Finance: Consolidated Retainage Invoices in AR

In previous versions of MYOB Acumatica, the system created a retainage invoice or credit memo for each original document for a particular customer and project. As a result, a large amount of retainage invoices were created at the end of each project, because there could be multiple invoices created for the project. Users had to create and record payments for multiple retainage invoices separately and match each retainage invoice to the original invoice.

In MYOB Acumatica 2024.1.1, the following changes to the creation and processing of retainage documents have been introduced:

- A consolidated retainage document can be created for multiple original documents that have the same customer and project. These documents can be fully or partially consolidated. If multiple lines of documents related to the same customer and project are selected for processing on the Release AR Retainage (AR510000) form, the system will automatically create a consolidated retainage document for them.

- A consolidated retainage document can be paid partially. The system will recalculate the Paid Retainage amount for each original invoice on the Invoices and Memos (AR301000) form.

- Retained taxes are supported in consolidated retainage documents.

The following sections describe the UI changes and changes in document processing that have been made to support this functionality.

Changes to the Release AR Retainage Form

On the Release AR Retainage (AR510000) form, the documents or document lines selected for processing are included in one consolidated retainage document if all of the following conditions are met:

- The Payment Application by Line feature is enabled on the Enable/Disable Features (CS100000) form.

- More than one document or document line is selected for processing.

- In the original documents related to the selected documents or document lines, the

following UI elements contain the same value.

UI Element Location Comments Customer Summary area of the Invoices and Memos (AR301000) form Project Summary area of the Invoices and Memos form If the Contract Management feature is enabled, the box name is Project/Contract. Location Summary area of the Invoices and Memos form Currency Summary area of the Invoices and Memos form Because retainage is not supported in foreign currency documents, all original invoices have the same currency, which is the base currency of the originating branch. Curr. Rate Type The Financial Settings section on the Financial tab of the Customers (AR303000) form Customer Tax Zone The Tax Info section on the Financial tab of the Invoices and Memos form Tax Calculation Mode The Tax Info section on the Financial tab of the Invoices and Memos form This box is displayed if the Net/Gross Entry Mode feature is enabled. Tax Exemption Number The Tax Info section on the Financial tab of the Invoices and Memos form Entity Usage Type The Tax Info section on the Financial tab of the Invoices and Memos form Branch The Link to GL section on the Financial tab of the Invoices and Memos form This is the originating branch of the document. AR Account The Link to GL section on the Financial tab of the Invoices and Memos form AR Subaccount The Link to GL section on the Financial tab of the Invoices and Memos form This box is displayed if the Subaccounts feature is enabled.

If the Payment Application by Line feature is enabled on the Enable/Disable Features form and only one document is selected on the Release AR Retainage form, a non-consolidated retainage document will be created. That is, for a line related to an original document with the Pay by Line check box cleared on the Invoices and Memos form, the retainage document will also have the Pay by Line check box cleared. Thus, in some cases, an original document can have both consolidated and non-consolidated retainage documents.

The type of the consolidated retainage document (Invoice or Credit Memo) is determined by the sign of the resulting amount in the consolidated document. If the amount is positive, the type of the consolidated document is Invoice; if the amount is negative, the type of the consolidated document is Credit Memo.

When a user clicks Release Retainage on the More menu of the Invoices and Memos form, the system opens the Release AR Retainage form with the Date and Post Period boxes filled in by default with the current business date and period.

Changes to the Invoices and Memos Form

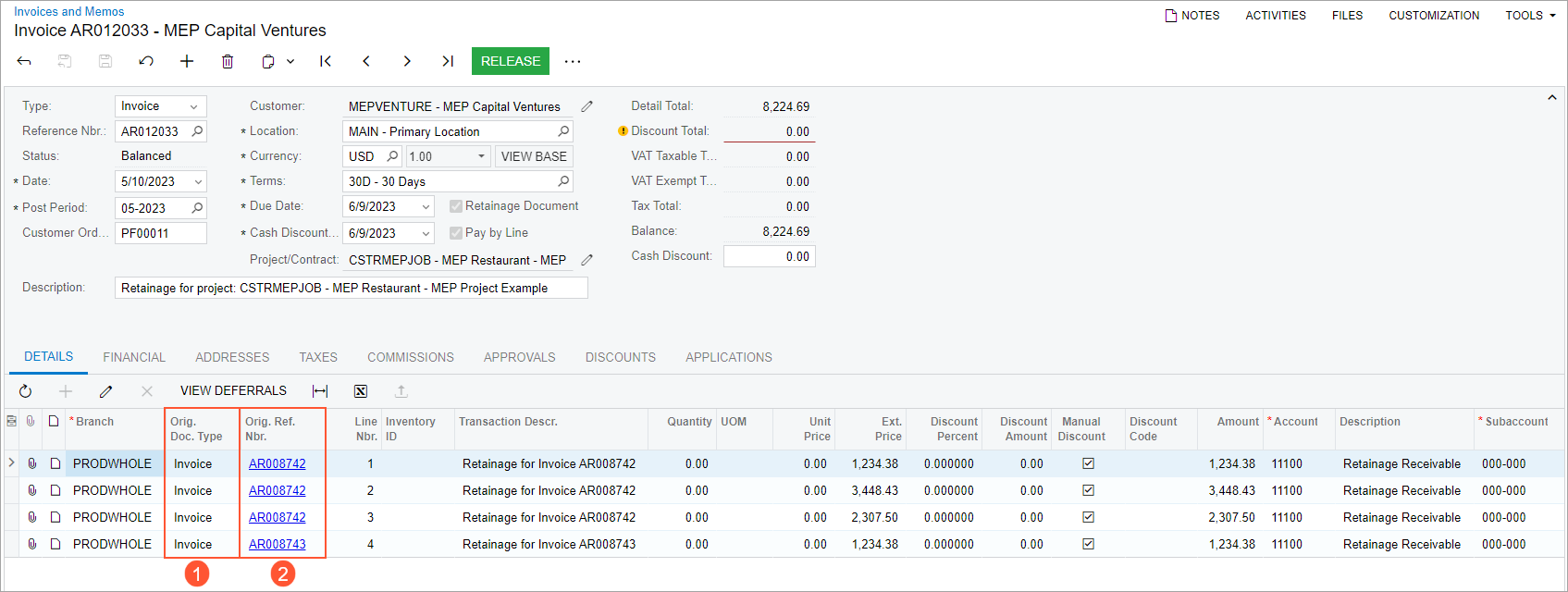

On the Details tab of the Invoices and Memos (AR301000) form, for a consolidated retainage document, the following columns have been added:

- Orig. Doc. Type (see Item 1 in the screenshot below): The type of the related original document—Invoice or Credit Memo.

- Orig. Ref. Nbr. (Item 2): The reference number of the related original document.

If the original document has the Pay by Line check box cleared on the Invoices and Memos form, the retainage amount from this document is shown in the consolidated retainage document as one line on the Details tab. If the original document has the Pay by Line check box selected, the retainage amount from this document is shown as multiple lines on the Details tab, depending on the number of lines selected for processing on the Release AR Retainage (AR510000) form (as is the case shown in the screenshot above).

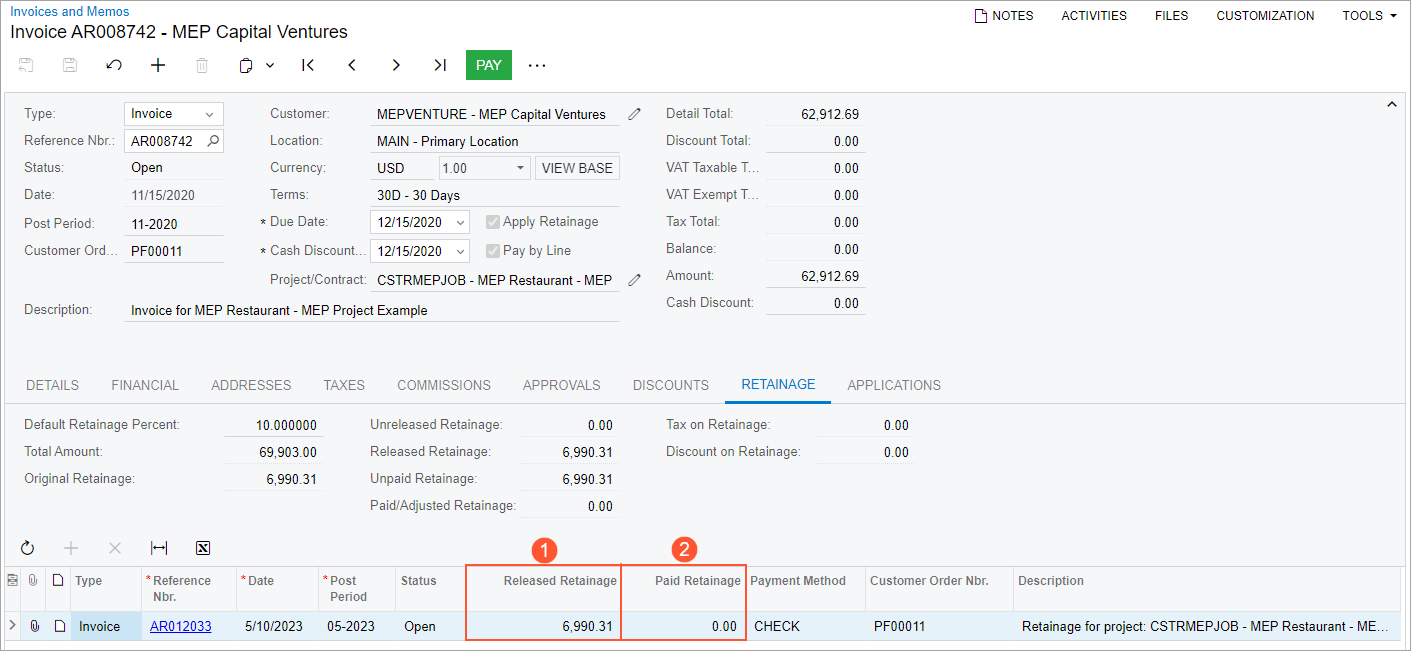

On the Retainage tab of the Invoices and Memos form, for an original document, the following UI changes have been introduced:

- One line is displayed for all lines included in the retainage document.

- The Amount column shows the total amount of the retainage document, including the applicable taxes. The Amount column has been made hidden by default.

- The Released Retainage column (Item 1 in the screenshot below) has been added. For unreleased retainage documents, the column is empty. For released retainage documents, the column shows the appropriate portion of the amount from the retainage document that is related to the original document.

- The Paid Retainage column has been added (Item 2). This column shows how much of the released retainage related to the current original document has been paid. For unreleased retainage documents, this column is empty.

- The Balance column has been removed.

- The amounts in the Released Retainage and Paid Retainage columns are shown with the corresponding sign to reflect that the released retainage was reduced or increased.

Support of Retained Taxes

If the Retain Taxes check box is selected in the Retainage Settings section on the Accounts Receivable Preferences (AR101000) form, the system calculates retained taxes for consolidated retainage documents. If the same Tax ID, Taxable Amount, and Tax Amount are applied to multiple lines of a retainage document related to different original documents, on the Taxes tab of the Invoices and Memos (AR301000) form, the tax amount will be summed for each tax ID in the Retained Tax column.

Changes in Reports and Inquiries

The following reports and inquiries that show retainage documents have been reworked to support consolidated retainage documents:

- AR Retained Balance (AR635000): A consolidated retainage document appears under each related original document if the Include Retainage Details check box is selected on the Report Parameters tab. On the printed report form, the Retainage Amount displayed for a consolidated retainage document is shown as a part of the total document amount that is related to a specific original document. The retainage amount includes taxes, if they are applicable.

- AR Documents by Customer (AR634000) and AR Documents by Project (AR634100): The formulas of calculating the Paid/Adjusted and Net Balance amounts have been updated. These columns now show only the part of paid retainage or the part of the balance of a retainage document related to a specific original document, not all paid retainage and full balance of a retainage document, as was the case in previous versions. The Paid/Adjusted column reflects the applications of payments and the direct applications of credit memos, if the document is not a reversing document.

- AR Retainage Register (AR634500): A consolidated retainage

document appears under each related original document. For consolidated retainage

documents, the Total Amount column reflects only the part of the

total amount that is related to a specific original document. The Paid

Retainage amount is calculated according to the following formula:

Paid Retainage = Total Amount – Total Balance.

Changes That Will Affect Existing Users

The following changes will affect existing users of the Retainage Support feature even if they will not create consolidated retainage documents:

- On the Details tab of the Invoices and Memos (AR301000) form, the Orig. Ref. Nbr. column will be displayed for retainage documents. This column will show the reference number of the original document for which the Apply Retainage check box is selected. For non-consolidated retainage documents, this column will show the same value as the value in the Original Document box on the Financial tab.

- On the Release AR Retainage (AR510000) form, the Date and Post Period boxes will be filled in by default with the current business date and period if a user opens this form by clicking Release Retainage on the More menu of the Invoices and Memos form.

- On the Retainage tab of the Invoices and Memos form, the Balance column

of the table has been removed and the Amount column has become

hidden. The following new columns have been added: Paid Retainage

(to replace the removed Balance column), and Released

Retainage (to replace the hidden Amount

column).

The formula of calculating the Paid/Adjusted Retainage has been changed. Now direct applications of credit memos to invoices are included in the amount shown in the Paid Retainage box on this tab.

- On the Invoices and Memos form, the credit terms for a retainage document, which are shown in the Terms box, are copied from the customer's settings by default. (In previous versions, they were copied from the original document.)

- On the Invoices and Memos form, a document that reverses a retainage document has a link to the document being reversed in the Original Document box on the Financial tab. (In previous versions, a reversing document always had a link to the original document.)

Upgrade Notes

During an upgrade of MYOB Acumatica to 2024.1.1, an upgrade script will update the Unpaid Retainage and Paid Retainage amounts on the Retainage tab of the Invoices and Memos (AR301000) form in documents that were created before the upgrade. These amounts will be recalculated according to the following formulas:

Unpaid Retainage = Unreleased Retainage + Balances of retainage documentsPaid Retainage = Original Retainage – Unpaid Retainage

Additional Information

For more information about consolidated documents, see Consolidated Retainage Documents.

For information about how to create a consolidated retainage document, see To Create Multiple Retainage Documents (Release Retainage for Multiple Documents).