Before Running the PTRS Report

Before running the PTRS report, you need to prepare by completing the tasks described here. This helps ensure that your PTRS report includes all the right suppliers and that your payment times are calculated accurately. When you're done, you'll be ready to run the PTRS report.

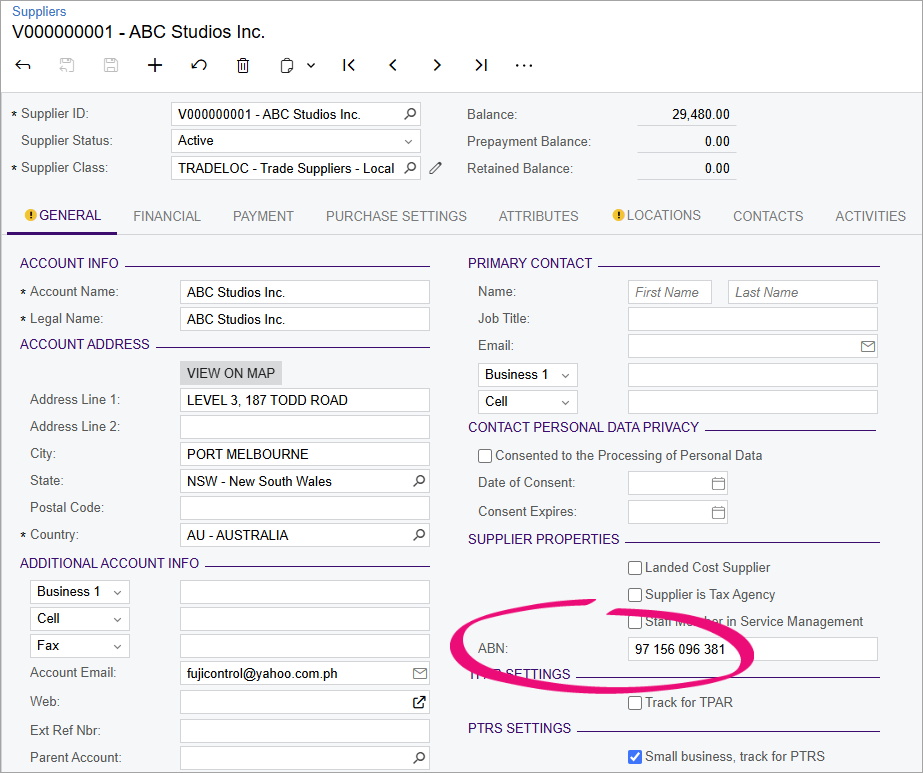

Make sure suppliers have ABNs

For a supplier to be included in PTRS reports, they need an Australian business number (ABN). If your Australian company has foreign sub-companies, you need to review their suppliers as well. For example, if you have a New Zealand sub-company that purchases from an Australian supplier, then that Australian supplier needs an ABN.

Identify which suppliers are small businesses

After you’ve made sure each of your supplier accounts has an ABN, you need to mark which of the suppliers are small businesses. Importing a CSV file lets you do this in bulk.

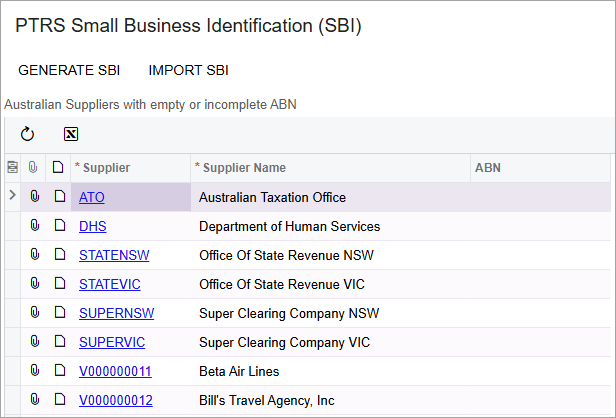

- Go to the PTRS Small Business Identification form (MY.PT.40.00).

- Click Generate SBI. This generates a CSV file with a list of your

suppliers' ABNs.Note:If any suppliers are missing valid ABNs, a warning message shows the number of suppliers that will be excluded from the file. You can still generate the SBI, but any suppliers excluded from the generated file will not be updated automatically.

- Log in to the Payment Times Reporting Portal.

- Upload the CSV file to the SBI Tool. The tool generates a new file with a list of small businesses to be included in the PTRS report.

- In MYOB Acumatica, go back to the PTRS Small Business Identification form.

- Click Import SBI and select the file you got from the SBI Tool. This selects or deselects the Small business, track for PTRS checkbox on the Suppliers form, depending on if the supplier is listed in the SBI file you imported.

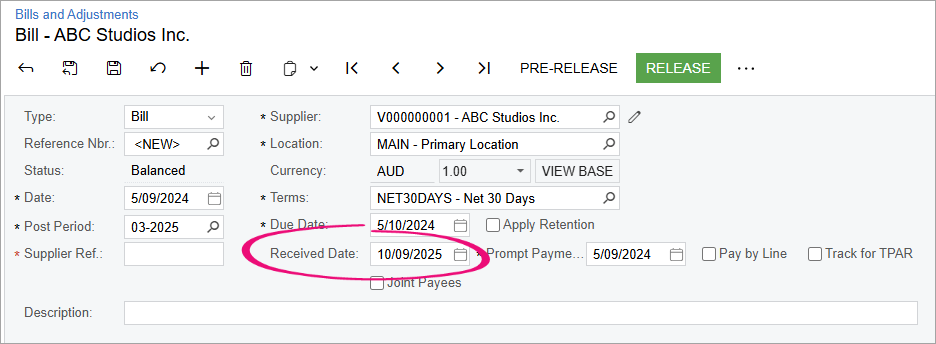

Enter Received Dates for Bills

If reporting for multiple companies, enter transactions into one tenant

If you'll be submitting a PTRS report for multiple companies, the transactions from those companies need be available in a single tenant of the company that is submitting report.