Finance: Recording of Finance Charges for Refunds

In previous versions of MYOB Acumatica, if a user was entering a refund on the Payments and Applications (AR302000) form, they could not add finance charges to the refund on the Charges tab.

Starting in MYOB Acumatica 2025.1, users can add charges to refunds and voided refunds on the Payments and Applications form. The charge amount can be either a positive value or a negative value.

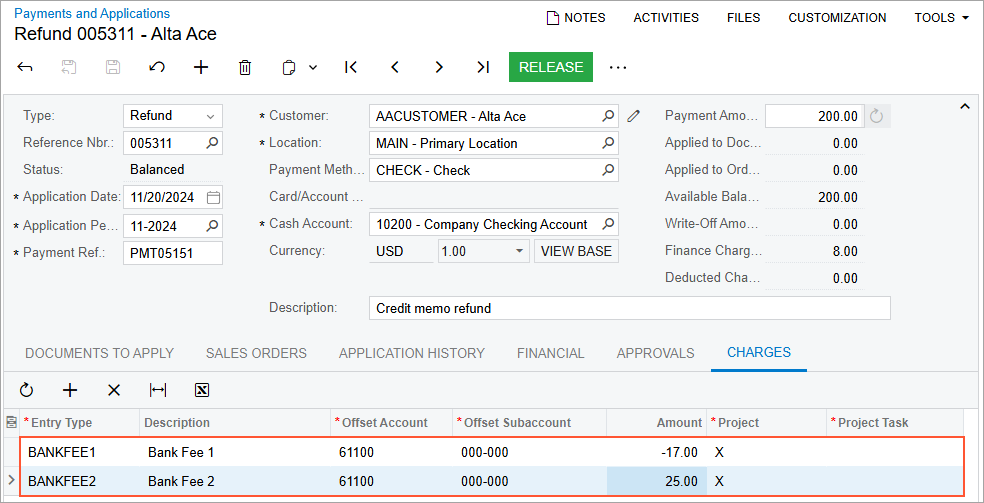

Entry of Charges for a Refund

On the Charges tab of the Payments and Applications (AR302000) form, a user can add finance charges to a refund, as shown in the following screenshot.

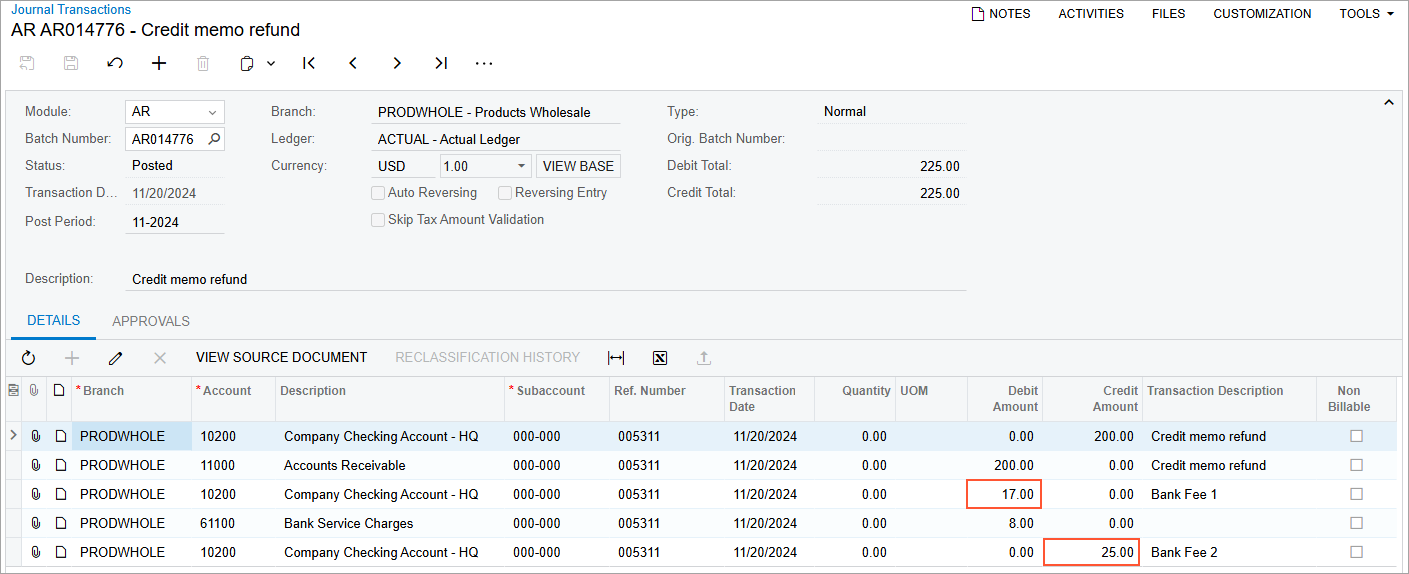

When the refund is released, the positive amount of the charge will credit the cash account, and the negative amount of the charge will debit the cash account. The posted GL transaction is shown in the following screenshot.

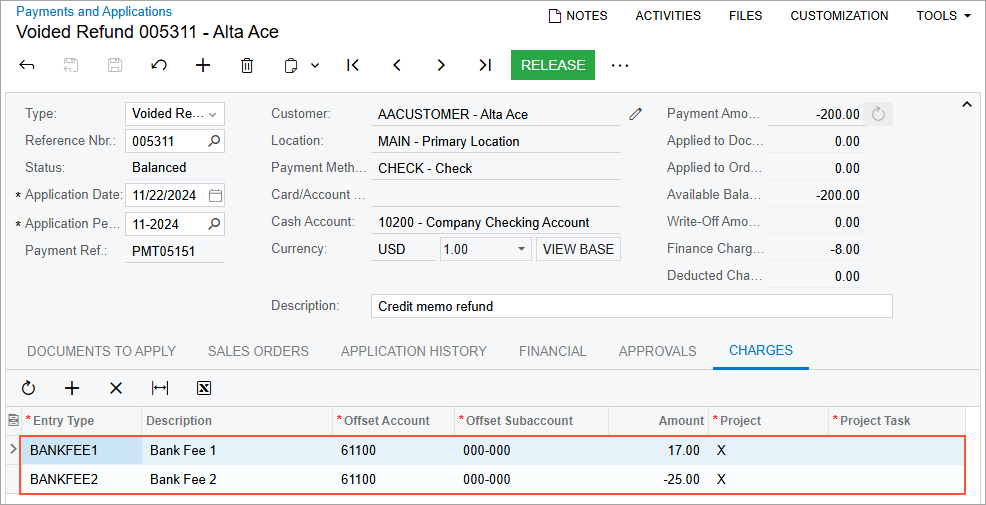

Entry of Charges for a Voided Refund

When a user voids a refund on the Payments and Applications (AR302000) form, the system creates a document with the Voided Refund type. On the Charges tab of the form, the system automatically adds charges with the opposite sign of the values in the original refund. A voided refund with charges is shown in the following screenshot.