Invoice Prepayments: To Process a Prepayment

In this activity, you will learn how to create a prepayment and apply it to an invoice.

Story

Suppose that the SweetLife Fruits & Jams company received a prepayment of $2,300 from one of its customers, Morning Cafe (MORNINGCAF) on January 12, 2025. On January 31, SweetLife sold a juicer to Morning Cafe and an invoice for $2,300 was entered in the system.

Acting as a SweetLife accountant, you need to create and release a prepayment, and later, apply this prepayment to the customer's invoice, and then release the prepayment application.

Configuration Overview

For the purposes of this activity, the following features have been enabled on the Enable/Disable Features (CS100000) form:

- Standard Financials, which provides the standard financial functionality

- Multibranch Support, which supports multiple branches in your instance of MYOB Acumatica

- Multicompany Support, which supports multiple companies within one tenant.

On the Accounts Receivable Preferences (AR101000) form, the Hold Documents on Entry check box has been selected in the Data Entry Settings section.

On the Customers (AR303000) form, the MORNINGCAF (Morning Cafe) customer has been defined.

Process Overview

On the Payments and Applications (AR302000) form, you will create and release a prepayment for the needed customer. You will review the generated GL transaction on the Journal Transactions (GL301000) form. You will then apply the prepayment manually to the customer's invoice and release the prepayment application. Finally, on the Journal Transactions form, you will review the transaction generated on release of the prepayment application.

System Preparation

To prepare the system, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. To

sign in as an accountant, use the following credentials:

- Username: johnson

- Password: 123

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/12/2025. If a different date is displayed, click the Business Date menu button and select 1/12/2025.

- On the Company and Branch Selection menu, also on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

Step 1: Creating and Releasing a Prepayment

To create and release a prepayment, do the following:

- Open the Payments and Applications (AR302000) form.Tip:To open the form for creating a new record, type the form ID in the Search box, and on the Search form, point at the form title and click New right of the title.

- On the form toolbar, click Add New Record, and specify

the following settings in the Summary area:

- Type: Prepayment

- Customer: MORNINGCAF

- Application Date: 1/12/2025 (inserted by default)

- Payment Amount: 2300

- Description: Juicer 15

When you create a new prepayment on the current form, as soon as you select the customer in the Summary area, the system forms the list of the customer's outstanding documents on the Documents to Apply tab. The system loads only open documents of the Invoice, Debit Memo, Credit Memo, and Overdue Charge type that do not have unreleased applications.

- On the form toolbar, click Remove Hold, and then click Release to release the prepayment.

- On the Financial tab, click the link in the Batch Nbr. box.

- On the Journal Transactions (GL301000) form, which is opened, review

the transaction that has been generated on the release of the prepayment.

The 10200 cash account specified for the prepayment has been debited with $2,300, while the 22100 (Customer Deposit) account specified for the customer as the prepayment account has been credited in the same amount.

Step 2: Applying the Prepayment to an Invoice

To apply the prepayment to an invoice, do the following:

- In the info area, click the Business Date menu button and select 1/31/2025.

- While you are still on the Payments and Applications (AR302000) form with the prepayment opened, on the Documents to Apply tab, click Add Row on the table toolbar.

- Specify the following settings in the added row:

- Doc. Type: Invoice

- Reference Nbr.: The invoice dated 1/31/2025 for the amount of $2,300

- Amount Paid: 2300 (inserted automatically by the system)

Notice that the system has automatically selected the unlabeled check box for the added row.

Tip:Alternatively, you can click Load Documents on the table toolbar; in the Load Options dialog box, which opens, you select the needed settings to load multiple documents and click Load. - On the form toolbar, click Save to save the changes.

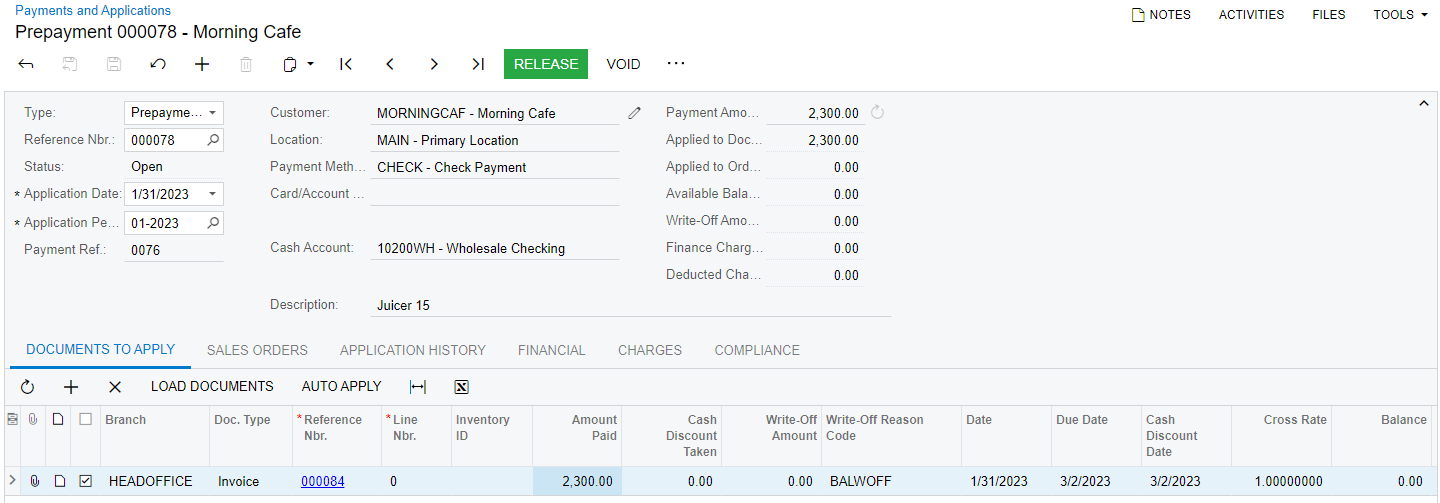

The released prepayment applied to the invoice is shown in the following screenshot.

Figure 1. The prepayment applied to the invoice before release of the prepayment application

Step 3: Releasing the Prepayment Application

To release the prepayment application to the invoice, do the following:

- While you are still on the Payments and Applications (AR302000) form, click Release on the form toolbar.

- On the Application History tab, click the link in the Batch Number column.

- On the Journal Transactions (GL301000) form, which is opened, review

the transaction that has been generated on the release of the prepayment

application.

The 22100 (Customer Deposit) account specified for the customer as the prepayment account has been debited with $2,300, while the 11000 (Accounts Receivable) account specified for the customer has been credited in the same amount.