Superannuation

MYOB Acumatica — Payroll allows superannuation contributions to be included employees' pays and paid out to superannuation funds. The process of setting up superannuation differs between Australia and New Zealand, but in both cases the same records (Pay Items and Superannuation Funds) are used.

Superannuation in Australia

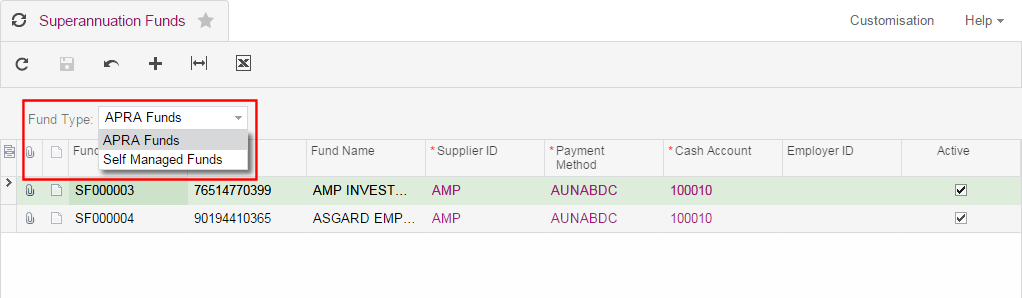

To pay superannuation in Australian companies, you must first set up superannuation funds on the Superannuation Funds (AU) (MP.PP.21.52) form. When creating a new fund, you must specify whether it is an APRA fund or a self-managed superannuation fund (SMSF). APRA funds are regulated superannuation funds supervised by the Australian Prudential Regulation Authority (APRA), while self-managed superannuation funds are supervised by the Australian Taxation Office (ATO).

Once you have set up the required superannuation funds, you can then set up pay items for employee and employer superannuation contributions on the Pay Items (MP.PP.22.10) form. By default, pay items are set to use the legislated Superannuation Guarantee (SG) contribution rates, but the option to override these rates is available.

Superannuation in New Zealand

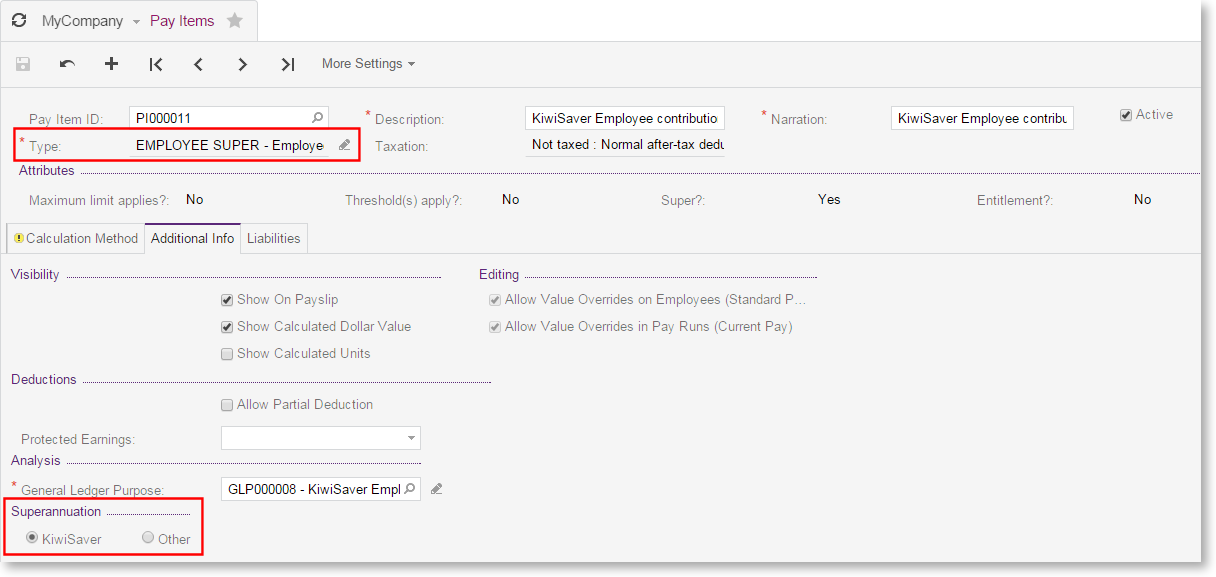

When making KiwiSaver contributions in New Zealand, there is no need to set up superannuation funds. Instead, set up pay items for employee and employer contributions, making sure to select the KiwiSaver option on the Additional Info tab of the Pay Items form:

To make contributions to non-KiwiSaver superannuation funds, you must set up the funds on the Superannuation Funds form, then create pay items with the Other option selected.

Adding Superannuation to Employees' Pays

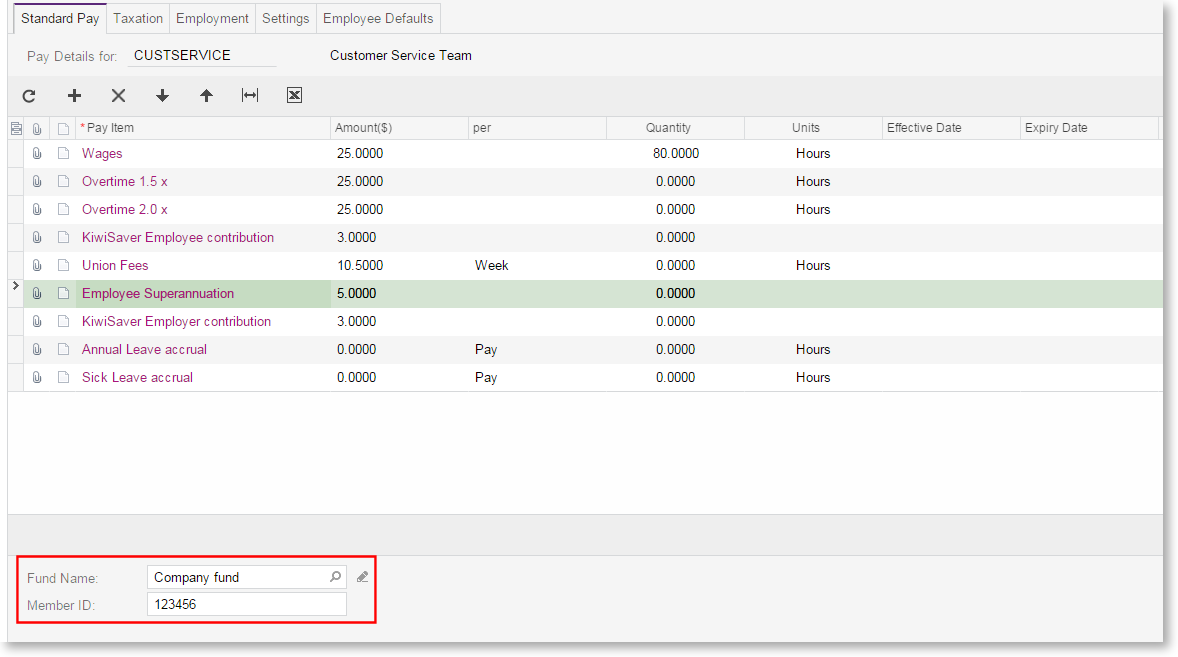

To pay superannuation contributions for an employee, add the pay items for employee and/or employer contributions to the employee's Standard Pay on the Pay Details (MP.PP.23.10) form. For Australian superannuation funds, and for non-KiwiSaver funds in New Zealand, you must select the superannuation fund that contributions will be made to and enter the employee's member ID in the footer section of the Standard Pay:

You can enter the contribution rate if the type of pay item allows it. For example, Australian Superannuation Guarantee items use the legislated SG rate automatically, but non-SG items allow you to enter a rate. KiwiSaver items allow you to enter a rate, but it must be one of the rates specified by KiwiSaver legislation.

Making Superannuation Contributions

Once one or more pays that include superannuation contributions have been completed, you can submit the contributions for payment. This process differs depending on the country and the kind of contribution.

In New Zealand, KiwiSaver contributions are submitted as part of the IRD reporting process (see "Reporting to the IRD").

For Australian superannuation contributions, and for contributions to non-KiwiSaver funds in New Zealand, a superannuation batch must be created and submitted. Superannuation batches are created on the Create Superannuation Batch (MP.PP.50.05) form. A batch can include contributions from multiple pays.

In New Zealand, submitting a batch generates a payment batch for processing the superannuation payments.

In Australia, you can submit superannuation batches online via the Pay Superannuation service. To use this service, you must first register for it. If you are not using the Pay Superannuation service, you must process payment batches for the superannuation contributions as in New Zealand.