Reversing Pays

If you need to correct a pay after it's been processed and marked as complete, you can reverse the pay and then make changes to it. This reverses the entire pay run, affecting all employees and transactions in the pay run. To keep your company ready for future audits, reversing a pay also records the user who reversed the pay run and when it was reversed.

This page explains how to reverse a pay run and what happens after reversing.

To Reverse a Pay Run

You can only reverse a pay run if it's the most recently completed pay run for its pay group and that pay group doesn't already have a new open pay run. If you need to make changes to a historical pay run that doesn't meet these criteria, see Adjusting Pays.

-

Go to the Manage Pays form (MP.PP.41.10).

-

Click the Status dropdown and select Completed.

-

From the list of completed pay runs, click the one you want to reverse. The Pay Run Details form (MP.PP.31.20) opens.

-

On the form toolbar, click the three dots icon (...) and choose Reverse. click the Actions menu and select Reverse.

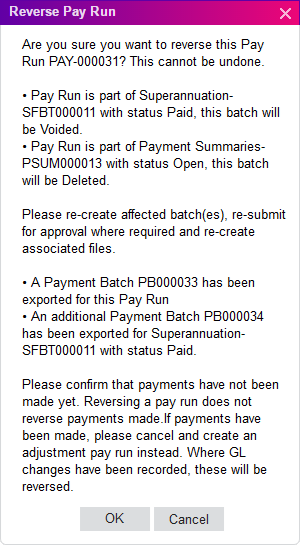

- Read the Reverse Pay Run message. If you still want to reverse the pay, click OK.

- To confirm the pay has been reversed, go to the Manage Pays page and select Reversed from the Status dropdown. This shows the details of any reversed pays.

Making Changes to a Reversed Pay Run

When you reverse a pay run, its status is set to reversed and you can't make changes to it.

However, a new open pay run is also created, which you can make changes to and process in place of the reversed pay run. The new open pay run is identical to the reversed pay, including:

-

changes from employees' standard pays

-

leave entered

-

the same physical pay day and pay period start and end dates.

General Ledger Transactions

When you reverse a pay run, it also reverses all the GL transactions generated by the original pay run. The original transactions are locked and reversing transactions are created for them.

Each reversed GL transaction includes a link to the reversing transaction that was created for it, and each reversing transaction includes a link to the reversed pay run as reference.

Superannuation and Tax Batches

- Batches that have already been approved are voided—the batch records remain, but have the VOIDED status and cannot be edited or processed.

- Batches that have not yet been approved are simply deleted.

Payment Batches

While it is possible to reverse payment batches and their related GL transactions, the MYOB Acumatica — Payroll system has no control over what happens once payment batch export files are submitted to a bank so that employees' pays can be distributed. (Indeed, the system has no way of knowing whether or not the file has been submitted to a bank.)

The presence of payment batches does not prevent a pay run from being reversed; if you reverse a pay run that payment batches have been created for, the batches will be voided in the same way as other batches. However, if you have submitted export files to a bank, you should not reverse the pay run. Instead, make a new adjustment pay run to correct the payments.

Pay Documents

- Links to payslip PDF files are removed from the main grid of the Pay Run Details (MP.PP.31.20) form.

- Links to payment summary PDF files are removed from the Files dropdown on the Pay Run Details (MP.PP.31.20) form.

Terminations

If the pay being reversed includes a termination, then all effects of the termination on the employee's record will be reversed—this includes setting the employee's record back to the "Active" status. In the new pay that is created to replace the reversed pay, all pay items from the termination will be present in the employee's pay—you can open the Termination (AU) (MP.PP.53.00) form to edit the termination details, or delete them altogether if you want to reverse the termination. If you keep the termination in the replacement pay, then when it is completed, the employee's record will be updated again, i.e. the record will be set back to "Inactive", etc.