Transactions (CA501000) form, a negative expense receipt with the Open or Pending Approval status is available for matching on the Match to Expense Receipts tab of the form.

- After a negative expense receipt is released, the system generates the respective cash return document, which is available for matching on the Match to Payments or Match to Invoices tab on the Process Bank Transactions form.

- If a cash transaction that originates from a cash return is matched on the Process Bank Transactions form, it is displayed as cleared on the Reconciliation Statements (CA302000) form.

Billing of Expense Claims with Negative Lines

If a user runs customer billing on the Bill Expense Claims (EP502000) form, for an expense claim with mixed (positive and negative) billable lines, the system creates the AR document based on the total claim amount:

- If the total claim amount for the billable lines is positive or 0, the system generates an AR invoice on the Invoices and Memos (AR301000) form.

- If the total claim amount for the billable lines is negative, the system generates an AR credit memo on the Invoices and Memos form.

Support for Refunds in Service Documents

If the Service Management feature is enabled on the Enable/Disable Features (CS100000) form, a user can create a negative expense receipt and link it to a service document. The system will show the linked negative expense receipt in the linked service document on the Details tab of the Appointments (FS300200) or Service Orders (FS300100) form.