Calculating Termination Payments (NZ)

After you've created a termination pay, you can calculate termination payments for an employee.

Entering termination details

On the Details tab of the Termination window:

- Select a Reason why the employee is terminated. This is used for record-keeping and reporting but does not affect how the employee is paid or taxed.

- Enter the employee's Last day of employment. This defaults to the current

business date.Warning:If you enter a last day that is later than the pay period end date, you must manually override the termination payment rates and amounts. Do not use the automatically calculated rates, as they will be incorrect.

Reviewing unused annual leave payments

Use the Unused Annual Leave tab to determine how much the employee is paid for unused leave.

If the Remaining "earned" units is incorrect in the Earned (Entitled) Payments section, then cancel the termination and use the Entitlement Adjustments form (MP.PP.30.00) to correct the entitlement units.

If there's a negative payment amount in the Accrual Payment section, it might be because the employee took annual leave in advance, which exceeded their holiday pay amount. To learn how check if the negative amount is correct, see our knowledge base article.

For detailed information about how unused leave values are calculated, see our reference page for the Termination (NZ) form (MP.PP.54.00).

Reviewing public holidays and unused other leave

- On the Public Holiday tab, check that the Rate is correct.

- If the rate is wrong, select the Override checkbox and enter a new rate in the Override Rate column.

- On the Unused Other Leave tab, check that the Rate and Calculated Amount are correct.

- If the rate or calculated amount is wrong, select the Override checkbox and enter a new rate in the Override Rate column.

If your company allows negative leave balances, then the employee might have negative payment amounts for non-annual leave entitlements. To fix this, you must cancel the termination, add a deduction pay item to the employee's current pay, then start the termination again.

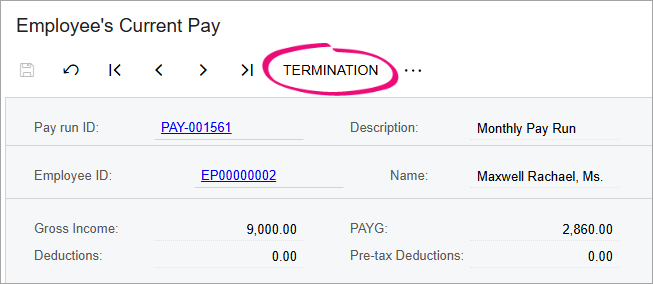

Finalising the pay

After going through the tabs on the Termination window, click the Save and close icon to go back to the employee's current pay, where the pay items for unused leave and lump sum payments have been added. You can now process and finalise the pay as normal. You might also want to review the employee's annualised income.

After the pay is finalised, the employee's records are updated:

- The termination date is added to two places: the Employee End Date field on the Pay Details form (MP.PP.23.10) and the Expiry Date column on the Employee Pay Groups form (MP.PP.22.50).

- If there's an active row on the Employment History tab of the Employees form (EP.20.30.00), it's updated to reflect the employee's termination.

- The status of the employee record is set to Inactive on the Pay Details and Employees forms.