Fringe Benefits

MYOB Acumatica — Payroll includes support for reportable fringe benefits in employees' pays. Reportable fringe benefit pay items can be created and added to employees' pays, and reportable fringe benefit amounts appear on payment summaries.

Setting up Fringe Benefits

Fringe Benefits are set up as pay items on the Pay Items (MP.PP.22.10) form. For a fringe benefit, the pay item's Type should be "FRINGE BENEFIT REPORTING" - pay items of this type have the following properties:

- The Taxation field on the Pay Items form is set to "Tax-free (Paid after tax)".

- A General Ledger Purpose is not required - the General Ledger Purpose field is hidden on the Pay Items form.

- The item's ATO Category on the Pay Item Liabilities form (MP.PP.10.25) is set to "Reportable fringe benefits amount".

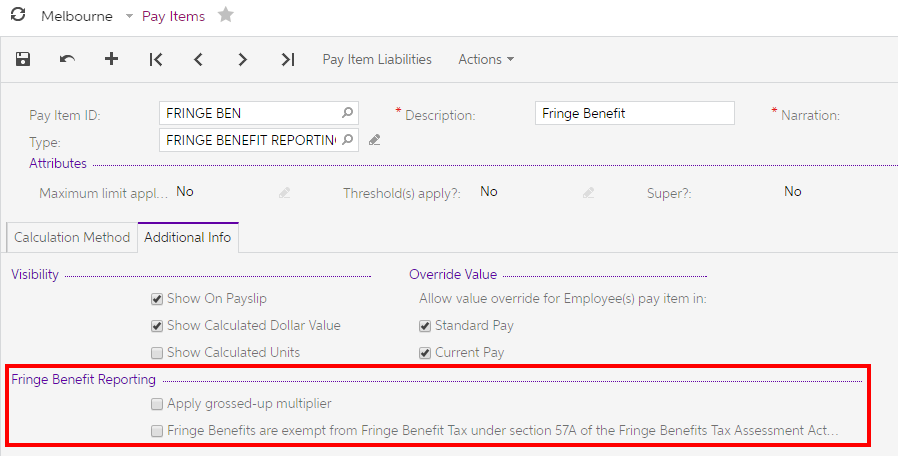

When a pay item has the "FRINGE BENEFIT REPORTING" type, a Fringe Benefit Reporting section becomes available on the Additional Info tab:

- Apply grossed-up multiplier - Fringe benefit amounts can be entered into the system already grossed-up or at their face value, in which case they will need to be grossed up by MYOB Acumatica. Tick or clear this option to indicate whether the values for the pay item will need to be grossed-up by the system or not. If your Fringe Benefits Tax is handled by an external agent, make sure to select the correct option according to how they return FBT data to you.

- Fringe Benefits are exempt from Fringe Benefits Tax - Certain types of organisation are exempt from Fringe Benefits Tax under section 57A of the FBTAA 1986; however, because it is possible for employees of such an organisation to perform some duties that are exempt from FBT, and some duties that are not, exempt/non-exempt status is set for individual pay items. Tick this option for pay items that apply to work that is exempt from FBT.

You may need to set up multiple pay items for each fringe benefit to cater for the different combinations of these two options, e.g. you may need to set up exempt and non-exempt items for one fringe benefit, or grossed-up vs not grossed-up items for another.

Reporting Fringe Benefits

You can use fringe benefit pay items in an annual pay run for employees who have received fringe benefits over the year, so that fringe benefit amounts can be captured and included in payment summaries or reported via Single Touch Payroll (STP).

When reporting via STP, to ensure that Fringe Benefit Tax amounts are included in STP data for the correct year, you must use a current Physical Pay Date for any pay runs that include reportable fringe benefits; otherwise the STP report will be deemed late. You must then back date the Pay Period Start and End Dates to be within the FBT year.