Reducing Balance Deductions

You can set up reducing balance deductions in employees' pays for cases like staff loans, where a fixed amount to repay is set, and regular deductions are made each pay run until the full amount has been repaid.

Setting up Reducing Balance Deductions

Like all deductions, a reducing balance deduction is set up as a pay item on the Pay Items (MP.PP.22.10) form. For a reducing balance deduction, the pay item's Type should be "DEDUCTION"—this enables the Deductions section on the Additional Info tab.

Adding a Reducing Balance Deduction to an Employee's Standard Pay

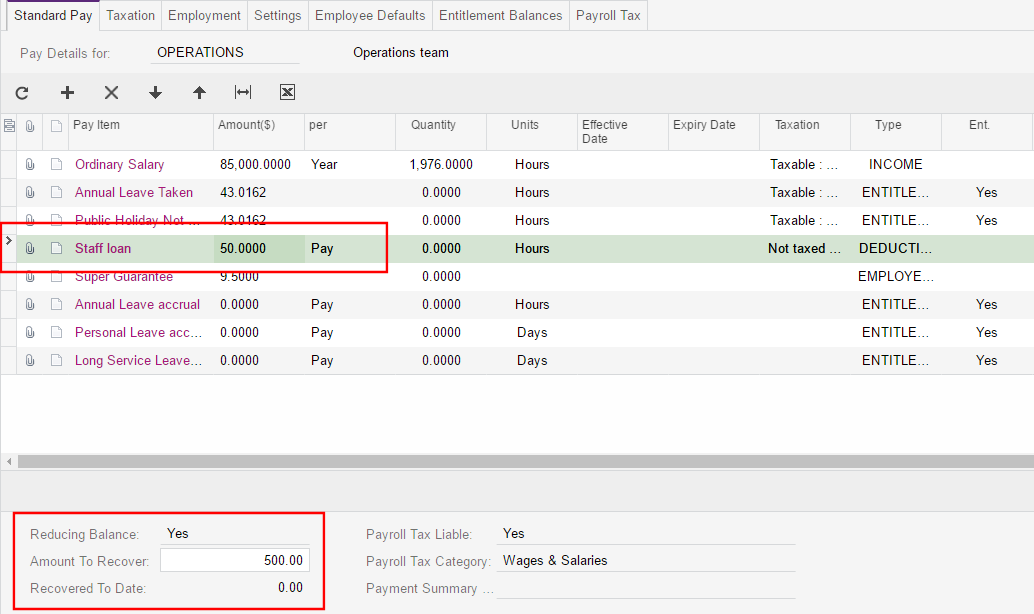

- In the Amount column of the main table, enter the amount to be deducted from the employee's pay each pay run.

- In the Amount to Recover field of the table footer, enter the total amount to be recovered.

The footer also includes a Reducing Balance field, which indicates that the pay item is a reducing balance deduction, and a Recovered to Date field, which displays the total amount of repayments made as at the currently selected Business Date.

Running Pays

Once a reducing balance deduction has been added to an employee's Standard Pay, it will appear in their Current Pay alongside all of their other pay items. A reducing balance deduction cannot be added to a Current Pay manually unless it already exists in at least one of the employee's Standard Pays (remember that employees can have multiple Standard Pays set up for multiple pay groups).

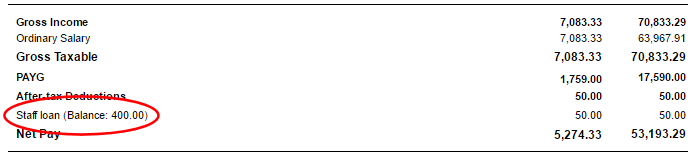

When the pay is completed, the reducing balance deduction will appear in the Deductions section of the employee's payslip. The remaining balance is displayed next to the deduction's name.

When the Balance is Repaid

Once a reducing balance deduction has been added to an employee's Standard Pay, the deduction amount will be taken from each pay run until the amount to recover has been repaid. If the final payment is less than the usual deduction amount, a partial payment will be made.

For example, if the amount to recover is $500 and the deduction amount each pay run is $40, then after twelve pay runs, $480 will have been paid, so the remaining balance will be $20. For the thirteenth pay run, only $20 will be deducted.

Once the full amount has been repaid, the deduction amount will be $0 in all subsequent pays, which means that the deduction will not appear on payslips. The deduction pay item remains in the employee's Standard Pay—it must be removed manually once the balance has been repaid.

Reusing a reducing balance deduction pay item

The New Amount button cannot be used if the pay item is currently included in an open pay. Once the reducing balance has been reset in this way, the changes will appear in new pay runs opened after the change was made.