Projects and Construction: Other Improvements

In MYOB Acumatica 2024.1.1, multiple improvements to projects and construction have been introduced, as described in the sections below.

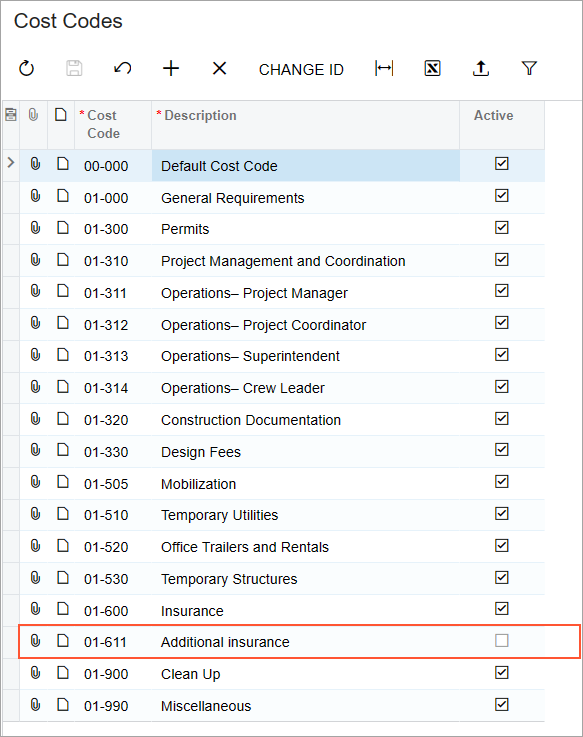

Deactivation of Cost Codes

Previously, users had no ability to deactivate a cost code that is no longer used in projects. Starting in MYOB Acumatica 2024.1.1, a user with the Project Accountant role can deactivate a particular cost code by clearing the Active check box in the line with this cost code on the Cost Codes (PM209500) form, as shown in the following screenshot, and saving their changes.

A cost code cannot be deactivated if either of the following conditions are met:

- The cost code is the default cost code.

- The cost code is specified in the project budget line along with a project task that has the Active status.

Once a cost code is deactivated, it becomes unavailable for selection on all MYOB Acumatica forms. Inactive cost codes, however, remain specified in all existing documents, and users can continue working with these documents. The following limitations apply:

- If an operation to be performed affects only this particular document and does not produce any other related documents, the system completes this operation successfully. For example, suppose that a user opens an accounts receivable invoice on the Invoices and Memos (AR301000) form that includes lines with inactive cost codes. If the user clicks Remove Hold on the form toolbar, the system will assign the document the Balanced status.

- If an operation should create a subsequent document, the system will not be able to complete the operation. That is, it will not be possible to create a new document with the inactive cost codes. For example, again suppose that the user opens an accounts receivable invoice on the Invoices and Memos form that includes lines with inactive cost codes. If the user clicks Release on the form toolbar, the operation will fail because a GL transaction with an inactive cost code cannot be created.

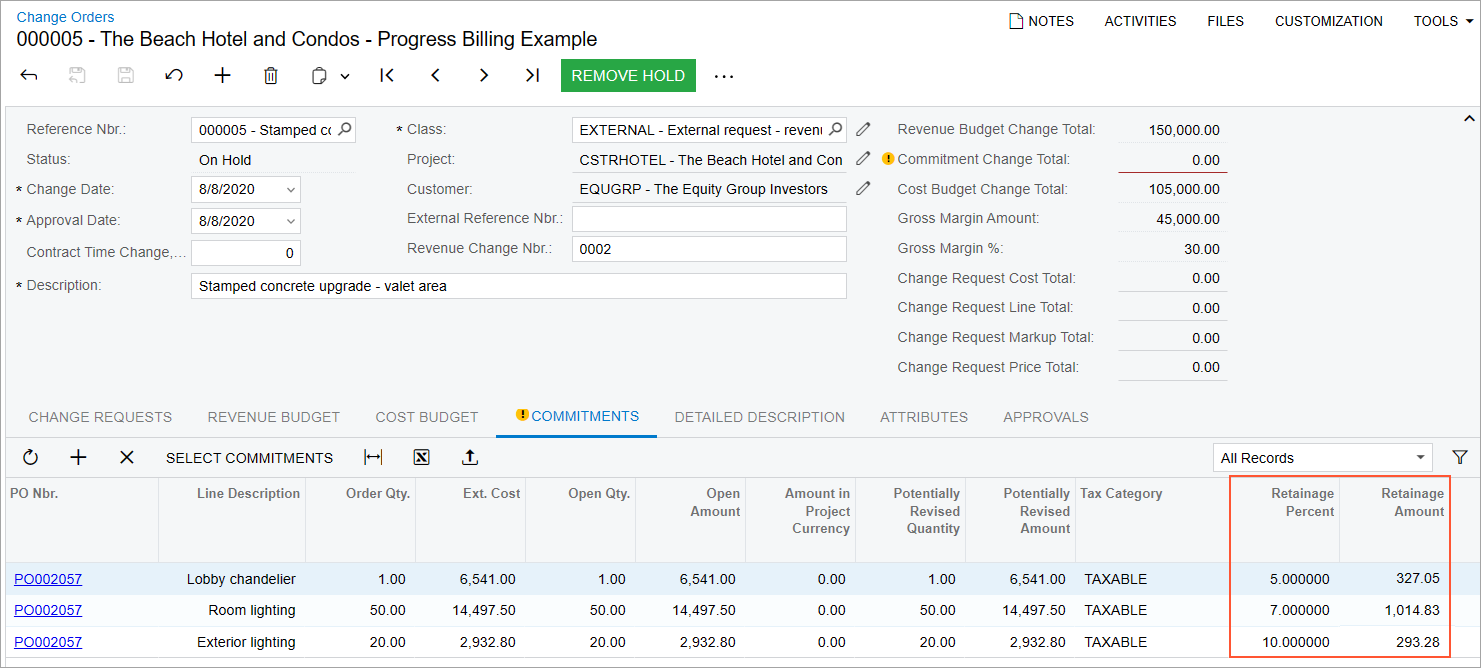

Editable Retainage in Change Orders to Commitments

Previously, users were not able to edit the retainage information in the subcontracts and purchase orders that are linked to a change order. Starting in MYOB Acumatica 2024.1.1, a user can change the retainage percent and retainage amount in the commitment lines of a change order on the Commitments tab of the Change Orders (PM308000) form.

If on the Enable/Disable Features (CS100000) form, the Retainage Support feature is enabled, the Retainage Amount and Retainage Percent columns are now shown on the Commitments tab of the Change Orders (PM308000) form (see the following screenshot).

The Retainage Amount and Retainage Percent values are editable if a change order is assigned the On Hold status regardless of the status specified in a commitment line (New Line, Update, Reopen, or New Document). If the user changes either of these values in a line, another value will be recalculated automatically.

In the commitment lines on the Commitments tab, the system determines the default retainage values to insert by using the following rules:

- If the commitment line has the New Document status, the system copies the default

retainage percent from the vendor specified in the subcontract or purchase order. If the

Apply Retainage check box is cleared for the vendor on the

Financial tab of the Vendors

(AP303000) form, the system sets the default retainage percent to 0. Note: If the user specifies a nonzero retainage amount in the commitment line, in the created new document, the system will select the Apply Retainage check box regardless of the retainage settings of the vendor.

- If the commitment line has the Update or Reopen status, the system copies

the default retainage percent from the corresponding line of the subcontract or purchase

order. The retainage amount for the line is calculated as

Line Amount * Retainage Percent. The user can manually override the calculated value. - If the commitment line has the New Line status, the system copies the default

retainage percent from the settings of the subcontract on the

Financial tab of the Subcontracts

(SC301000) form or the settings of the purchase order on the Other

tab of the Purchase Orders (PO301000) form. The retainage

amount for the line is calculated as

Line Amount * Retainage Percent. The user can manually override the calculated value.

For more information about processing changes to project commitments, see Change Orders for Commitments: General Information.

Returns for Project Drop Shipments Without Receipts

Previously, it was not possible to process a returns for purchase orders of the Project Drop-Ship type that were created for the projects that have the Skip Receipt Generation option selected in the Drop-Ship Receipt Processing box on the Defaults tab of the Projects (PM301000) form. Now, users can process returns for these purchase orders by using debit adjustments.

To process a return for a drop-ship purchase order without a receipt, a user opens the related accounts payable bill on the Bills and Adjustments (AP301000) form and clicks Reverse on the More menu. If no lines of the bill are linked to a purchase receipt, the system creates a debit adjustment that is linked to the drop-ship purchase order.

In the lines of the created debit adjustment, the user can edit the quantity, extended cost, and unit cost if any of the following conditions is met:

- The Apply Retainage check box is cleared for the debit adjustment on the Bills and Adjustments form.

- The debit adjustment line is not linked to a purchase receipt.

- The debit adjustment line is linked to a project drop-ship purchase order.

When a debit adjustment is released, the system changes the status of the corresponding drop-ship purchase order from Closed to Completed. In the lines of this purchase order, the system clears the Closed check box to indicate that the lines of the purchase order have not been billed in full.

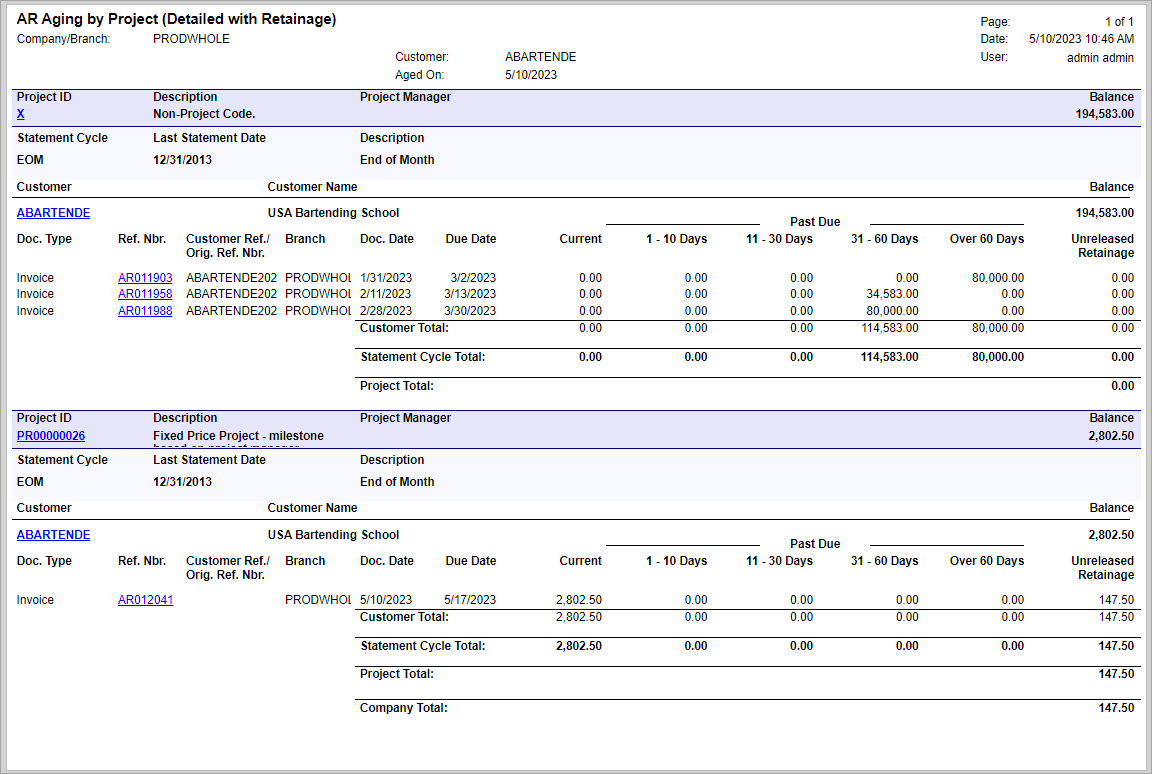

Deprecated AR Aged Period-Sensitive with Retainage Report

In MYOB Acumatica 2024.1.1, the AR Aged Period-Sensitive with Retainage (AR744000) report has been removed. Now a user can review the outstanding documents along with their unreleased retainage on the particular date by using the Detailed with Retainage report format of the AR Aging by Project (AR631200) report, which was introduced in MYOB Acumatica 2023 R1. The report is shown in the following screenshot.

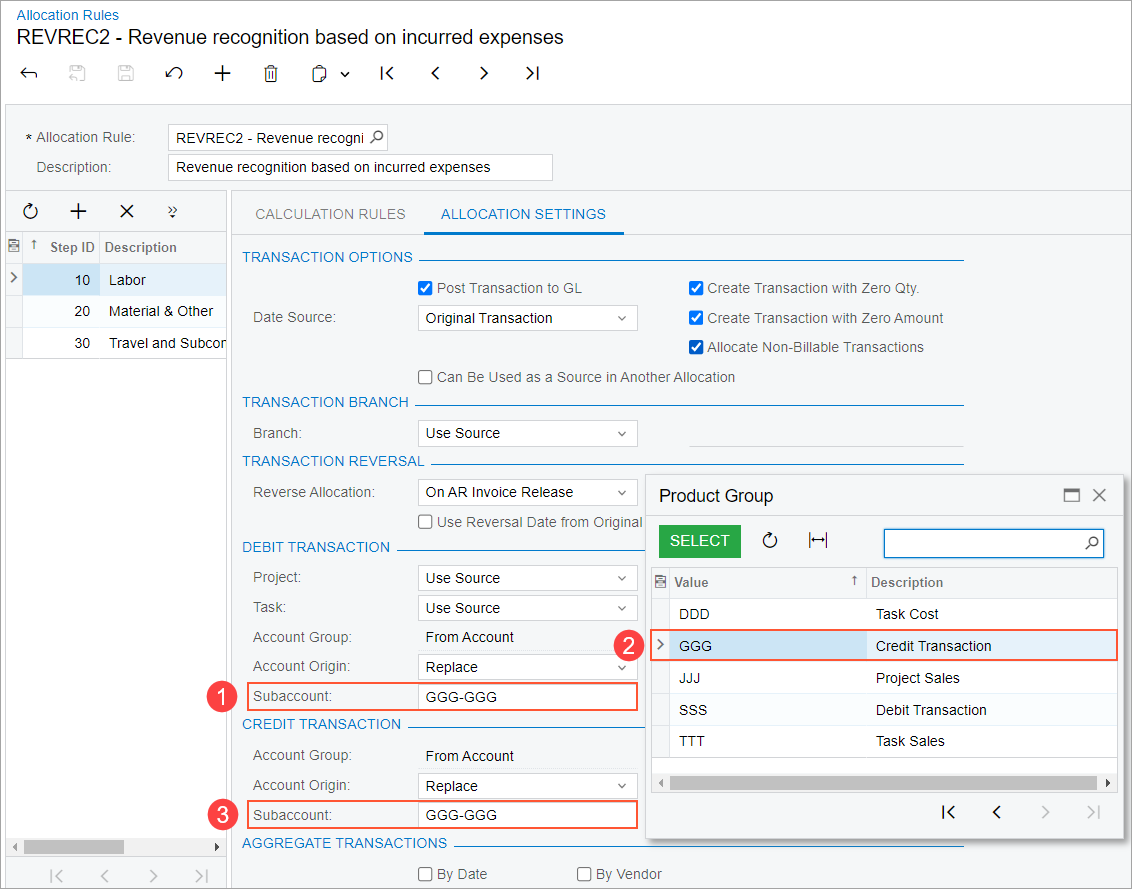

Enhancements in Allocation Rules

Previously, there was no way to configure an allocation rule so that the debit subaccount of the source transaction could be used as the credit subaccount for the allocation transaction. In this case, some of the unrecognized revenues could be not properly recognized as actual revenues for projects because they did not contain credit subaccount information.

In MYOB Acumatica 2024.1.1, new options have been introduced on the Allocation Settings tab of the Allocation Rules (PM207500) form as follows:

- In the Debit Transaction section, the Subaccount box (see Item 1 in the following screenshot) now includes the G subaccount mask, which refers to the credit subaccount of the source transaction (Item 2). The S subaccount mask refers to the debit subaccount of the source transaction.

- In the Credit Transaction section, the Subaccount box (Item 3) now includes the G subaccount mask, which refers to the debit subaccount of the source transaction. The S subaccount mask refers to the credit subaccount of the source transaction.