Payroll (NZ): Automatically Calculating Annualised Income For Extra Termination Payments

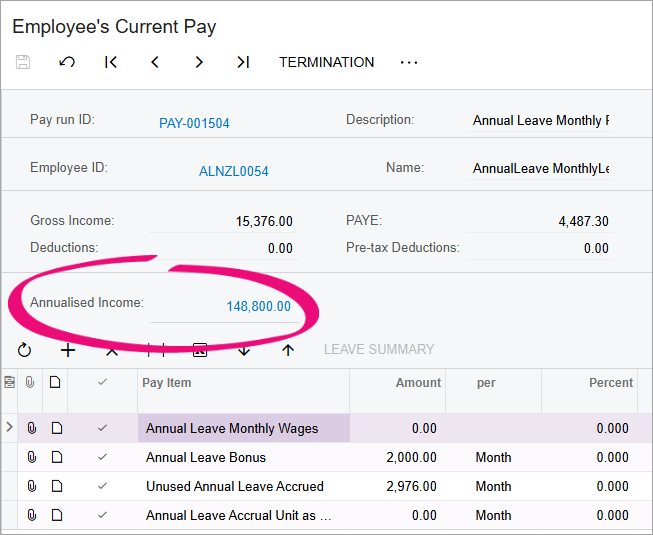

For New Zealand companies, you no longer need to manually calculate annualised income, making it easier to ensure that employees are taxed correctly for extra termination payments.

Now, MYOB Acumatica — Payroll uses Inland Revenue (IR) formulas to automatically calculate an employee's annualised income by using the gross income from their last two pay periods.

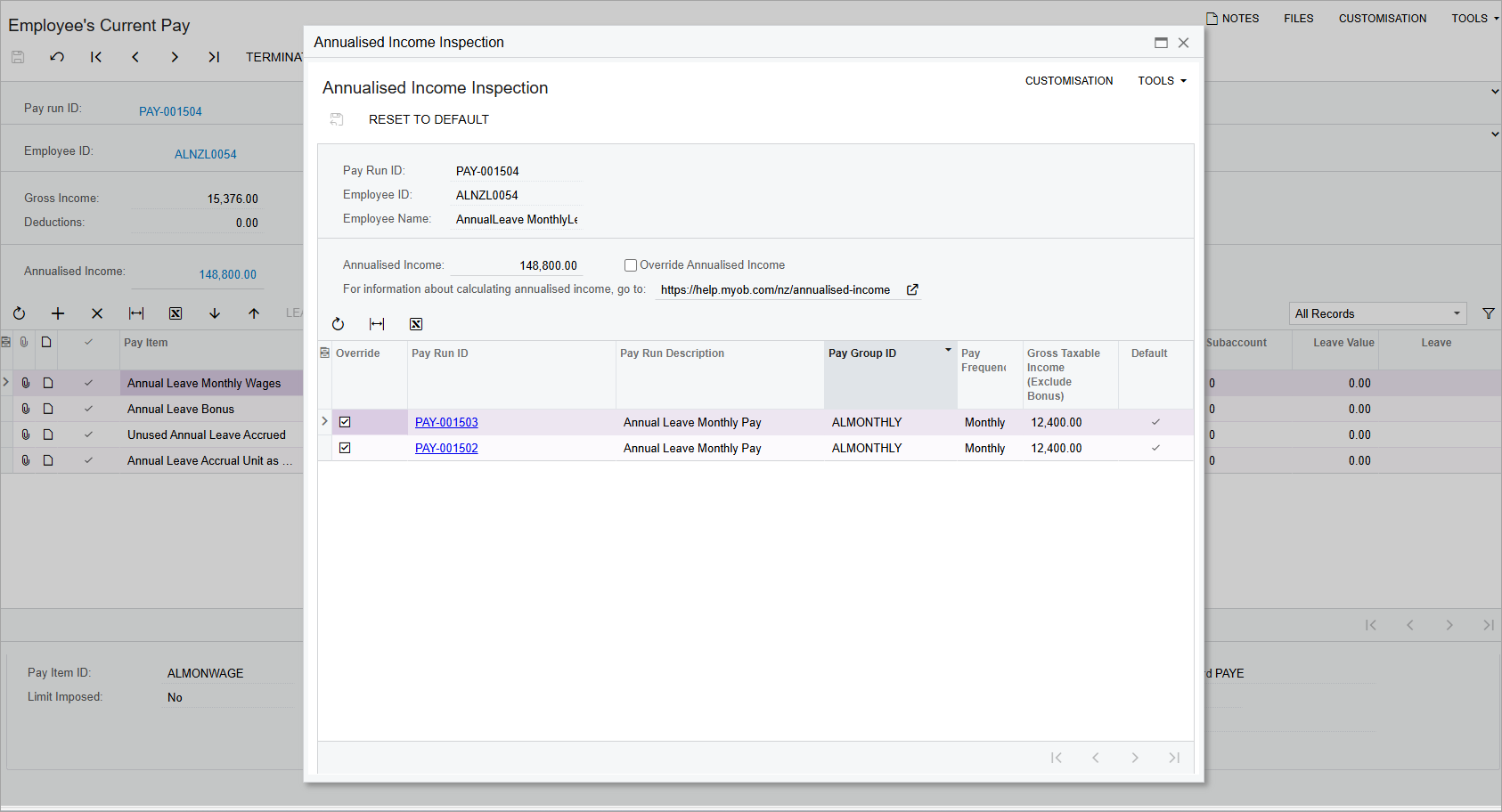

If the value is incorrect, click the annualised income amount to open the new Annualised Income Insepction window. This window shows you which pay runs were used to calculate the amount and lets you override the automatic calculation.

For detailed steps on overriding annualised income, see Calculating Tax for Extra Termination Payments (NZ).