Calculating Tax for Extra Termination Payments (NZ)

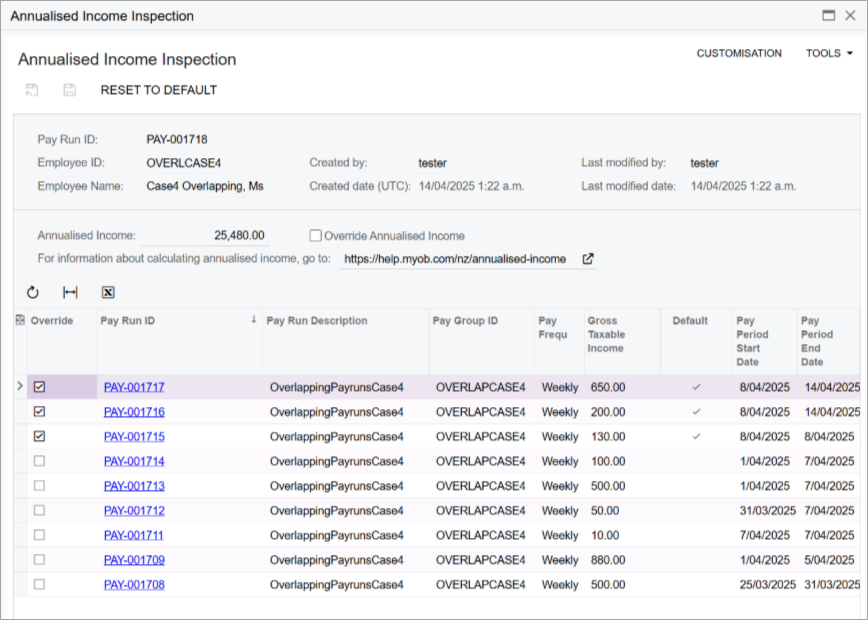

When a New Zealand employee receives an extra payment as part of their termination, the employee's annualised income is used to calculate the extra payment's marginal tax rate. MYOB Acumatica — Payroll automatically calculates an employee's annualised income by using the gross income from their last two pay periods.

For information about calculating PAYE for a lump sum payment at the end of employment, see the Inland Revenue (IR) website.

You can see annualised income in the summary area of the Employee's Current Pay form (MP.PP.31.30), as long as their current pay has an active termination batch.

Recalculating annualised income

There are two ways you can override the automatic calculation:

- In the table, select the Override checkbox for different pay runs.

- Manually calculate the employee's annualised income, then select the Override Annualised Income checkbox and enter the new amount in the Annualised Income field.

After overriding an amount, make sure to save your changes.

To undo an override, click Reset to Default at the top of the Annualised Income Inspection window.