Calculating Termination Payments (AU)

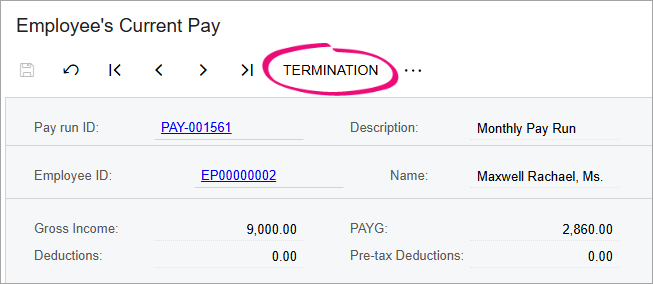

After you've created a termination pay, you can calculate termination payments for an employee.

Entering a termination reason

- On the Details tab of the Termination window, select a

Reason why the employee is terminated:

- Resignation – For any time an employee has decided for themselves to leave the company.

- Genuine Redundancy – For terminations that meet the Australian Taxation Office (ATO) criteria for genuine redundancy or approved early retirement.

- Dismissal – For all other times your company might have decided to terminate the employee.

- Select a Cessation Reason, which is used in Single Touch Payroll (STP) reporting. For more information about what to report and when, see the ATO website.

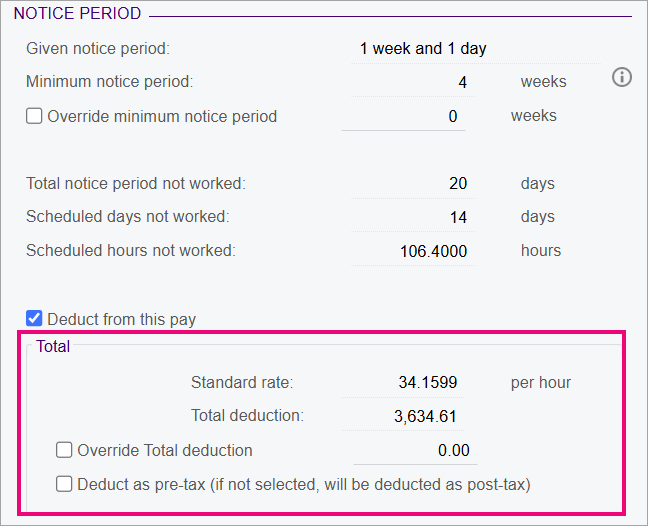

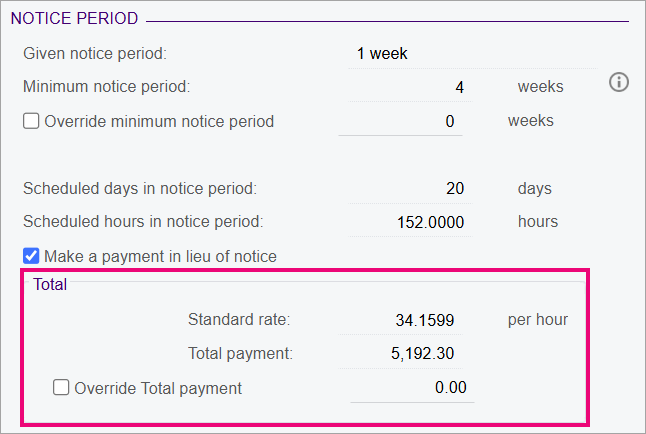

Making or deducting notice period payments

Depending on why the employee is being terminated, you have two options. You can either deduct an unworked notice period from their pay, or you can pay them if they weren't notified ahead of their termination.

Notice periods are calculated according to National Employment Standards – see the Fair Work website. The period is in calendar days. Deductions are based on scheduled work days in the employee calendar, including days taken as leave.

- On the Details tab of the Termination window, enter the Last day of

employment and the Date when notice was given. MYOB Acumatica then calculates the employee's period of continuous service and minimum

notice period. Note:Any periods marked as a service break on the on the Employment History tab of the Employees form (EP.20.30.00) are excluded from the period of continuous service.

- If the notice period is incorrect, select the Override minimum notice period checkbox and enter the correct number of weeks.

- For a resignation – If the Total notice period not worked is more than

zero, you can select the Deduct from this pay checkbox. The amount

deducted from their pay is calculated automatically in the Total section.

The deduction will be added to their current pay when you save and close the

Termination window.

- For a genuine redundancy or dismissal – You can select the Make a payment in

lieu of notice checkbox if the employee wasn't given enough notice to

cover the minimum notice period. The full period of notice will be paid, as

shown in the Total section. The payment will be added to the Other

Termination Payments tab of the Termination window, then added to the

employee's current pay when you save and close the window.

Overriding unused leave

All unused leave balances for the employee are calculated and displayed on two tabs: Unused Annual and Long Service Leave and Unused Other Leave. If necessary, you can override the calculated amounts by selecting the Override checkbox and entering a new amount in the Override Amount column. To explain why the amount was overriden, enter a Comment.

Adding other termination payments

You can use the Other Termination Payments tab for lump sum payments. To add a payment, click the plus icon (+) to add a row, then select a pay item.

If the termination is a genuine redunancy, a minimum redundancy payment is automatically added with the Excluded Payment checkbox selected. You can also manually add a minimum redundancy payment for a dismissal.

Setting ATO reporting labels

For unused leave, other termination payments and custom payments, the read-only ETP checkbox indicates whether the leave type is an employee termination payment or not. Apart from time off in lieu (TOIL), all other leave types are ETPs. The taxation treatment of the pay item determines this. You can also select the Excluded Payment checkbox if appropriate. These two checkboxes determine the ETP code and ATO reporting categories that will be used in the Single Touch Payroll (STP) submission. The exception to this is when the entitlement is configured to use your own pay item, which has been set to be treated as Other. You can't override this on the Termination window.

Finalising the pay

After going through the tabs on the Termination window, click the Save and close icon to go back to the employee's current pay, where the pay items for unused leave and other termination payments have been added. You can now process and complete the pay as normal.

After the pay is finalised, the employee's records are updated:

- The termination date is added to two places: the Employee End Date field on the Pay Details form (MP.PP.23.10) and the Expiry Date column on the Employee Pay Groups form (MP.PP.22.50).

- If there's an active row on the Employment History tab of the Employees form (EP.20.30.00), it's updated to reflect the employee's termination.

- The status of the employee record is set to Inactive on the Pay Details and Employees forms.

- The Single Touch Payroll submission for the pay includes a finalisation declaration.