Interbranch Invoices Without Balancing: Process Activity

In this activity, you will learn how to create and process an invoice for items provided by multiple branches not requiring balancing and review account balances.

Story

On March 1, 2025, the SweetLife Fruits & Jams company issued an invoice to the FourStar Coffee & Sweets Shop customer in the amount of $290 for goods and services delivered to the customer by two branches that do not require balancing. The SweetLife Head Office and Wholesale Center branch has provided home canning training in the amount of $90, and the SweetLife Store branch has provided fruits and berries in the amount of $200.

Acting as a SweetLife accountant, you need to create an invoice in the system and then release it, which causes a batch to be generated for it.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Companies (CS101500) form, the SweetLife company has been defined.

- On the Branches (CS102000) form, the HEADOFFICE and RETAIL branches of the SweetLife company have been created.

- On the Chart of Accounts (GL202500) form, multiple accounts have been created.

- On the Ledgers (GL201500) form, the ACTUAL ledger has been created.

- On the Customers (AR303000) form, the COFFEESHOP customer has been created.

Process Overview

To process an interbranch invoice between branches that do not need to be balanced, you will create and release the invoice on the Invoices and Memos (AR301000) form. You will then review the generated batch on the Journal Transactions (GL301000) form and check the account balances on the Account Summary (GL401000) form.

Optionally, you will generate the trial balance report by using the Trial Balance Summary (GL632000) report form.

System Preparation

Before you begin performing the steps of this activity, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as an accountant Nenad Pasic by using the pasic username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 3/1/2025. If a different date is displayed, click the Business Date menu button and select 3/1/2025.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

Step 1: Creating and Processing an Invoice for Branches Not Requiring Balancing

To create and process an AR invoice for goods and services provided by multiple branches (HEADOFFICE and RETAIL) that do not require balancing, do the following:

- Open the Invoices and Memos (AR301000) form.Tip:To open the form for creating a new record, type the form ID in the Search box, and on the Search form, point at the form title and click New right of the title.

- Click Add New Record on the form toolbar, and specify the

following settings in the Summary area:

- Type: Invoice

- Customer: COFFEESHOP

- Date: 3/1/2025 (inserted by default)

- Description: Fruit Delivery and Home Canning Training

- On the Details tab, click Add Row, and

specify the following settings in the row you have added:

- Branch: HEADOFFICE

- Transaction Descr.: Home Canning Training

- Ext. Price: 90

- Add another row with the following settings:

- Branch: RETAIL

- Transaction Descr.: Fruit Delivery

- Ext. Price: 200

Notice the 40000 - Sales Revenue account has been specified in the Account column for both lines, because it is a sales account associated with the customer by default.

- On the form toolbar, click Save to save the invoice.

- On the form toolbar, click Remove Hold and then click Release to release the invoice.

- On the Financial tab, notice that the originating branch of the invoice is HEADOFFICE, which is specified in the Branch box. The system has filled in the Branch box automatically with the branch to which you are signed in. Also, notice 11000 - Accounts Receivable is specified in the AR Account box.

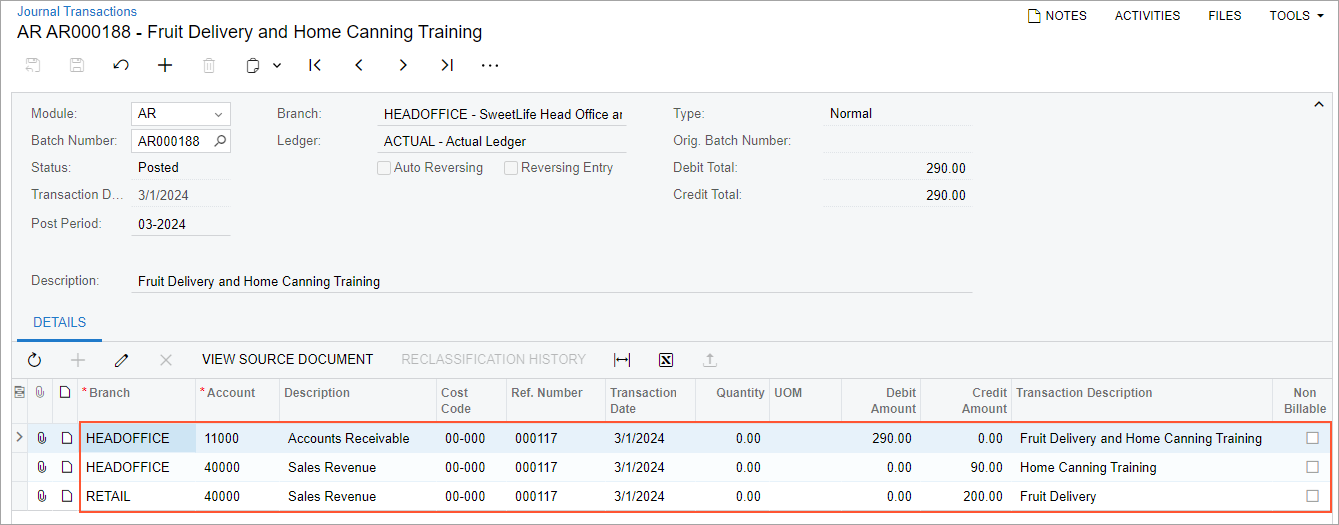

- Click the link in the Batch Nbr. box, and review the GL batch,

which is opened on the Journal Transactions (GL301000)

form.

When you released the invoice, the system generated and posted the related GL transaction. The AR account of the originating branch of the invoice has been debited and accounts from each document line are credited in the destination branch specified in detail lines (see the following screenshot).

Figure 1. GL transactions posted to different branches

In the next step, you will check the balances of these accounts.

Step 2: Reviewing the Account Balances

To review the account balances for the branches in the 03-2025 financial period, do the following:

- Open the Account Summary (GL401000) form.

- To review the account balances in the HEADOFFICE branch, in the Summary area,

specify the following settings:

- Company/Branch: HEADOFFICE

- Ledger: ACTUAL

- Period: 03-2025

- In the table, review the account balances. Notice the amount in the Credit Total column for the 40000 - Sales Revenue account is $90.00.

- In the Company/Branch box of the Summary area, select RETAIL to review the account balances in the RETAIL branch.

- In the table, review the account balances. Notice the amount in the Credit Total column for the 40000 - Sales Revenue account is $200.00.

Now you will review the balances for the financial period for the company as a whole.

Step 3 (Optional): Reviewing the Balances for the Financial Period

To review the balances for the 03-2025 financial period, do the following:

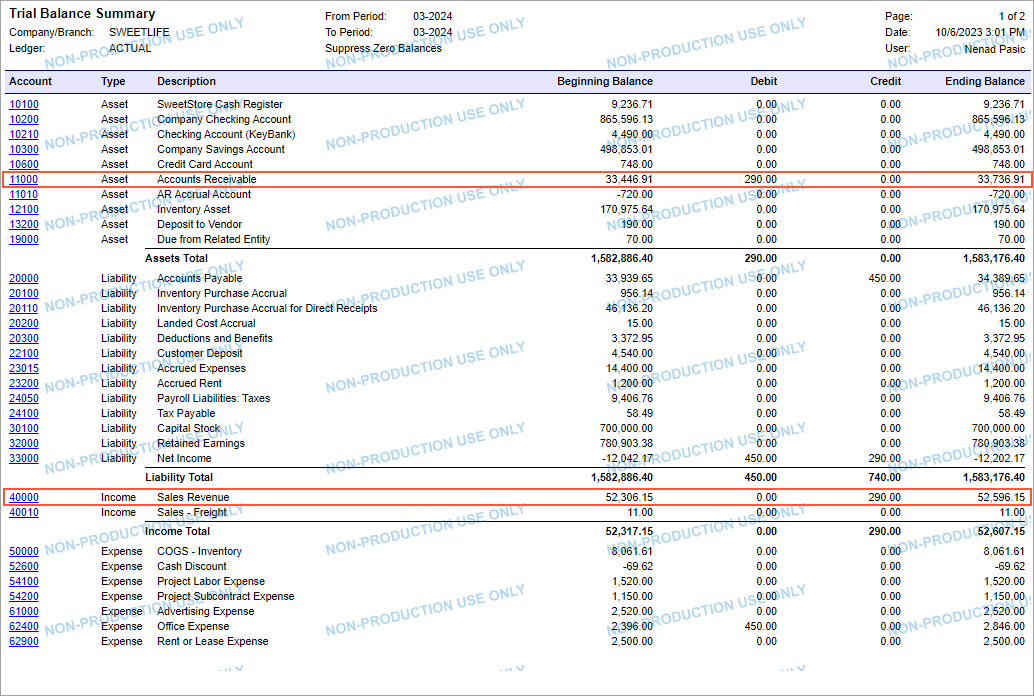

- Open the Trial Balance Summary (GL632000) report form.

- On the Report Parameters tab, specify the following

parameters:

- Company/Branch: SWEETLIFE

- Ledger: ACTUAL

- From Period: 03-2025

- To Period: 03-2025

- Suppress Zero Balances: Selected

- On the report form toolbar, click Run Report.

- In the generated report, review the account balances. As you can see in the following screenshot, the amount in the Debit column for the 11000 - Accounts Receivable account equals the amount in the Credit column for the 40000 - Sales Revenue account.

In this activity, you have created and processed an invoice between branches that do not require balancing, and you have learned how to review the relevant account balances.