Period-End Procedures: To Perform Account Reconciliation

The following activity will walk you through the process of reviewing the accounts payable balance by GL account and reconciling AP and GL accounts.

Story

Suppose that at the end of March 2024, the SweetLife Fruits & Jams company needs to prepare for closing the 03-2024 financial period in the accounts payable subledger.

Acting as a SweetLife accountant, you have to review the accounts payable balance for each GL account and reconcile these balances with the general ledger. This process is required to ensure that there are no discrepancies or inconsistencies in balances. To do this, you will use two MYOB Acumatica reports.

Configuration Overview

For the purposes of this activity, the following features have been enabled on the Enable/Disable Features (CS100000) form:

- Standard Financials, which provides the standard financial functionality

- Multibranch Support, which supports multiple branches in your instance of MYOB Acumatica

- Multicompany Support, which supports multiple companies within one tenant.

Process Overview

To perform the process outlined in this activity, you will run the AP Balance by GL Account (AP632000) report and review it; you will then run the Trial Balance Summary (GL632000) report and compare the AP balances in both reports.

System Preparation

To prepare the system, do the following:

- Launch the MYOB Acumatica website, and sign in as an accountant by using the following credentials:

- Username: johnson

- Password: 123

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 3/31/2024. If a different date is displayed, click the Business Date menu button and select 3/31/2024. For simplicity, in this activity, you will create and process all documents in the system on this business date.

- On the Company and Branch Selection menu, also on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

Step 1: Reviewing the Balance of the AP Account

To review the balance of the AP account, do the following:

- Open the AP Balance by GL Account (AP632000) form.

- On the Report Parameters tab, specify the following

parameters:

- Report Format: Account Summary

- Company/Branch: HEADOFFICE - SweetLife Head Office and Wholesale Center (inserted by default based on the selected branch)

- Financial Period: 03-2024 (inserted by default)

- Include Applications: Cleared

- On the form toolbar, click Run Report.

- Review the generated report. Notice the amount in the Balance column for the 20000 - Accounts Payable account, which is the total balance posted to the account.

Step 2: Reviewing the Balances for the Financial Period

To review the balances for the financial period, do the following:

- Open the Trial Balance Summary (GL632000) form.

- On the Report Parameters tab, verify that the following

parameters are displayed:

- Company/Branch: HEADOFFICE - SweetLife Head Office and Wholesale Center

- Ledger: ACTUAL

- From Period: 03-2024

- To Period: 03-2024

- Suppress Zero Balances: Selected

- On the form toolbar, click Run Report.

- Review the report. Notice the amount in the Ending Balance column for the 20000 - Accounts Payable account. This amount should be equal to the amount you noticed in the AP Balance by GL Account report you ran in Step 1.

Step 3: Reconciling the AP and GL Accounts

To reconcile the AP and GL balances for the 20000 Accounts Payable account, do the following:

- Compare the two figures you noted from both reports. If these balances are equal, the AP and GL accounts can be considered reconciled.

- If there is a discrepancy between these figures, do the following:

- On the Post Transactions (GL502000) form, verify that all batches have been posted to the general ledger.

- Post any unposted documents you have found.

- To verify that there are no transactions posted to the 20000 -

Accounts Payable account by other modules, open the Transactions for Account (GL633500) form and specify the following

parameters:

- Company/Branch: HEADOFFICE - SweetLife Head Office and Wholesale Center

- Ledger: ACTUAL

- From Period and To Period: 03-2024

- Account: 20000 - Accounts Payable

- Module: Empty

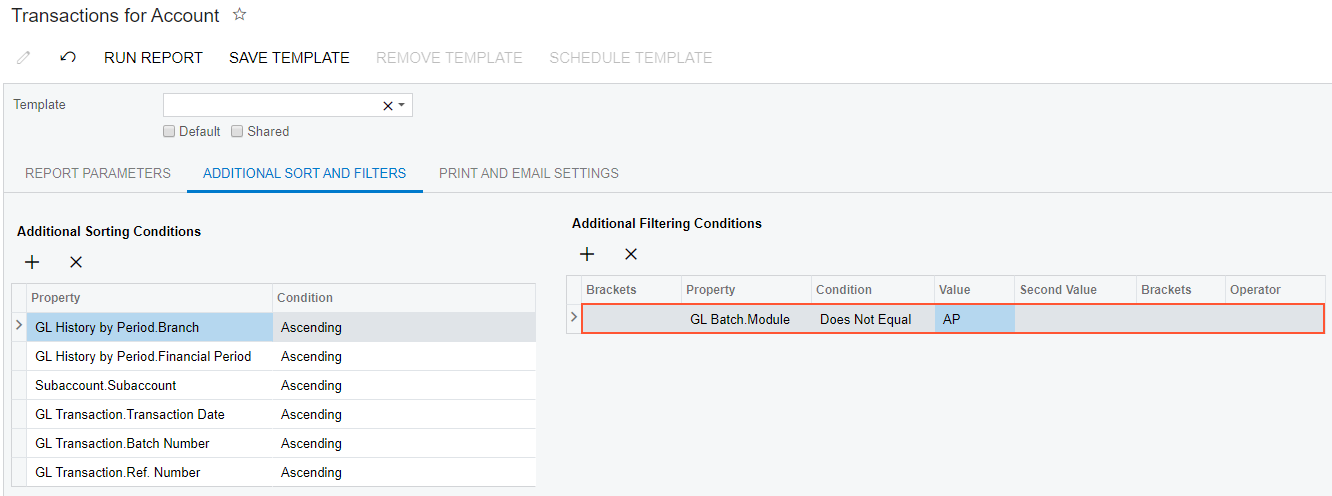

- Additional Sort and Filters tab, Additional Filtering Conditions: Property: GL Batch.Module, Condition: Does Not Equal, Value: AP.

The following screenshot illustrates the application of additional filtering conditions for the report.

Figure 1. Additional filtering conditions for the Transactions for Account (GL633500) report

- Click Run Report on the form toolbar of the Transactions for Account form, and review the report.