Setting up Leave Cash Up (NZ)

You can use MYOB Acumatica — Payroll to pay annual leave cash up and alternative holiday cash up. You need to create a cash up pay items for each. As for entitlements, you can re-use the ones that you use for other pay items.

Creating Cash-up Pay Items

Whether you’re creating a pay item for annual leave cash up or alternative holiday cash up, the basic settings are the same.

However, depending on how much annual leave your company’s employees are entitled to, you might need to create two annual leave cash up pay items. The only difference between them would be their liabilities.

-

Go to the Pay Items screen (MPPP2210).

-

On the form toolbar, click the New Pay Item icon (+).

-

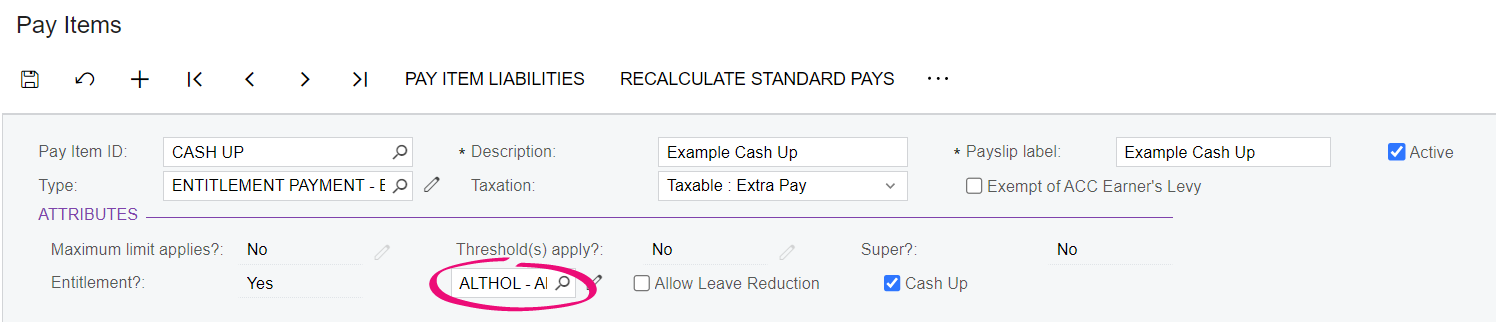

Complete the Pay Item ID, Description and Payslip label fields.

-

Set the Type field to Entitlement Payment.

-

In the Taxation field, select Taxable Extra Pay.

-

In the Attributes section:

-

Select the Cash Up checkbox.

-

In the empty field, select the same entitlement that's associated with your alternative leave pay item.

-

Ensure you have not selected the Allow Leave Reduction checkbox.

-

-

Click the Additional Info tab.

-

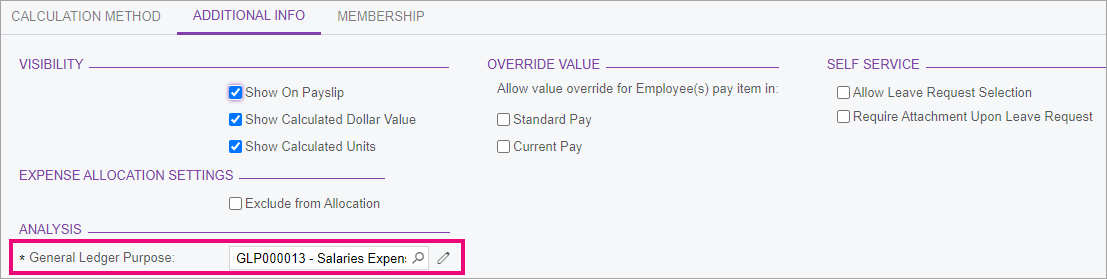

In the Visibility section, select all the checkboxes:

-

Show On Payslip

-

Show Calculated Dollar Value

-

Show Calculated Units.

-

-

Because employees can’t request cash up through employee self service or workforce management, ensure you have not selected these checkboxes:

-

In the Self Service section, Allow Leave Request Selection and Require Attachment Upon Leave Request.

-

In the Workforce Management section, Available to Workforce Management.

-

-

In the Analysis section, in the General Ledger Purpose field, select the same purpose that's associated with the relevant leave taken pay item. For example, if you’re creating an alternative holiday cash up pay item, select the purpose associated with your alternative holiday taken pay item.

-

On the form toolbar, click the Save icon.

-

If you created an annual leave pay item, set its liabilities.

Liabilities for Annual Leave Cash up

The amount of annual leave an employee can cash up depends on how much annual leave they are entitled to. In New Zealand, employees are entitled to a minimum of four weeks. Of those four weeks, an employee can cash-up a maximum of one week in the entitlement year. Let's call this the statutory amount of cash-up.

However, an employee's contract might entitle them to more than four weeks of annual leave. This means an employee could request the statutory one week of cash-up, as well as an additional non-statutory amount. For this non-statutory amount, an employee can cash-up all of their additional weeks of annual leave.

For more information, see Cashing-up annual holidays on the Employment New Zealand website.

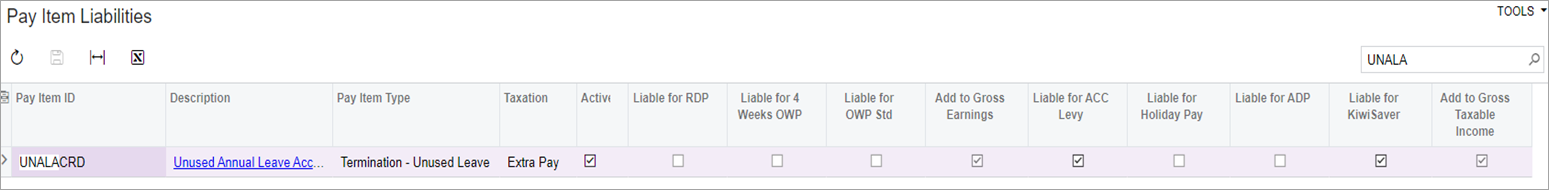

Setting up a Liability for a Statutory Cash up

Statutory cash-ups aren't liable for holiday pay rate calculations.

-

Go to the Pay Item Liabilities form (MPPP1025).

-

From the list, open your statutory annual leave cash up pay item.

-

Select the following checkboxes:

-

Add to Gross Earnings

-

Liable for ACC Levy

-

Liable for KiwiSaver

-

Add to Gross Taxable Income.

-

-

On the form toolbar, click the Save icon.

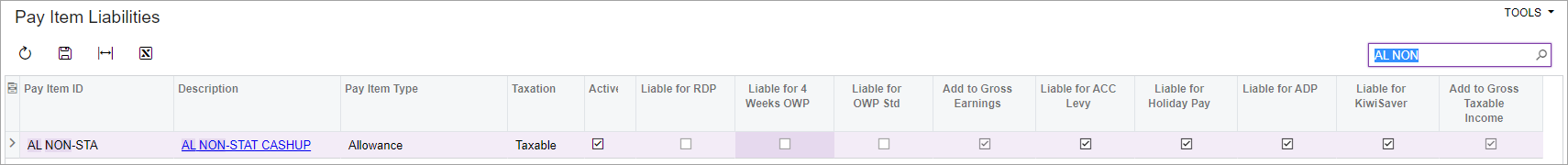

Setting up a Liability for a Non-Statutory Cash up

For non-statutory cash-ups, it's up to you as an employer to ensure the pay item liabilities are compliant and meet the terms of the employee's contract. However, the following procedure outlines some recommended liabilities.

-

Go to the Pay Item Liabilities form (MPPP1025).

-

From the list, open your non-statutory annual leave cash up pay item.

-

Select the following checkboxes:

-

Add to Gross Earnings

-

Liable for ACC Levy

-

Liable for Holiday Pay (AWE)

-

Liable for ADP

-

Liable for KiwiSaver

-

Add to Gross Taxable Income.

Note:Based on the Holidays Act and the IRD's descriptions of lumpsum payments, we recommend that you select the Liable for Holiday Pay and Liable for ADP checkboxes. However, because this is for a non-statutory cash-up, you need to check if these recommendations meet your needs.

-

-

On the form toolbar, click the Save icon.