Projects and Construction: Inclusive Taxes in Pro Forma Invoices and Project Quotes

In MYOB Acumatica 2024.1.1 multiple enhancements have been made to provide support for inclusive taxes in project-related documents and reports. For details, see the following sections.

Inclusive Tax Support for Projects

In previous versions of MYOB Acumatica, the usage of inclusive taxes with the Inclusive Line-Level or Inclusive Document-Level calculation rule was not supported in pro forma invoices. The system showed an error if a user had run project billing or tried to release an existing pro forma invoice to which inclusive taxes were applicable. Due to these limitations, users were forced to use direct AR invoices in projects and were not able to use pro forma invoices, which are draft invoices that can be edited without affecting accounts receivable, thus minimizing corrections in the accounts receivable invoices.

Also, in previous versions, in project quotes on the Project Quotes (PM304500) form, users could not use taxes with the Inclusive Line-Level or Inclusive Document-Level calculation rule or taxes with the Gross tax calculation mode.

MYOB Acumatica 2024.1.1 fully supports inclusive sales tax and VAT calculation. Also, inclusive tax information is displayed in the following documents and reports:

- Pro forma invoices on the Pro Forma Invoices (PM307000) form

- Project quotes on the Project Quotes (PM304500) form

- The following project and construction reports:

- Project WIP (PM651500)

- Project WIP Detail (PM652500)

- Construction Bonding Report (PM650500)

- Project Profit Analysis (PM656000)

- Project Performance (PM654000)

- Projects Pending Billing (PM706300)

Inclusive Taxes in Pro Forma Invoices

A user can now run project billing for a project for which the Create Pro Forma Invoice on Billing check box is selected on the Projects (PM301000) form to prepare pro forma invoices that are subject to inclusive taxes. In the prepared pro forma invoice, actual amounts now include inclusive tax amounts, as shown in the following screenshot.

On release of the accounts receivable document created based on the pro forma invoice, the system updates the revenue budget lines of the project that have the same project budget key that is specified in the lines of the accounts receivable document being released.

UI Changes on the Projects (PM301000) Form

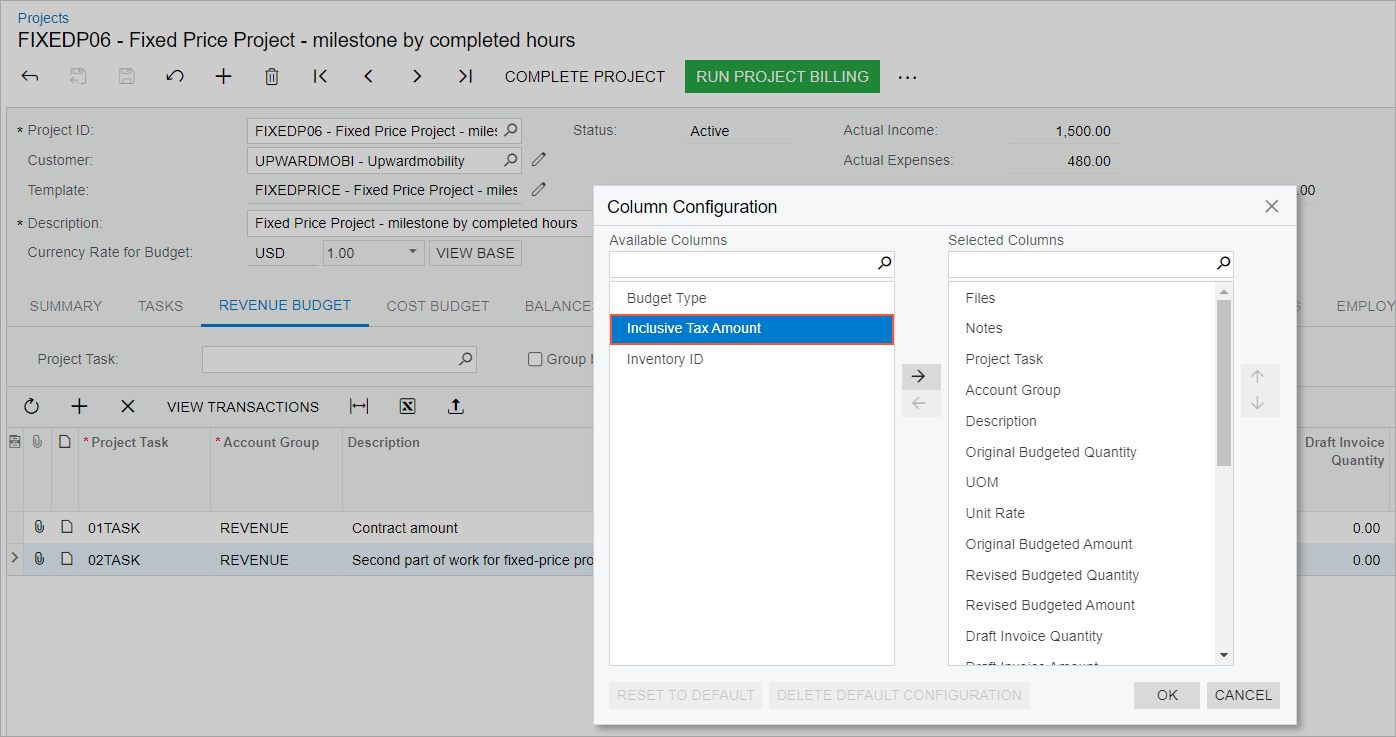

On the Revenue Budget tab of the Projects (PM301000) form, the Inclusive Tax Amount column has been added. The system inserts the values in this column on release of accounts receivable invoices, credit memos, and debit memos related to the revenue budget lines of the selected project.

The Inclusive Tax Amount column is hidden by default. For a project with inclusive taxes that have progress billing by amount, a project manager can review the inclusive tax amount for each revenue budget line. To do this, the project manager should add the Inclusive Tax Amount column to the table by using the Column Configuration dialog box, as shown in the following screenshot.

With this column added to the table, the project manager can analyze how the calculated taxes affect the calculation of the Performance (%) and Completed (%) values in the revenue budget line. The user can also review the total of the Actual Amount and Inclusive Tax Amount for the revenue budget lines in the project reports described in the Changes to Projects and Construction Reports section below.

Project Balance Recalculation

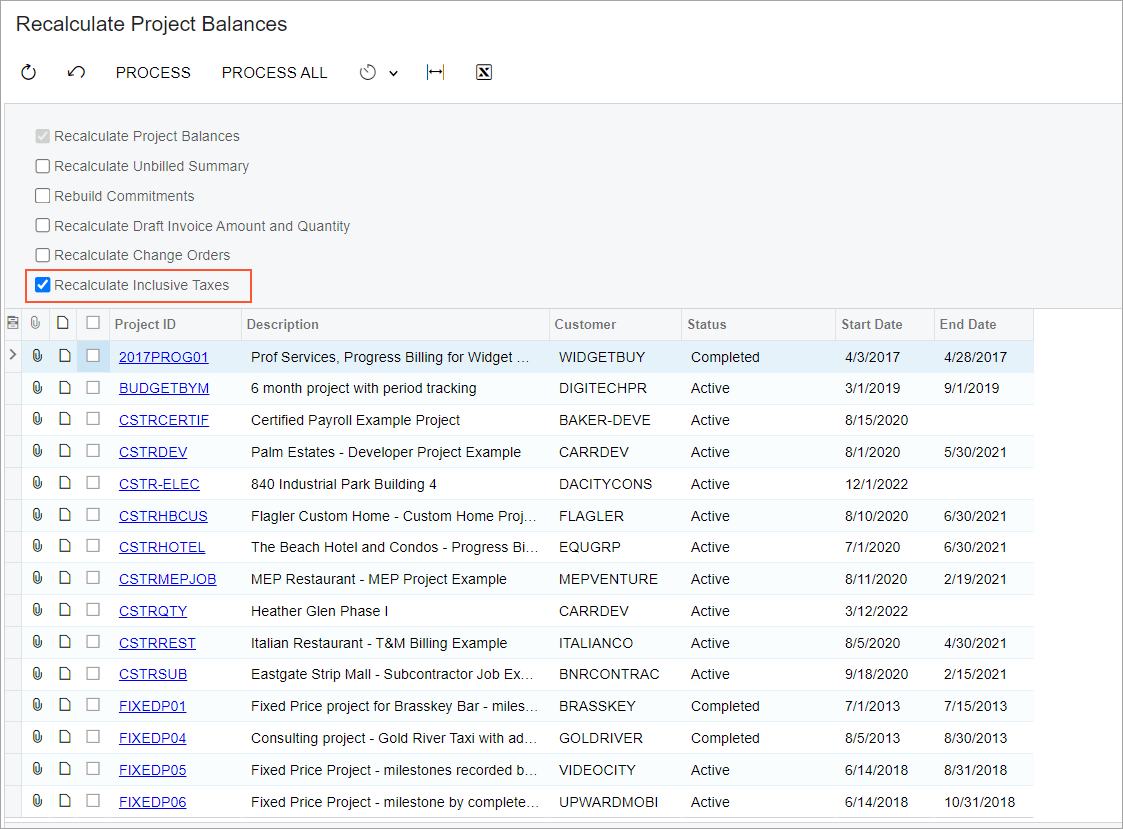

On the Recalculate Project Balances (PM504000) form, the Recalculate Inclusive Taxes check box has been added. By default, this check box is selected, indicating that the system will recalculate the inclusive tax amounts in the revenue budget lines of the projects for which a user runs the recalculation process.

With this check box selected, users are able to eliminate possible discrepancies that may occur after a system upgrade or due to inconsistent data import or changes to the project budget structure. The recalculation process clears the Inclusive Tax Amount values in the revenue budget lines of the selected project or projects, and recalculates the total amount of the project-related AR invoices, credit memos, and debit memos related to these projects.

Changes to Project Quotes

Starting in MYOB Acumatica 2024.1.1, support for inclusive taxes and the Gross tax calculation mode has been added for project quotes created on the Project Quotes (PM304500) form. These changes do not affect the conversion of project quotes to projects because inclusive taxes are not copied from a project quote to the resulting project.

Changes to Project and Construction Reports

The following values in the project and construction reports now include the inclusive tax amounts along with the actual amounts:

- In the Project WIP (PM651500) report: Period Billings and Billings to Period

- In the Project WIP Detail (PM652500) report: Period Billings and Billings to Period

- In the Construction Bonding Report (PM650500) report: Billed to Date and Period Billings

- In the Project Profit Analysis (PM656000) report: Billed to Date

- In the Project Performance (PM654000) report: Work Billed

- In the Projects Pending Billing (PM706300) report: Billed (%)

Other Enhancements

If the Net/Gross Entry Mode feature is enabled on the Enable/Disable Features (CS100000) form, in the projects for which the Create Pro Forma Invoice on Billing check box is selected on the Projects (PM301000) form, the system will ignore the Gross and Net tax calculation modes that are specified for the customer on the Customers (AR303000) form. It will instead use the Tax Settings tax calculation mode in the pro forma invoices that are created during project billing.

In accounts receivable documents that are entered in migration mode, the system calculates taxes based on the tax zone and tax category specified in these documents. On release of these accounts receivable documents, the system will update the values in the Inclusive Tax Amount column on the Revenue Budget tab of the Projects form.

Upgrade Notes

If a tax with the Inclusive Line-Level or Inclusive Document-Level calculation rule is configured on the Taxes (TX205000) form, for each project with the Create Pro Forma Invoice on Billing check box cleared on the Summary tab of the Projects (PM301000) form, the system will notify the users that the recalculation of the project balances is required for the project, as shown in the following screenshot.