Paying Cashed-up Leave (NZ)

If an employee has decided to cash up/cash out their leave instead of taking time off work, there are two things you need to pay them:

-

A written agreement between the employee and their manager, which you’ll attach to their pay.

-

A cash up/cash out pay item, which you can add to their pay just like you would with any other pay item.

Adding Cash Out to an Employee's Pay

-

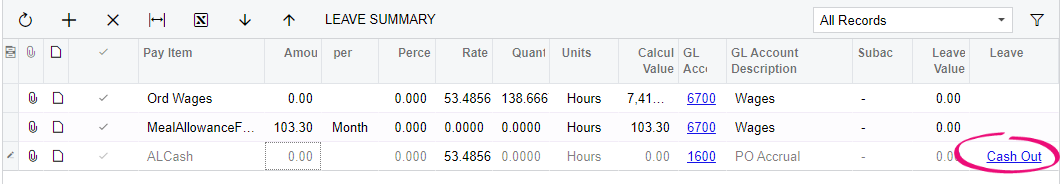

On the Employee’s Current Pay screen (MPPP3130), add a row with the cash up/cash out pay item.

-

In the Leave column, click Cash Up.

-

In the Cash Up window, enter how much leave the employee is cashing up in the Quantity field.

-

Save your changes. You can now run the pay as normal.

Attaching Written Requests to the Employee's Pay

You can attach a written request on either the Employee’s Current Pay screen or the Cash Up window.

or detailed instructions on attaching files, see Attachments: File Upload and Attachment.

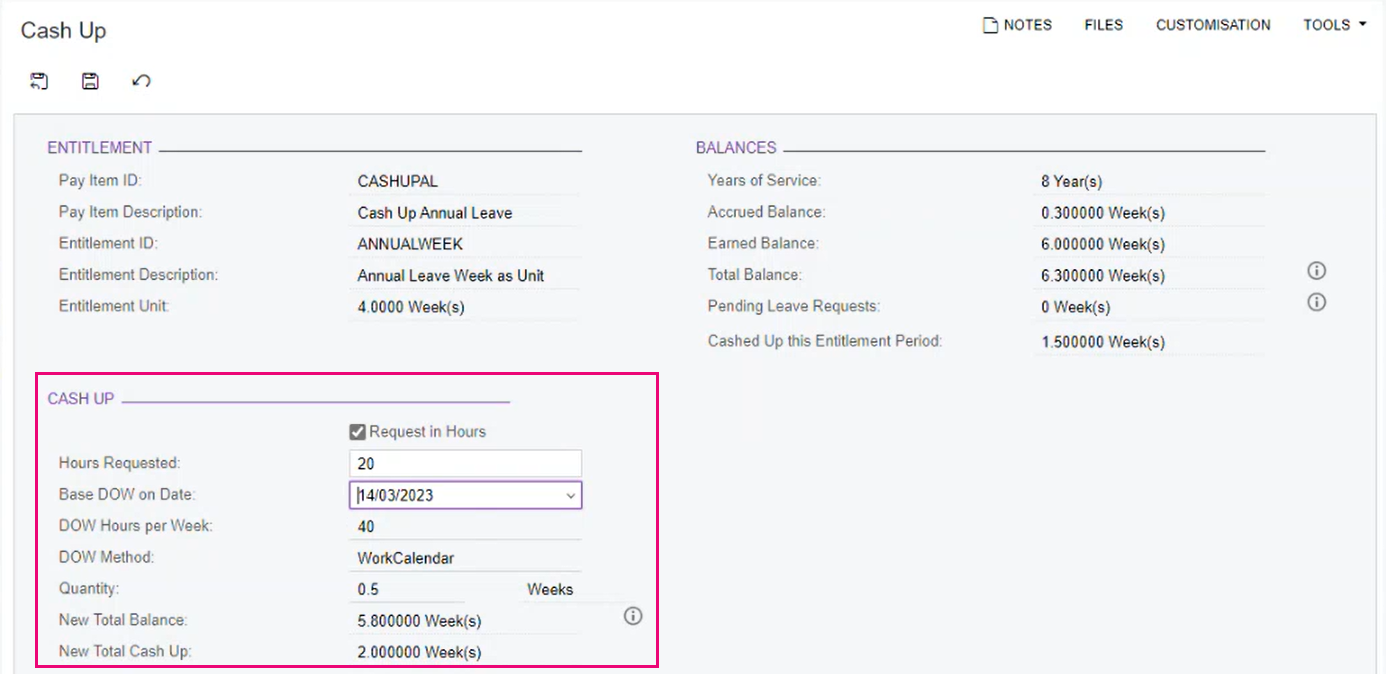

Cashing Up Annual Leave in Hours

If an employee is cashing up less than a week of annual leave, you can enter their cash up quantity in hours instead of weeks. This saves you the hassle of manually calculating how many weeks to enter – for example, if you had to enter one third of a week.

-

On the Employee’s Current Pay screen (MPPP3130), add a row with the cash up pay item.

-

In the Leave column, click Cash Up.

-

In the Cash Up window, select the Request in Hours checkbox.

-

In the Hours Requested field, enter the number of hours the employee wants to cash up.

-

Optionally, change the date in the Base DOW on Date. This changes the DOW Hours per Week field. by default, the Base DOW on Date is set to the pay date.

-

Click the Save icon.

When Can an Employee Cash Up an Alternative Holiday?

If an employee doesn't take their alternative holiday within 12 months of becoming entitled to it, they can request to cash up that alternative holiday. You and your employee need to agree on the payment amount.