Retail Commerce: Improvements to the Mapping of Taxes for Shopify

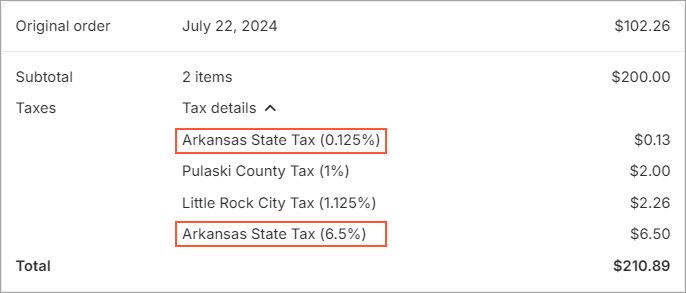

Taxes in Shopify can have the same name but different rates, as the following screenshot shows.

In MYOB Acumatica 2024 R2 and previous versions, the mapping of taxes from Shopify with taxes configured in MYOB Acumatica was performed by the tax name. In MYOB Acumatica 2025.1, the mapping of taxes has been improved to support the import of taxes with the same name but different rates from Shopify.

Configuring the Mapping of Taxes

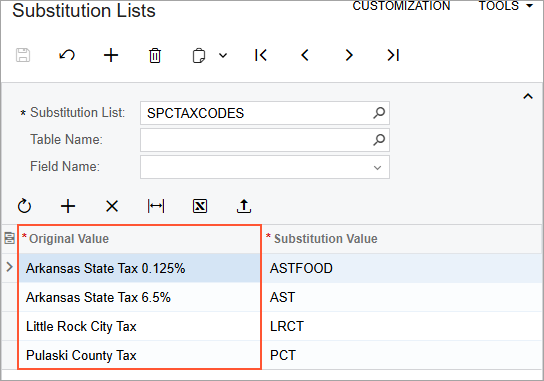

To map taxes from Shopify with taxes from MYOB Acumatica, an administrative user creates a substitution list on the Substitution Lists (SM206026) form. In the substitution list, the administrative user specifies a tax from the Shopify store in the Original Value column in either of the following ways (see the screenshot below):

- <Tax Name>: The tax name if the name is unique (for example, Arkansas State Tax).

- <Tax Name> <Tax Rate>: The tax name followed by the space character and the

tax rate if there are multiple taxes with the same name but different rates (for example,

Arkansas State Tax 6.5%).

The administrative user specifies the tax rate as a decimal followed by the % character, as it is represented in the Shopify store. For example, the tax rate of 6.5% is specified as 6.5% and the tax rate of 0.125% is specified as 0.125%.

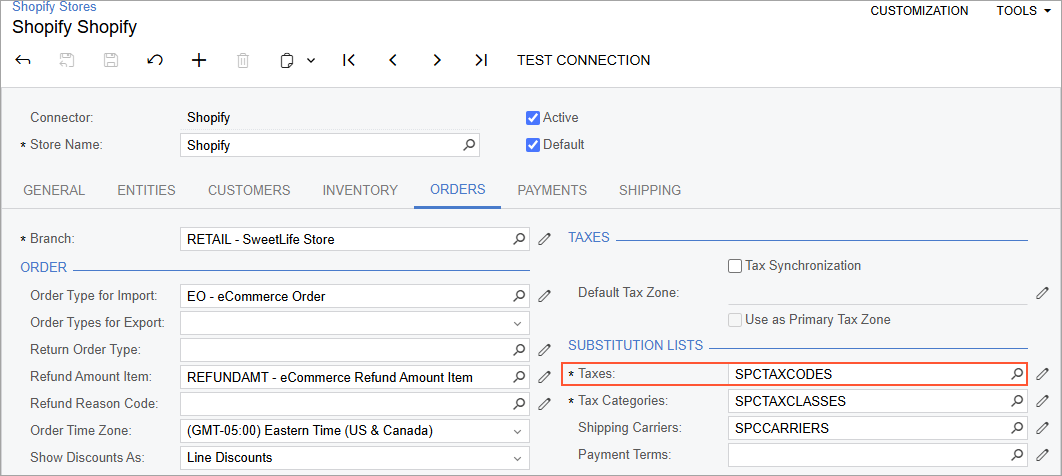

To use the created substitution list for the Shopify store, the administrative user specifies the substitution list in the Taxes box on the Orders tab of the Shopify Stores (BC201010) form. (See the following screenshot.)