Projects and Construction: Improved Process of Pro Forma Invoice Correction

If the Construction feature is enabled on the Enable/Disable Features (CS100000) form, the pro forma invoice correction workflow is available in MYOB Acumatica. With this workflow, a user can make corrections to a pro forma invoice with the Closed status for which the corresponding accounts receivable document has already been released.

In previous versions of MYOB Acumatica, to finalize the correction process, the user had to manually apply the reversing document to the AR document related to the previous revision of the pro forma invoice. In MYOB Acumatica 2024.1.1, the correction workflow has been streamlined to ensure accurate corrections and efficient handling of pro forma adjustments.

The sections below describe the changes to the correction workflow in more detail.

Changes to Pro Forma Invoice Correction Process

Suppose that a user needs to correct a pro forma invoice that has already been released; the AR invoice that corresponds to this invoice has also been released and has the Open status.

To create a new revision of the pro forma invoice, the user clicks Correct on the More menu of the Pro Forma Invoices (PM307000) form. The system changes the status of the pro forma invoice to On Hold and adds a line with the previous revision of the pro forma invoice to the Previous Revisions table on the Financial tab of the Pro Forma Invoices form.

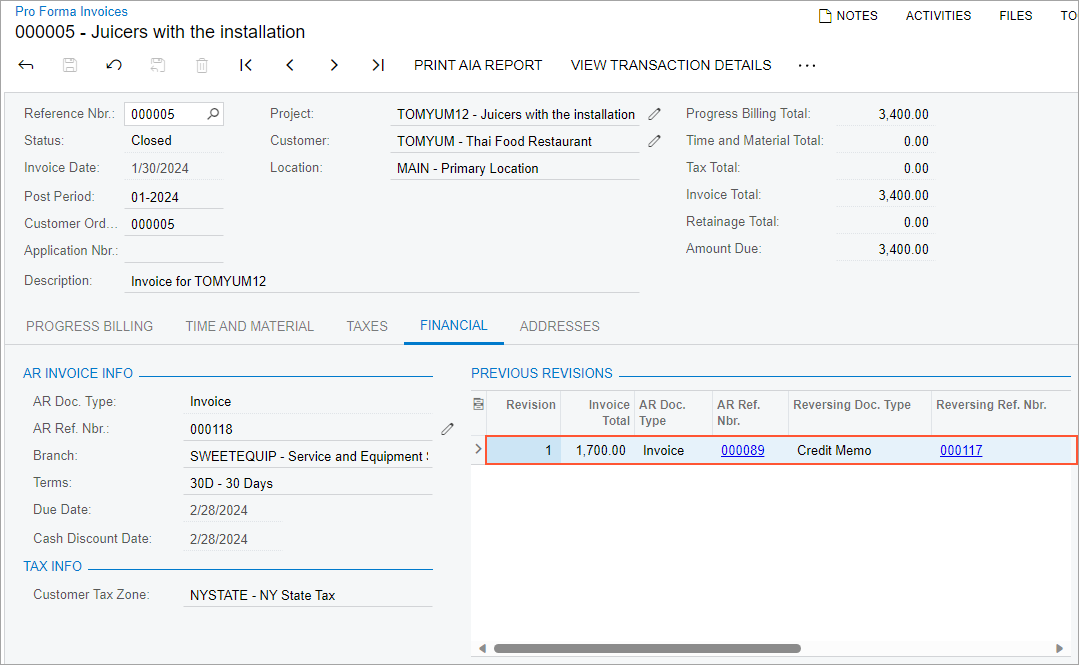

On release of the new revision of the pro forma invoice, the system creates a reversing document (credit memo), which is listed in the Previous Revisions table, as shown in the following screenshot.

Starting in MYOB Acumatica 2024.1.1, on release of the correction pro forma invoice, the system automatically releases and applies the reversing AR document to the original AR document to completely reverse the previous revision and update project actual values.

The way the system applies the prepared reversing document to the original AR document depends on whether the original document can be paid by lines as follows:

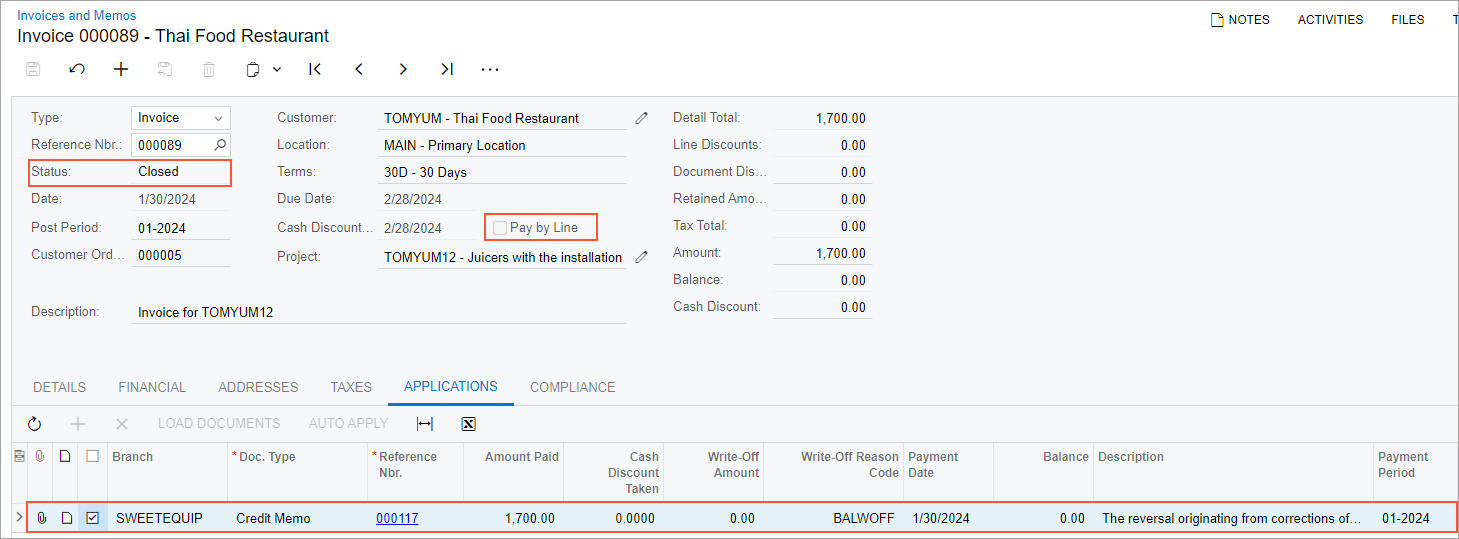

- If the Pay by Line check box is cleared for the AR invoice in the

Summary area of the Invoices and Memos (AR301000) form, on

release of the correction pro forma invoice, the system automatically releases and applies

the credit memo to the original AR invoice, as shown in the following screenshot. The

reversing credit memo and original AR invoice become closed.

Figure 2. Credit memo applied to original AR invoice

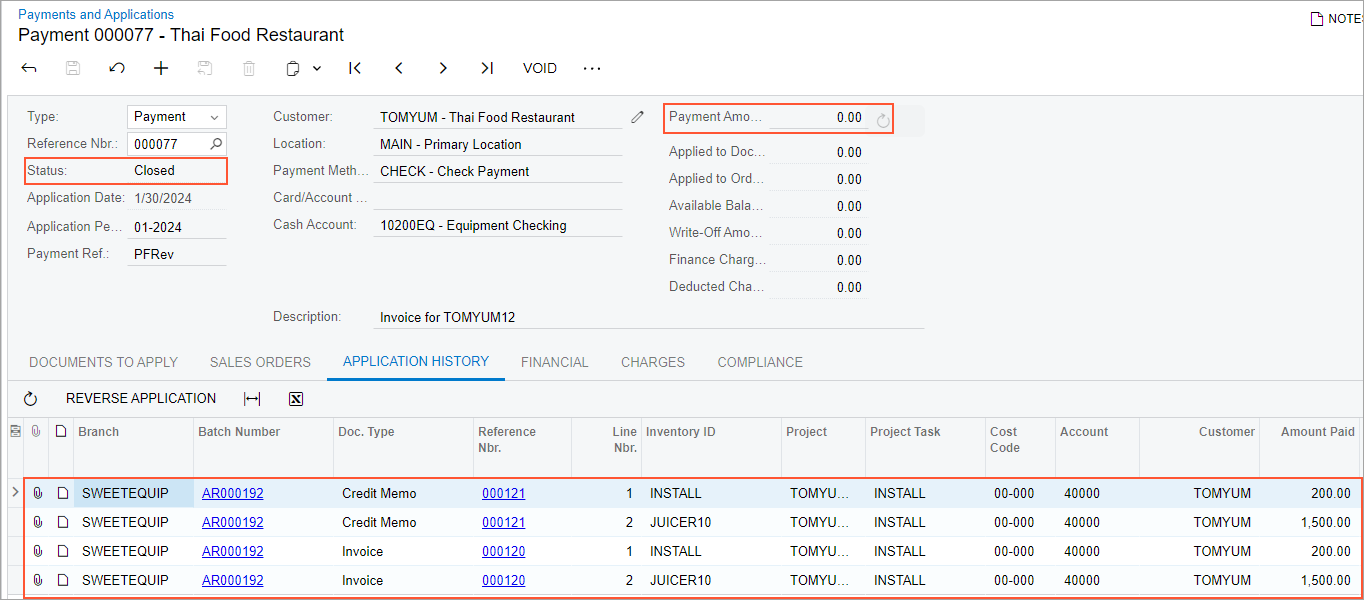

- If the Pay by Line check box is selected for the AR document in

the Summary area of the Invoices and Memos form, on release of

the correction pro forma invoice, the system performs the following operations:

- Generates and releases the credit memo.

- Generates and releases a payment that includes the credit memo lines and original invoice lines and has a total payment amount of 0. (See the first screenshot below.)

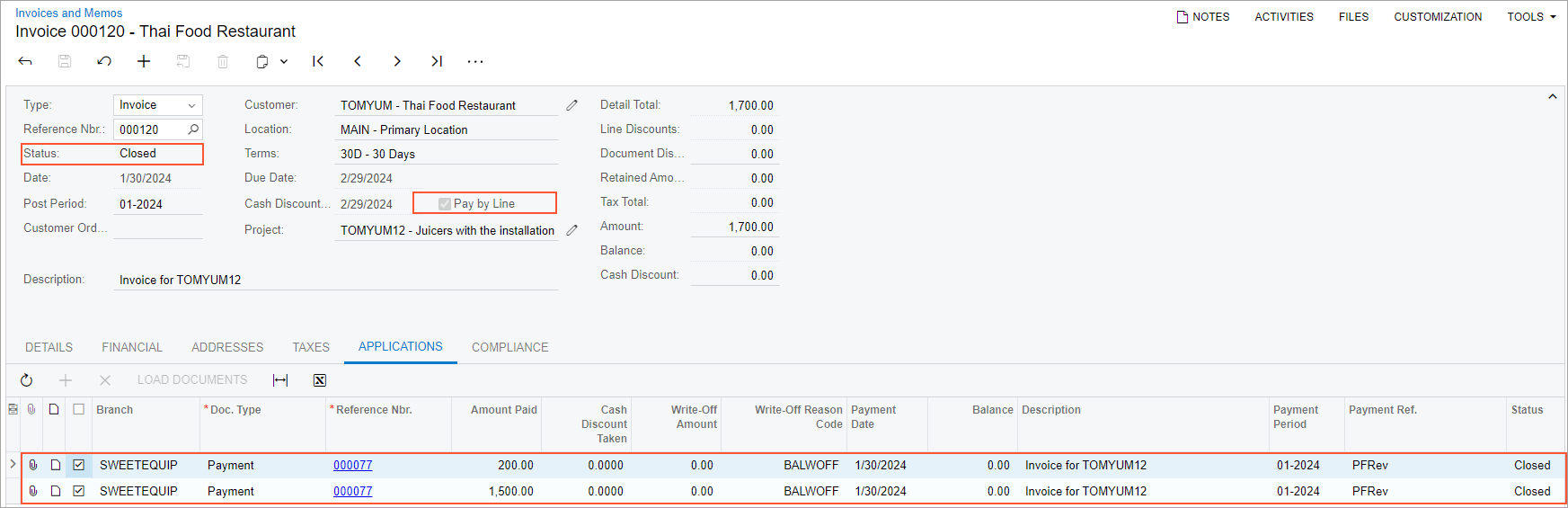

- Releases the payment and a payment application. The payment document, the reversing credit memo, and the original AR invoice become closed. (See the original AR invoice in the second screenshot below.)

Figure 3. Payment document with the lines of the original invoice and the reversing lines

Figure 4. Original invoice that is closed after release of the payment application

Important: All correction operations must be performed for the latest AR document that originates from the pro forma invoice. Users must not make any corrections to the automatically generated documents (that is, they may not void the payment document or reverse the payment application).

For more information about pro forma invoice correction, see Correcting Pro Forma Invoices.

Upgrade Notes

Because in previous versions of MYOB Acumatica, the reversing documents were applied manually, in a production system, there may be existing reversing documents that still require application to the original AR documents. Before the upgrade, we recommend finalizing the correction process for all existing reversing AR documents. That is, each reversing AR document that originates from a pro forma invoice should be applied to the corresponding AR document.

A user can find the reference number of the document to which the reversing AR document should be applied in the Original Document box on the Financial tab of the Invoices and Memos (AR301000) form.