Finance: Other Improvements

In MYOB Acumatica 2025.1, multiple improvements to financial management processes and the UI have been introduced, as described below.

Refined Validations for a Custom Due Date Type

In previous versions of MYOB Acumatica, credit terms with the Custom due date type could be created without the dates covering all the dates of a month. As a result, issues occurred when the system tried to insert the default due date in transactions.

In MYOB Acumatica 2025.1, on the Credit Terms (CS206500) form, the following refinements have been made to the validations that the system performs if Custom is selected in the Due Date Type box:

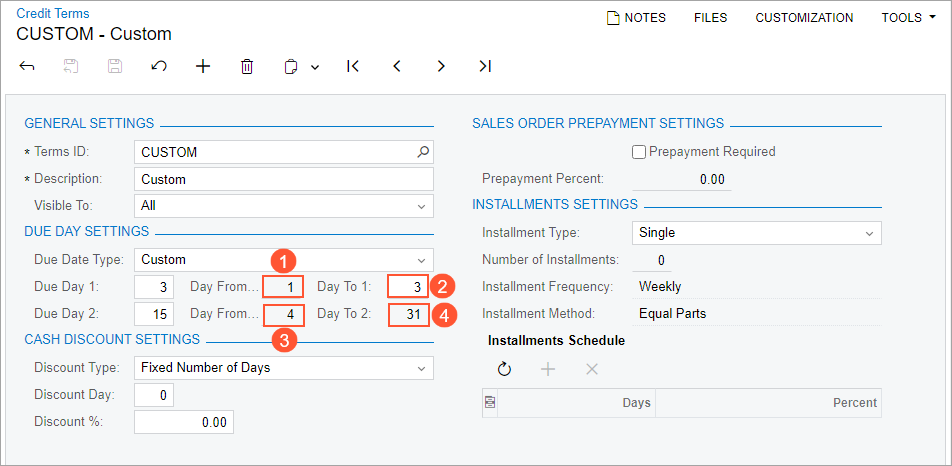

- The system now inserts 1 in the Day From 1 box for Due Day 1 (see Item 1 in the screenshot below) to ensure that the beginning of the month is covered. This setting is read-only.

- The value in the Day To 1 box for Due Day 1 must (Item 2) be less than 31; otherwise, the system displays an error message. Also, the day in the Day To 1 box must be later than or the same as the day specified in the Day From 1 box. If this condition is not met, the system displays an error message.

- The Day From 2 setting for Due Day 2 (Item 3) is now read-only. Its value is one day later than the day in the Day To 1 box.

- The system inserts 31 in the Day To 2 box for Due Day 2 (Item 4) to ensure that the end of the month is covered. This setting is read-only. The day in the Day To 2 box must be later than or the same as the day specified in the Day From 2 box. If this condition is not met, the system displays an error message.

Improvements on the Manage Credit Holds Form

In previous versions of MYOB Acumatica, if Credit Hold was selected in the Action box on the Manage Credit Holds (AR523000) form and a user selected the Show All check box, nothing changed from what was previously shown in the table. If the Remove Credit Hold action was selected and the user selected the Show All check box, all available records with all statuses were added to the table. This behavior was confusing because with this check box selected, the system should ignore all selection criteria on the form. Also, if one of the dates was not specified in the Start Date or the End Date box, no records were listed in the table.

To fix these issues, the following changes have been introduced on the Manage Credit Holds form:

- The Show All check box has been removed from the Selection area.

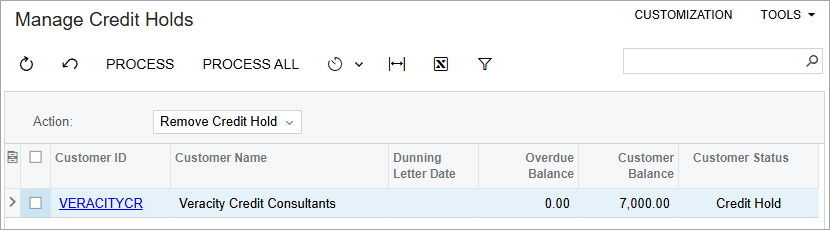

- If the Remove Credit Hold option is selected in the Action

box, the form’s UI changes as follows:

- The Start Date and End Date boxes in the Selection area become hidden.

- The system displays only customers with the Credit Hold status.

The following screenshot illustrates the form with the Remove Credit Hold option selected.

Figure 2. The form with Remove Credit Hold selected

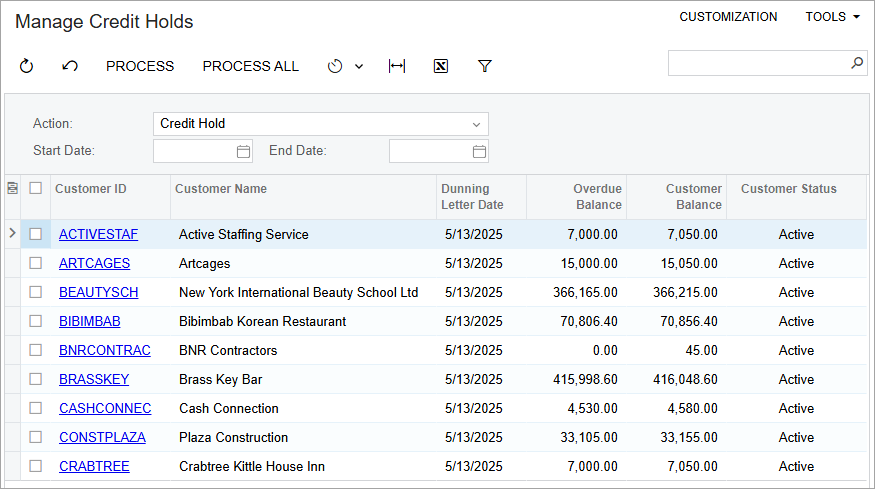

- If the Credit Hold option is selected in the Action box,

the form’s UI changes as follows:

- The Start Date and End Date boxes are empty by default.

- If the start date is specified, the table shows only customers with the Active and One-Time statuses whose final dunning letter date is later than or the same as the start date.

- If the end date is specified, the table shows only customers with the Active and One-Time statuses whose final dunning letter date is earlier than or the same as the end date.

The following screenshot illustrates the form with the Credit Hold option selected.

Figure 3. The form with Credit Hold selected

Cancellation or Correction of an Invoice with Externally Calculated Taxes

In previous versions of MYOB Acumatica, an issue arose with canceling or correcting invoices whose taxes were calculated by external tax providers. When a user canceled or corrected such an invoice, the taxes in the created credit memo could differ from those applied to the original invoice. This caused the credit memo to fail when being applied to the invoice and prevented the release of the correction invoice.

In MYOB Acumatica 2025.1, the process for canceling or correcting invoices with taxes calculated by external providers has been optimized. When a user cancels or corrects an invoice, the system creates a credit memo with the same taxes and document totals as the original invoice. Thus, the credit memo can be applied to the invoice, and the correction invoice can be released.