Finance: Prepayment Invoices in Accounts Receivable

In some countries with value-added tax (VAT) regulations, companies are required to report taxes upon receiving prepayments from clients. Therefore, when a company receives a prepayment from a customer, it is typically required to report taxes on that prepayment for the period in which the prepayment was received.

To help companies meet these requirements, MYOB Acumatica has introduced the prepayment invoice functionality. With this functionality, users can create prepayment invoices for the items and services ordered by customers. The system calculates taxes on each prepayment invoice. Once the prepayment invoice is paid, the company can report the taxes in the reporting period in which the prepayment was received.

Users can create prepayment invoices when the new VAT Recognition on Prepayments feature is enabled on the Enable/Disable Features (CS100000) form.

Creation and Processing of a Prepayment Invoice

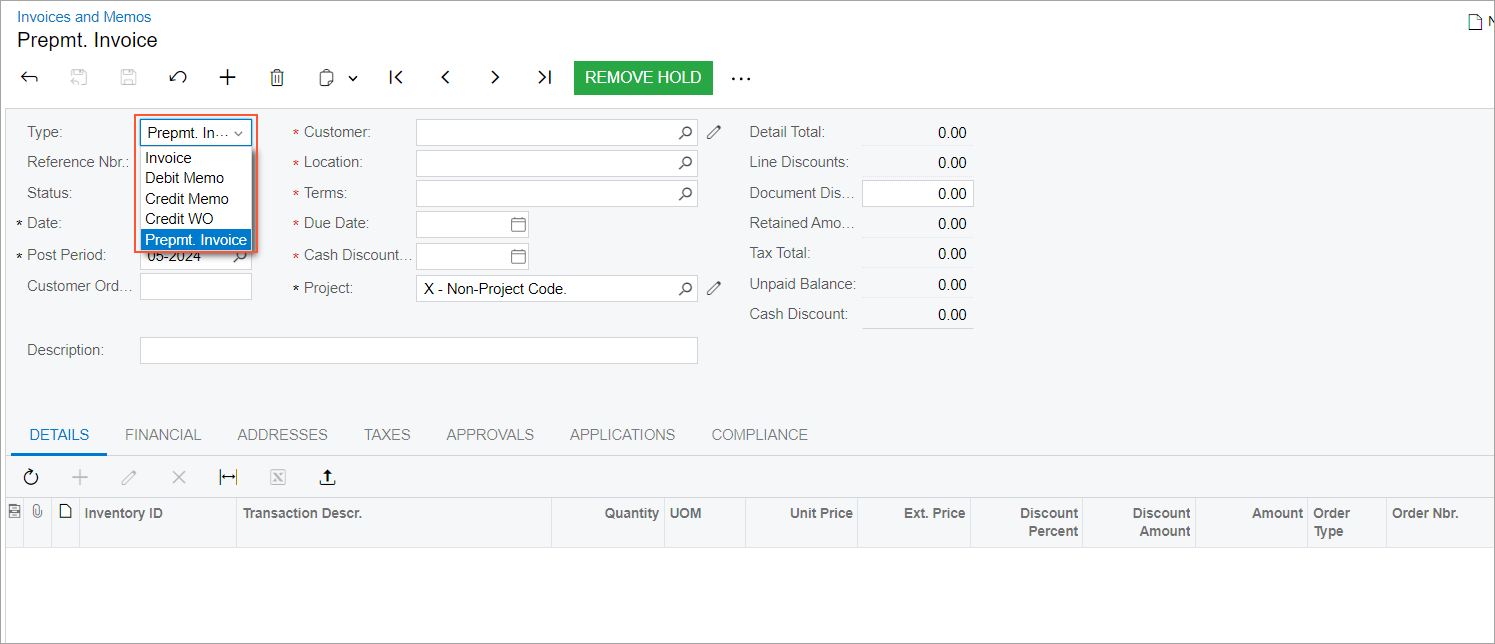

A user creates a prepayment invoice on the Invoices and Memos (AR301000) form. In the Type box of the Summary area, the user selects the new Prepmt. Invoice document type (see the following screenshot).

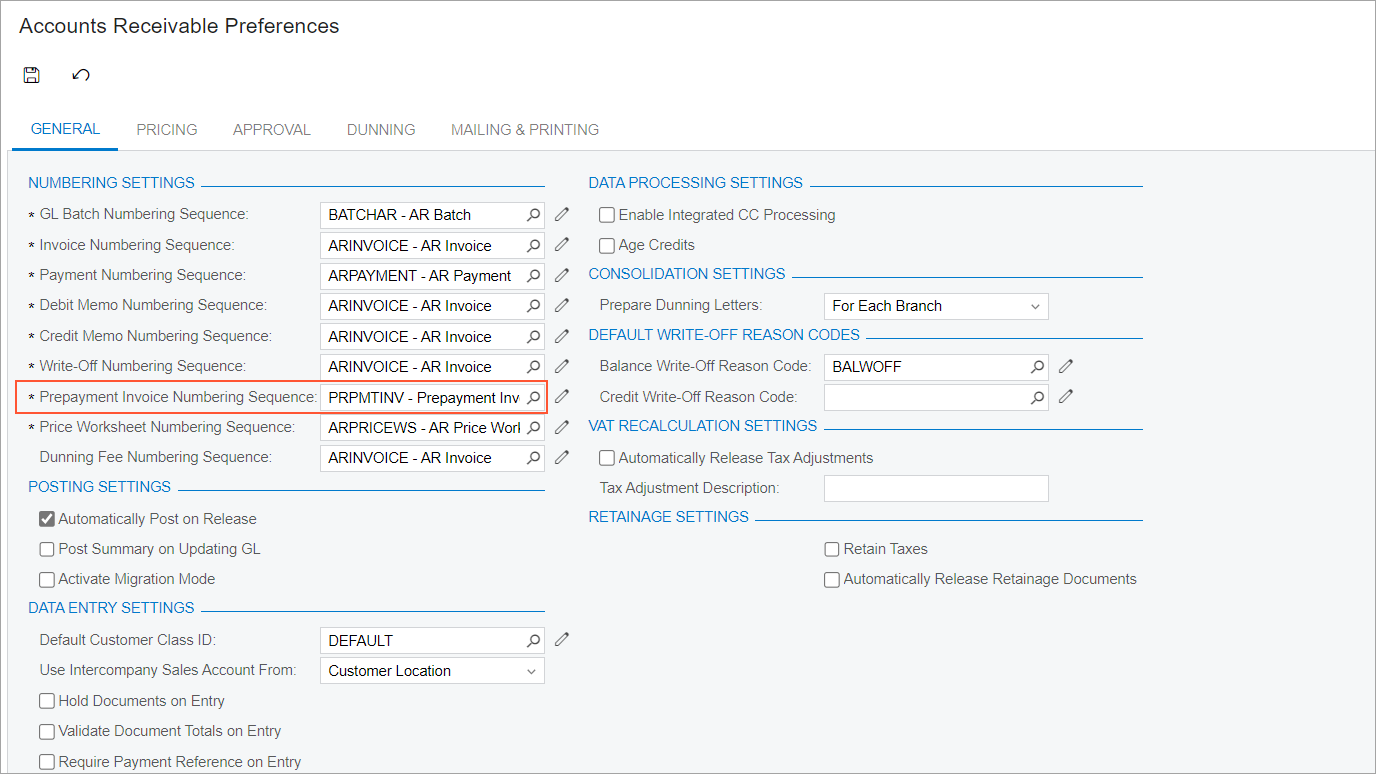

Once the prepayment invoice is saved, the system assigns a reference number to the prepayment invoice based on the numbering sequence specified in the new Prepayment Invoice Numbering Sequence box on the Accounts Receivable Preferences (AR101000) form (shown in the following screenshot).

In the prepayment invoice, the system calculates the total invoice amount, including taxes, and displays it in the Unpaid Balance box of the Summary area.

When the user releases the prepayment invoice, the system assigns it the Pending Payment status and generates a GL batch to debit the Accounts Receivable account and credit the Prepayment Account in the amount of the prepayment invoice.

Once the prepayment invoice is released, it can be paid. On the Invoices and Memos form, a user clicks Pay on the form toolbar. The system creates a payment application and opens it on the Payments and Applications (AR302000) form. On this form, on the Documents to Apply tab, the prepayment invoice is added. The prepayment invoice can be paid fully or partially as follows:

- To pay the prepayment invoice in full, the user ensures that the system has inserted the

amount of the unpaid balance of the prepayment invoice in the Payment

Amount box of the Summary area and in the Amount Paid

column of the Documents to Apply tab of the Payments and Applications form. The user releases the payment.

On release, the system generates a GL batch to debit the company's cash account and credit the Accounts Receivable account. The batch also includes tax transactions debiting the Pending Tax Payable account and crediting the Tax Payable account. The Payment document is assigned the Closed status. On the Application History tab of the Payments and Applications form, the system has added the line with the reference numbers of the prepayment invoice and of the generated GL batch. The prepayment invoice has been assigned the Unapplied status, which means that the prepayment invoice can be applied to AR invoices or debit memos issued to the customer specified in the prepayment invoice. For a fully paid prepayment invoice, the available balance is displayed in the Balance box in the Summary area of the Invoices and Memos form; this box replaces the Unpaid Balance box once the prepayment invoice is paid. The system also updates the customer’s balance on the Customers (AR303000) form.

- To apply a partial payment to the prepayment

invoice, the user specifies the payment amount in the Payment

Amount box of the Summary area and in the Amount Paid

column on the Documents to Apply tab of the Payments and Applications form; the user then releases the application. The

generated GL batch includes tax transactions, with tax amounts calculated based on the

partially paid amount. The Payment document is assigned the Closed status.

The system removes the line on the Documents to Apply tab and adds

a new line with the prepayment invoice on the Application History

tab. The prepayment invoice keeps the Pending Payment status. The remaining invoice

amount is specified in the Unpaid Balance box of the Summary area

on the Invoices and Memos form.

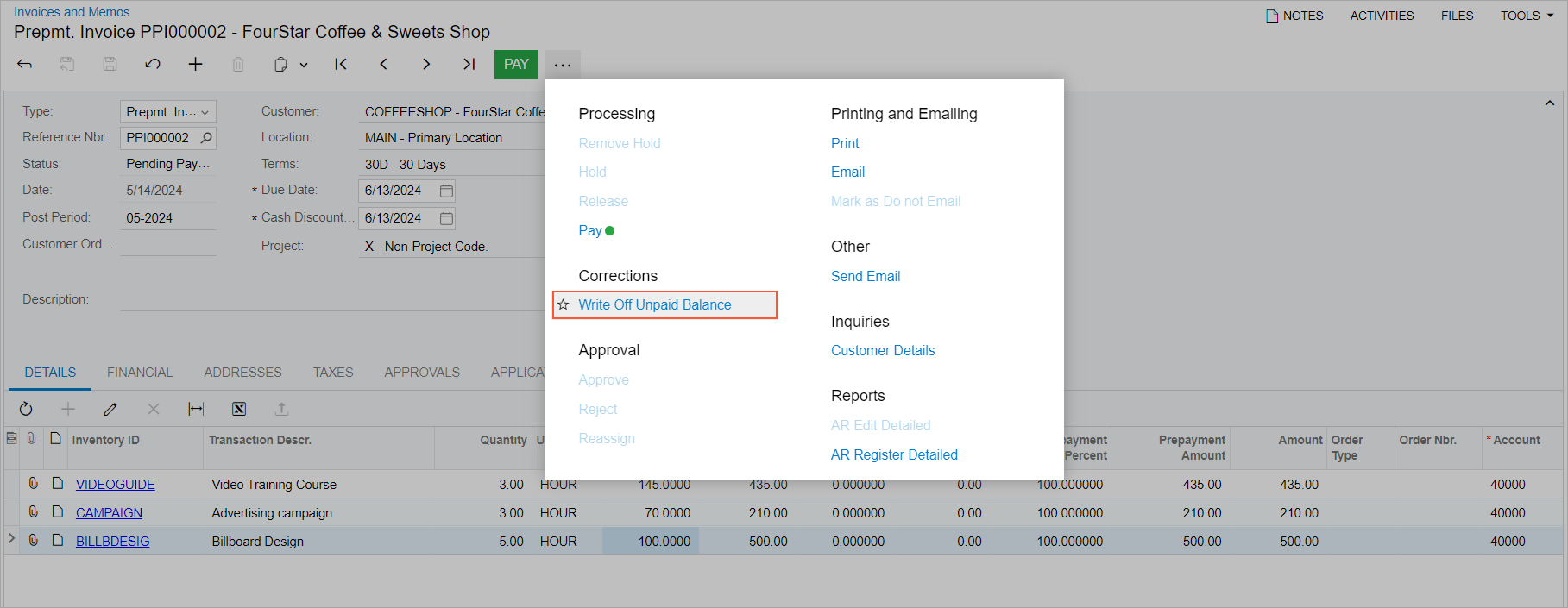

The unpaid balance of the prepayment invoice can be either paid or written off. To write off the unpaid balance of the invoice, the user clicks Write Off Unpaid Balance on the More menu of the Invoices and Memos form. The system creates a document of the Credit Memo type and opens it on the current form. On release of the credit memo, the system generates a GL transaction, which debits the customer's prepayment account and credits the Accounts Receivable account.

When the prepayment invoice has been fully paid, it can be applied to any number of accounts receivable invoices or debit memos. The user applies the prepayment invoice with the Unapplied status to one AR invoice or debit memo in full or distributes the unapplied balance of the prepayment invoice to multiple invoices or debit memos of the customer. In the prepayment invoice, on the Invoices and Memos form, the user clicks Apply on the form toolbar. The system opens the Payments and Applications form with the prepayment invoice selected in the Summary area. On the Documents to Apply tab, the user selects one or more AR invoice or debit memos of the customer. In the Amount Paid column of the tab, they specify the amount to be paid for the selected AR invoice or memo. Then on the form toolbar, they click Release. On release, the system generates a GL batch to debit the prepayment account and credit the Accounts Receivable account. The batch also includes tax transactions debiting the Tax Payable account and crediting the Pending Tax Payable account.

The statuses and balances of prepayment invoices and AR invoices or debit memos can be affected as follows, depending on whether the AR invoice or debit memo is fully or partially paid and how much of the unapplied balance from the prepayment invoice is used (an AR invoice is used in this example):

- If part of the AR invoice balance has been specified in the Amount Paid column on the Documents to Apply tab of the Payments and Applications form and the application has been released, the AR invoice keeps the Open status, and its balance is decreased by the amount paid. If the AR invoice has been paid in full, the invoice’s status changes to Closed, and its balance is 0.

- If the full available balance of the prepayment invoice has been applied to an AR invoice or multiple AR invoices, the status of the prepayment invoice changes to Closed and its available balance is 0. If a part of the available balance of the prepayment invoice has been applied to an AR invoice or multiple invoices, the prepayment invoice’s status remains Unapplied, and the remaining available balance specified in the Available Balance box of the Summary area of the Payments and Applications form is decreased.

On the Application History tab of the current form, the system has added a line with the details of the AR invoice and the reference number of the generated GL batch. The GL batch contains the reversed tax entries posted on application of the payment to the prepayment invoice. The system updates the customer balance on the Customers form.

Correction of Prepayment Invoices

In certain cases, a prepayment invoice may need to be corrected or voided. This could happen, for instance, if the items included in the prepayment invoice are no longer needed. In these cases, the unpaid balance of the prepayment invoice can be written off or a prepayment invoice can be voided if it has not been paid yet.

Writing Off the Unpaid Balance of the Partially Paid Prepayment Invoices

A user can write off the unpaid balance of prepayment invoices that have been paid partially.

To do this, on the Invoices and Memos (AR301000) form, the user opens a prepayment invoice with the Pending Payment status. On the More menu (under Corrections), they click Write Off Unpaid Balance (see the following screenshot).

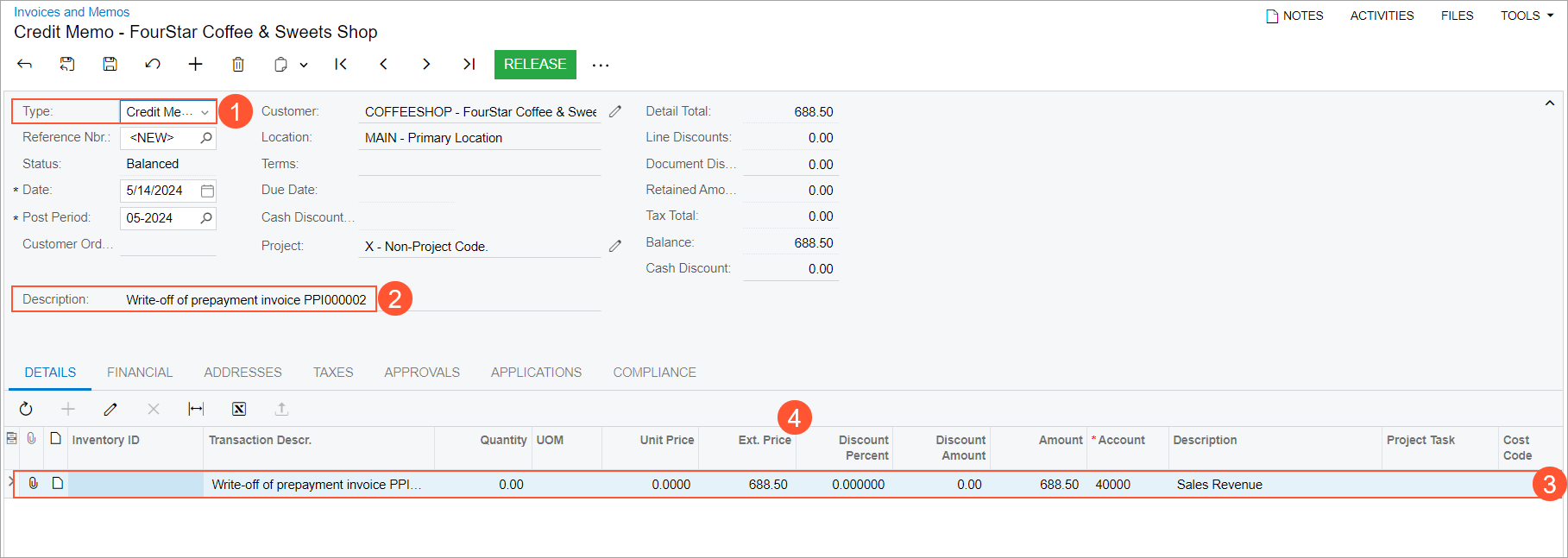

The system creates a Credit Memo document (see Item 1 in the following screenshot) with the Write-off of prepayment invoice [Reference Nbr.] description (Item 2) and opens it on the current form. On the Details tab, the credit memo has a single line that summarizes all detail lines of the prepayment invoice (Item 3) and displays the invoice’s unpaid balance in the Ext. Price column (Item 4). This amount cannot be edited.

On the Applications tab, the system has added the related prepayment invoice.

The application of the credit memo that was created during the write-off of the unpaid balance of a prepayment invoice cannot be reversed.

Voiding the Unpaid Prepayment Invoices

The prepayment invoices with the Pending Payment status that have not been paid at all can be voided. A user voids a prepayment invoice by writing off its unpaid balance.

To do this, on the Invoices and Memos (AR301000) form, the user opens the prepayment invoice with the Pending Payment status. On the More menu, the user clicks Write Off Unpaid Balance under the Corrections section. The system creates a Credit Memo document with the Voiding of prepayment invoice [Reference Nbr.] description and opens it on the current form. On the Details tab, the credit memo has a single line that is the sum of all detail lines of the prepayment invoice and displays the invoice’s unpaid balance in the Ext. Price column. This amount cannot be edited. On the Applications tab, the system has added the related prepayment invoice.

On release of the credit memo, the system generates a GL transaction that debits the customer's prepayment account and credits the Accounts Receivable account. This GL transaction reverses the GL transaction that was generated on release of the prepayment invoice. The system specifies the reference number of the newly created transaction on the Financial tab of the current form. Once the credit memo is released, it is assigned the Closed status, and the prepayment invoice is assigned the Voided status.

The application of the credit memo that was created during the write-off of the unpaid balance of a prepayment invoice cannot be reversed.

Reports and Inquiry Forms Affected by Prepayment Invoices

Users can do the following on the report or inquiry forms that have been affected by the prepayment invoice functionality:

- Review the customer balance: When a prepayment invoice is released, the customer’s

balance is updated. Users can view the prepayment balance of a customer on the Customer Details (AR402000) form. This form can be opened directly

or by clicking Customer Details (under

Inquiries) on the More menu of the Invoices and Memos (AR301000) or Payments and Applications (AR302000) form.

Unlike other documents, prepayment invoices are displayed on the Customer Details form in two lines:

- The first line shows the amount that has been posted to the customer’s AR account; this amount has a positive sign.

- The second line shows the amount that has been posted to the customer's prepayment account; this amount has a negative sign.

Note: The AR Account and AR Subaccount columns are visible only if the VAT Recognition on Prepayments feature is enabled on the Enable/Disable Features (CS100000) form. - Prepare customer statements: Prepayment invoices of the Pending Payment status

(if they have not been paid yet or have been partially paid) are included in statements.

The unpaid balances of prepayment invoices are shown in statements with a positive sign.

Users can prepare statements on the Prepare Statements

(AR503000) form or view any generated statement of a particular customer on the Customer Statement History (AR404600) form. Note: The total amount due shown in a statement does not match the customer's balance because the customer's balance includes the balances of the fully and partially paid prepayment invoices.

- Prepare dunning letters: Prepayment invoices with the Pending Payment status (if

they have not been paid yet or have been partially paid) are included in dunning letters.

On the Prepare Dunning Letters (AR521000) form, users can generate

dunning letters for customers that have unpaid and overdue invoices and unpaid prepayment

invoices. Note: This functionality is available only if the Dunning Letter Management feature is enabled on the Enable/Disable Features (CS100000) form.

- Generate the AR Aging reports: All of the following reports show all AR documents in the

system, including unpaid or partially paid prepayment invoices (that is, prepayment

invoices of the Pending Payment status) that are outstanding at the end of the

specified period: AR Aging (AR631000), AR Aging by Project (AR631200), AR Aged Period-Sensitive (AR630500), AR Aged Period-Sensitive by Project (AR630600), AR Aging MC (AR631100). Note: The AR Aging MC report is available only if the Multicurrency Accounting feature is enabled on the Enable/Disable Features (CS100000) form.In these reports, the unpaid balances of prepayment invoices are included with a positive sign.Note: The Customer Total amount specified in reports does not match the customer's balance because the customer's balance includes the balances of the fully and partially paid prepayment invoices.

The following reports have been also updated to include data related to prepayment invoices:

- AR Balance by GL Account (AR632000)

- AR Balance by Customer (AR632500)

- AR Balance by Customer MC (AR633000)

- AR Edit (AR611000)

- AR Edit Detailed (AR610500)

- AR Register (AR621500)

- AR Register Detailed (AR622000)

- Customer Summary (AR401000)