Interbranch Bills with Balancing: Process Activity

In this activity, you will learn how to create and process a bill for branches requiring balancing. You will then review the relevant account balances.

Story

The head office of the Muffins & Cakes company needs to process a $350 bill that it has received from the Spectra Stationery Office vendor on March 1, 2025. The bill is for stationery that is being purchased for the head office branch in the amount of $250 and for the retail store branch in the amount of $100; these entries need to be balanced.

Acting as a Muffins accountant, you need to create a bill in the system to reflect the bill received from the vendor, and then release the bill, which causes a batch to be generated for it.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Companies (CS101500) form, the MUFFINS company has been defined.

- On the Branches (CS102000) form, the MHEAD and MRETAIL branches of the MUFFINS company have been created.

- On the Chart of Accounts (GL202500) form, multiple accounts have been created.

- On the Ledgers (GL201500) form, the MACTUAL ledger has been created.

- On the Vendors (AP303000) form, the STATOFFICE vendor has been created.

- On the Inter-Branch Account Mapping (GL101010) form, the account mapping rules between the Muffins & Cakes head office branch (MHEAD) and the Muffins & Cakes retail store branch (MRETAIL) have been defined.

Process Overview

To process an interbranch bill between branches requiring balancing, you will create and release the bill on the Bills and Adjustments (AP301000) form. You will then review the generated batch on the Journal Transactions (GL301000) form and check the account balances on the Account Summary (GL401000) form.

Finally, you will generate the trial balance report by using the Trial Balance Summary (GL632000) report form.

System Preparation

Before you begin performing the steps of this activity, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as an accountant Nenad Pasic by using the pasic username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 3/1/2025. If a different date is displayed, click the Business Date menu button and select 3/1/2025.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, select the MHEAD - Muffins Head Office & Wholesale Center branch.

Step 1: Creating and Processing a Bill for Branches Requiring Balancing

To create and process an AP bill for stationery purchased for multiple branches (MHEAD and MRETAIL) that require balancing, do the following:

- Open the Bills and Adjustments (AP301000) form.Tip:To open the form for creating a new record, type the form ID in the Search box, and on the Search form, point at the form title and click New right of the title.

- Click Add New Record on the form toolbar, and specify the

following settings in the Summary area:

- Type: Bill

- Vendor: STATOFFICE

- Date: 3/1/2025 (inserted by default)

- Description: Stationery

- On the Details tab, click Add Row, and

specify the following settings in the row you have added:

- Branch: MHEAD

- Transaction Descr.: Stationery

- Ext. Cost: 250

- Add another row with the following settings:

- Branch: MRETAIL

- Transaction Descr.: Stationery

- Ext. Cost: 100

Notice that the 62400 - Office Expense account has been inserted in the Account column for both lines automatically because it is the expense account associated with the vendor.

- On the form toolbar, click Save to save the bill.

- On the form toolbar, click Remove Hold and then click Release to release the bill.

- On the Financial tab, notice that the originating branch of the bill is MHEAD, which is specified in the Branch box. The system has filled in the Branch box automatically with the branch to which you are signed in. Also, notice 20000 - Accounts Payable account is specified in the AP Account box.

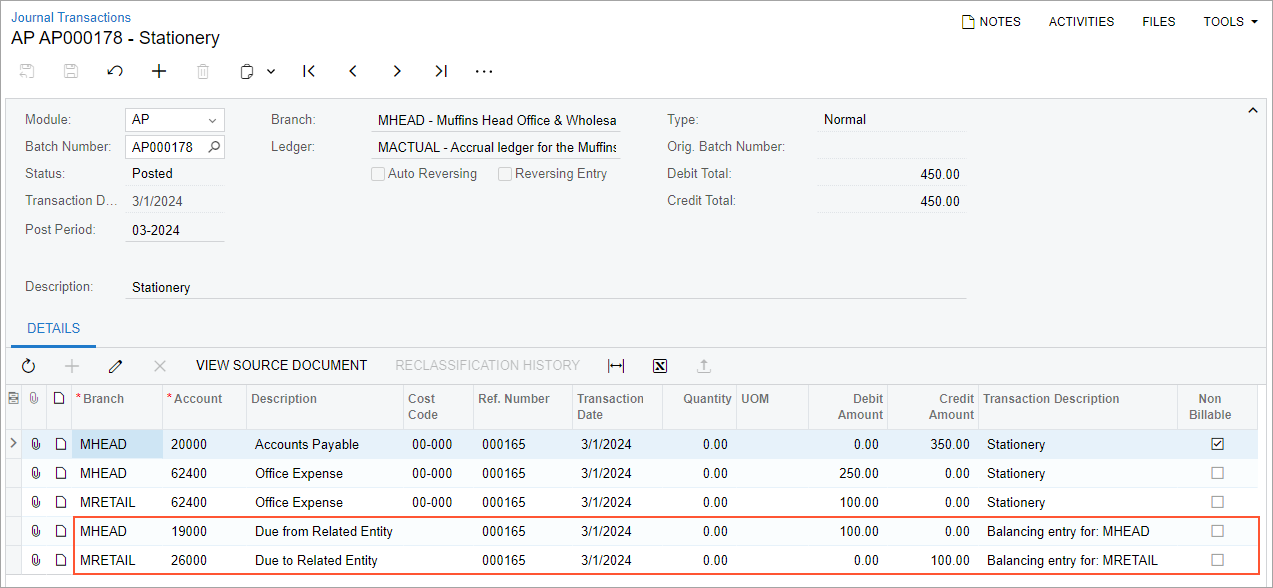

- Click the link in the Batch Nbr. box, and review the GL batch,

which the system has opened on the Journal Transactions (GL301000) form.

When you released the bill, the system generated and posted the related GL transaction. The AP account of the originating branch of the bill has been credited and accounts from each document line have been debited in the destination branch specified in detail lines. Notice that the system added the balancing entries to the batch during the posting process (see the following screenshot). The balancing entries have been created based on the mapping rule that has been configured on the Inter-Branch Account Mapping (GL101010) form.

Figure 1. The balancing entries added to the batch

You have added an AP bill that includes items purchased for two branches requiring balancing, and you have released this bill and reviewed the batch created when the bill was released. In the next step, you will check the account balances in each of the branches.

Step 2: Reviewing the Account Balances

To review the account balances for the MHEAD and MRETAIL branches and the 03-2025 financial period, do the following:

- Open the Account Summary (GL401000) form.

- To review the account balances in the MHEAD branch, in the Summary area, specify

the following settings:

- Company/Branch: MHEAD

- Ledger: MACTUAL

- Period: 03-2025

- In the table, review the account balances. Notice that the amount in the Ending Balance column for the 20000 - Accounts Payable account is $350.00, for the 62400 - Office Expense account is $250.00, and for the 19000 - Due from Related Entity account is $100.00.

- In the Company/Branch box of the Summary area, select MRETAIL to review the account balances in the MRETAIL branch.

- In the table, review the account balances. Notice the amount in the Ending Balance column for the 62400 - Office Expense account is $100.00 and for the 26000 - Due to Related Entity account is $100.00.

You have reviewed the account balances for the branches for which goods were purchased in the AP bill you created. Now you will review the balances for the financial period for the company as a whole.

Step 3 (Optional): Reviewing the Balances for the Financial Period

To review the balances for the 03-2025 financial period, do the following:

- Open the Trial Balance Summary (GL632000) report form.

- To prepare this report for the MHEAD branch, on the Report

Parameters tab, specify the following parameters:

- Company/Branch: MHEAD

- Ledger: MACTUAL

- From Period: 03-2025

- To Period: 03-2025

- Suppress Zero Balances: Selected

- On the report form toolbar, click Run Report.

- In the generated report, review the account balances. Notice the amount in the Ending Balance column for the 20000 - Accounts Payable account, the 62400 - Office Expense account, and the 19000 - Due from Related Entity account.

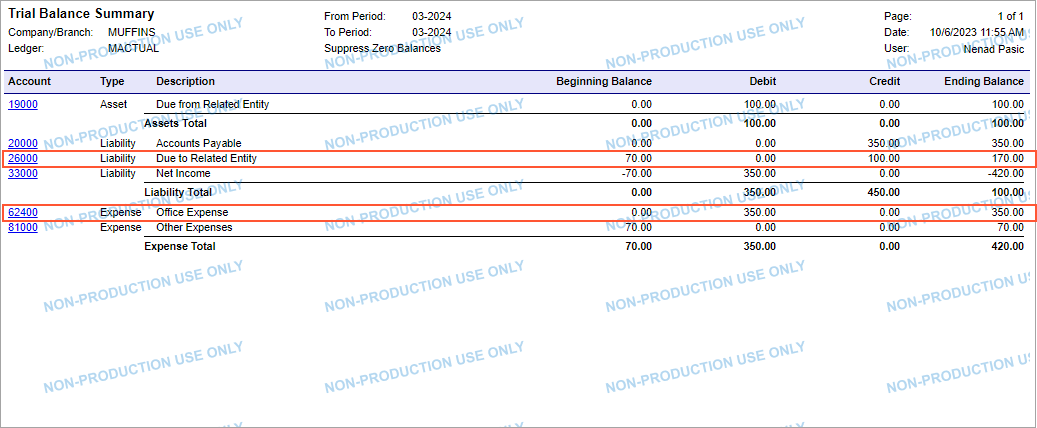

- Run the same report for the whole company. To do so, in the Company/Branch box of the Report Parameters tab, select MUFFINS.

- In the generated report, review the account balances. Notice the amount in the Ending Balance column for the 62400 - Office Expense account and the 26000 - Due to Related Entity account, which are shown in the following screenshot.

In this activity, you have created and processed a bill that includes items purchased for branches that require balancing, and you have learned how to review the relevant account balances.