Bank Reconciliation: To Process a Bank Statement in OFX Format (Part 1)

In this activity, you will learn how to upload the first bank statement and match the uploaded transactions to the existing documents or transactions in the system. This bank statement is in OFX format.

Video Tutorial

This video shows you the common process but may contain less detail than the activity has. If you want to repeat the activity on your own or you are preparing to take the certification exam, we recommend that you follow the instructions in the steps of the activity.

Story

Suppose that on January 31, 2025, the accounting department of SweetLife Fruits & Jams received a bank statement in Open Financial Exchange (OFX) format from KeyBank in the amount of $4,704.

Acting as a SweetLife accountant, you need to perform bank statement reconciliation for January 2025 as you prepare to close the 01-2025 financial period in the general ledger. During reconciliation, you will match the records in the system (the book balance) and in the statement for the bank account (the bank balance).

Configuration Overview

For the purposes of this lesson, the following features have been enabled on the Enable/Disable Features (CS100000) form:

- Standard Financials, which provides the standard financial functionality

- Multibranch Support, which supports multiple branches in your instance of MYOB Acumatica

- Multicompany Support, which supports multiple companies within one tenant

On the Cash Accounts (CA202000) form, the 10210WH - KeyBank Checking account has been configured for the HEADOFFICE (SweetLife Head Office and Wholesale Center) branch.

On the Tax Zones (TX206000) form, the NYSTATE tax category has been added with the NYSTATETAX applied to it on the Applicable Taxes tab.

On the Reason Codes (CS211000) form, the CRWOFF (Credit Write Off) reason code has been defined.

Process Overview

In this activity, you will review the system settings on the Cash Management Preferences (CA101000) form and the settings of the cash account whose balance you will reconcile on the Cash Accounts (CA202000) form. Then you will upload the OFX bank statement on the Import Bank Transactions (CA306500) form and match the uploaded transactions with the existing transactions in the system on the Process Bank Transactions (CA306000) form.

On the Process Bank Transactions form, you will enter a transaction that reflects an amount included in the bank statement that has not been entered into the system. You will match one bank transaction to several payments in the system. You will match a Disbursement bank transaction to multiple bills and a debit adjustment of the same vendor. You will also match a bank payment to an invoice and create a write off to record an amount overpaid by a customer, match a bank transaction to an invoice and create a bank charge, and create a disbursement cash transaction with a tax. Finally, you will prepare a reconciliation statement on the Reconciliation Statements (CA302000) form and review the transactions that have been reconciled.

System Preparation

To prepare the system, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. To

sign in as an accountant, use the following credentials:

- Username: johnson

- Password: 123

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 2/1/2025. If a different date is displayed, click the Business Date menu button and select 2/1/2025. For simplicity, in this activity, you will create and process all documents in the system on this business date.

- On the Company and Branch Selection menu, also on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu button to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

- Download the Bank_Statement_KeyBank_01312025.ofx file, which you will import in Step 2.

Step 1: Reviewing System Settings and Preparing the Cash Account for Uploading Bank Statements

You need to be sure that the system settings and the needed cash account are configured so that a bank statement for the cash account can be uploaded. Perform the following instructions:

- Open the Cash Management Preferences (CA101000) form.

- On the Bank

Statements tab, review the following settings in the

Import Settings section:

- Import

Bank Statement to Single Cash Account: Selected

This check box indicates whether the system should import a bank statement to a specific cash account, as opposed to importing a bank statement for multiple cash accounts. When the check box is selected, you can import the data on the Import Bank Transactions (CA306500) form only after you select the applicable cash account.

- Statement

Import Service:

PX.Objects.CA.OFXStatementReader

The statement import service is the application service that reads the data being imported. The PX.Objects.CA.OFXStatementReader service is used for importing bank statements from OFX files.

Attention: You can import bank statements from OFX, QBO, QFX, and Excel files.

- Import

Bank Statement to Single Cash Account: Selected

- Open the Cash Accounts (CA202000) form.

- In

the Cash Account box, select the 10210WH

- KeyBank Checking cash account, and specify the following

settings, which are required for accounts for which bank statements will be

imported from OFX:

- External

Ref. Number:

001-204-00289-01

(the bank account number that is specified in

ACCTIDin the OFX file) - Statement Import Service: PX.Objects.CA.OFXStatementReader

- External

Ref. Number:

001-204-00289-01

(the bank account number that is specified in

- On the Entry

Types tab,

for

the BANKFEE entry type, select NYSTATE in the Tax

Zone column.

This setting is needed if you want to create a disbursement cash transaction with a tax applied during bank reconciliation.

- On the form toolbar, click Save to save your changes.

Step 2: Uploading the Bank Statement for the Cash Account

To upload the 1/31/2025 bank statement for the 10210WH - KeyBank Checking cash account, do the following:

- On the Import Bank Transactions (CA306500) form, click Add New Record on the form toolbar.

- In the Cash Account box, select 10210WH - KeyBank Checking.

- On the form toolbar,

click Upload File, and in the Statement File

Upload dialog box, which opens, click

Choose File, and select

the Bank_Statement_KeyBank_01312025.ofx file you downloaded

during system

preparation.

Click Upload to close the dialog box and upload the

file.

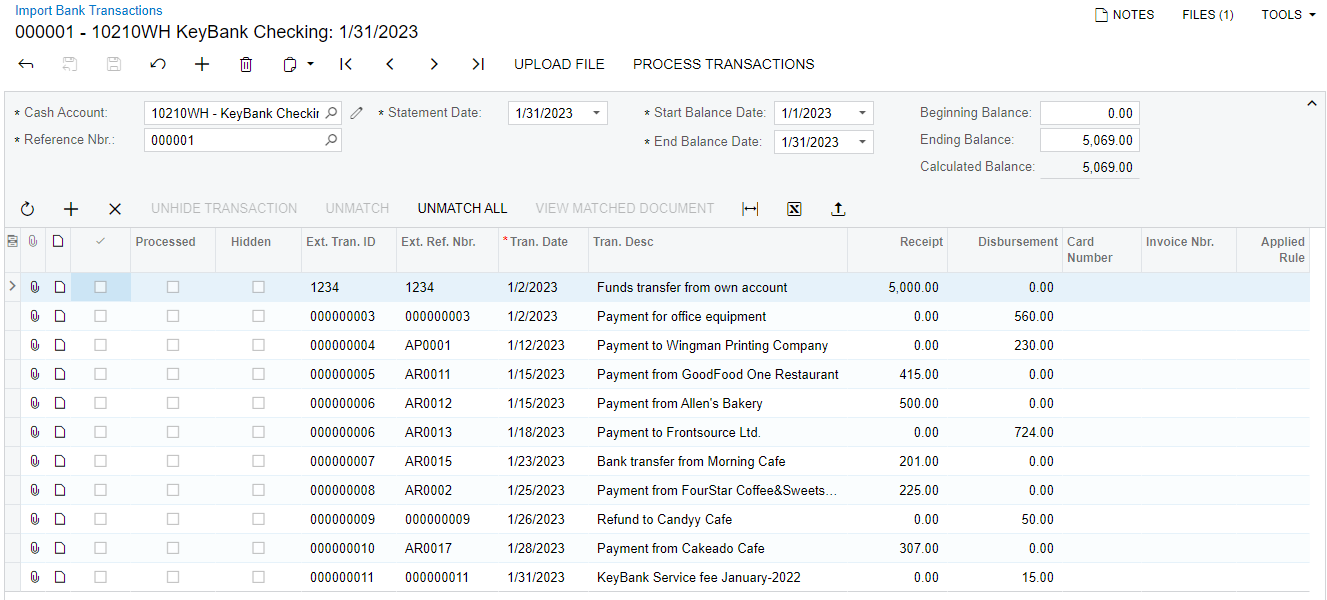

The system uploads the transactions from the file to the current form for the cash account. The OFX file contains the 1/31/2025 bank statement with the transactions in the bank account at KeyBank from 1/1/2025 to 1/31/2025, as shown in the screenshot below.

Tip: The uploaded OFX file is now attached to the form; if you ever needed to download the file, you could do so by clicking Files on the form title bar while viewing the form.The Statement Date, Start Balance Date, End Balance Date, and Ending Balance values have been imported from the file. The OFX format does not provide the beginning balance in bank statements, so for the first imported bank statement for a particular cash account, you have to manually specify the beginning balance of the statement. In the subsequent statements for the cash account, the system uses the Ending Balance value of the previous bank statement as the current Beginning Balance value.

Figure 1. January bank transactions uploaded from the OFX file

- Leave the Beginning Balance box as is (0.00) because you have just started using this bank account.

Step 3: Processing the Imported Bank Transactions

To process the imported bank transactions, do the following:

- While you are still on the Import Bank Transactions

(CA306500) form with the bank statement uploaded,

click

Process Transactions on the form toolbar.

The system opens the Process Bank Transactions (CA306000) form.

- On

the form toolbar, click Auto-Match to run the

auto-matching process for the bank transactions.

The following screenshot illustrates the transactions after auto-matching.

Figure 2. Auto-matched bank transactions

- In the left pane, click the row with the $5,000 transaction, and on the right pane, review the Match to Payments tab. Notice that for the transaction, the system has found only one matching GL batch.

- In

the left pane, click the row with the $225 transaction. On the right pane,

review the Match to Payments tab.

The

system has found one AR payment that matches the receipt transaction.

On the

Match to Invoices tab,

notice

that the system has also found an outstanding invoice

for

the same amount,

the

same customer,

but

for a different date.

Separately from the search for the matching payments, the system searches for outstanding documents. To find a document to which the payment could be applied, the system compares the payment amount with the amount of any outstanding documents with the same transaction sign (indicating whether it is a receipt or disbursement).

Notice that the invoice on the Match to Invoices tab has a lower match relevance than the payment on the Match to Payments tab, so the system has selected the payment as the best match.

Attention: The system will always try to find the best match among payments; only if a match is not found will it try to find the best match among invoices. Thus, even if an invoice has a higher match relevance than a payment but the payment's match relevance passed the threshold, the system will match the transaction to the payment.

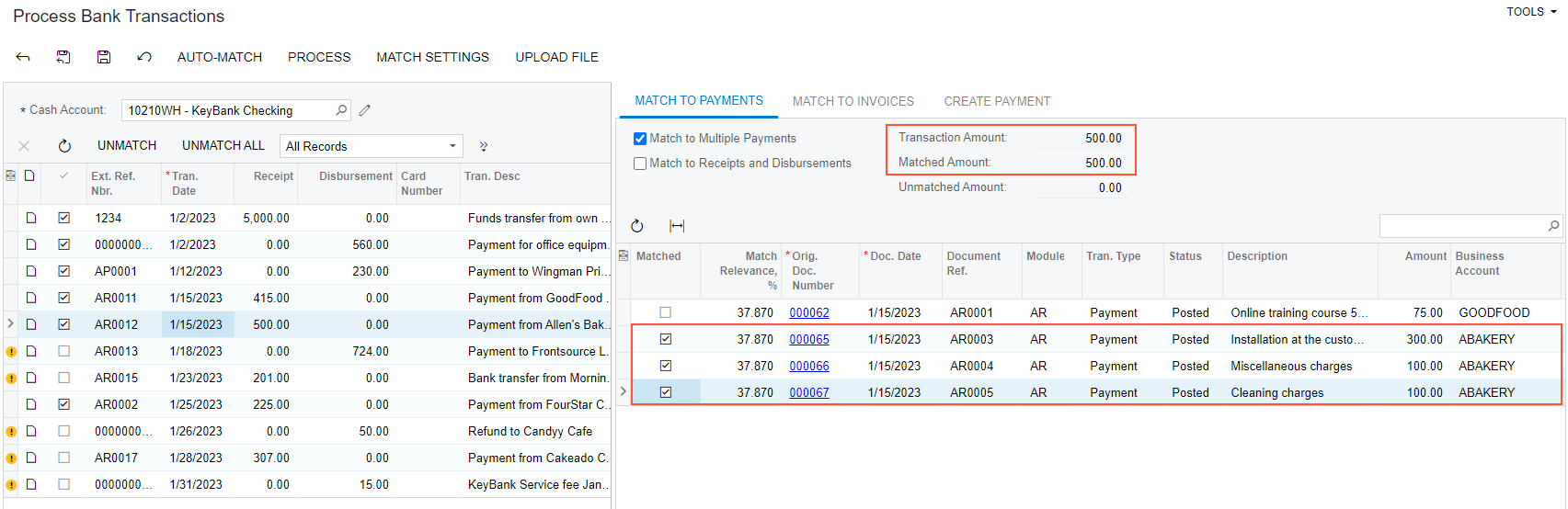

Step 4: Matching a Transaction to Multiple Payments

To match the $500 transaction to three payments, while remaining on the Process Bank Transactions (CA306000) form, do the following:

- In the left pane, click the $500 transaction.

- Optional: On the Create Payment tab of the right pane, clear the Create check box.

- On the Match to Payments tab of the right pane, select the Match to Multiple Payments check box, and review the table in the Detail area. The system fills it in with outstanding payments that you can match to the selected bank transaction.

- Select

the Matched check box in the rows of the three payments

from ABAKERY with the date of 1/15/2025. Notice that with every payment for which you select the

Matched check box for, the system updates the values

in the Matched Amount and Unmatched

Amount boxes, respectively, as shown in the

screenshot below.

Once

Matched Amount and Transaction

Amount are equal (in this case, $500), you can process

the transaction.

Figure 3. Multiple payments matched to one bank transaction

- On the form toolbar, click Save.

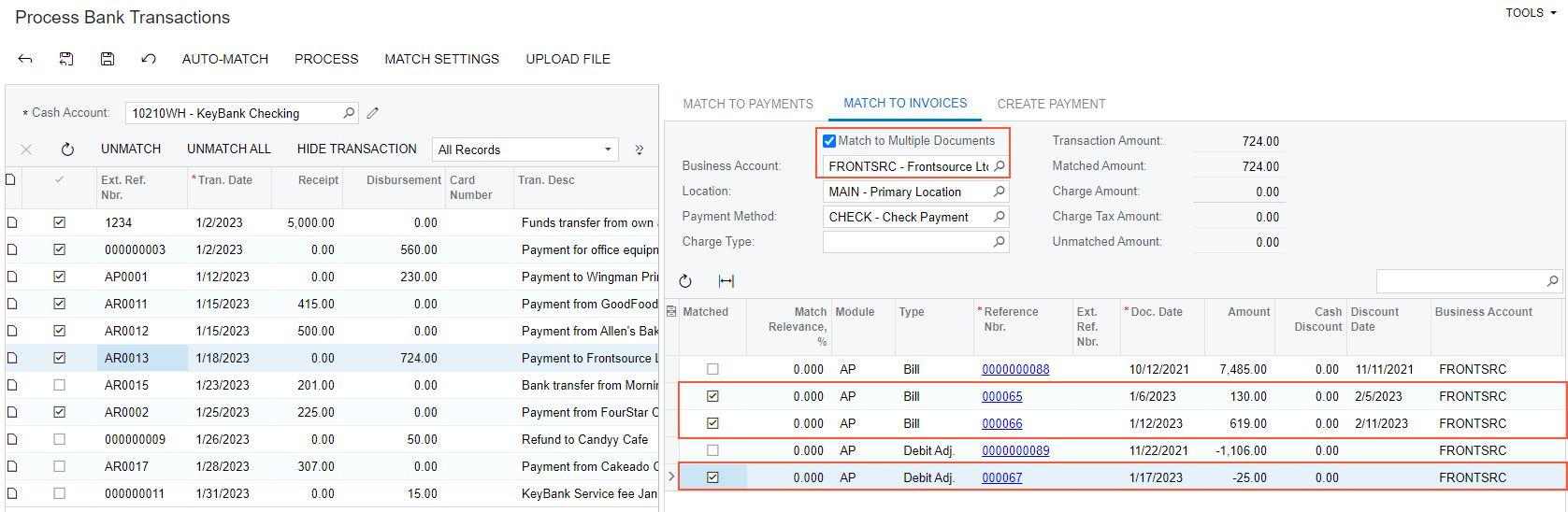

Step 5: Matching a Disbursement Transaction to Multiple AP Documents

To match a $724 disbursement transaction to multiple bills and a debit adjustment, while remaining on the Process Bank Transactions (CA306000) form, do the following:

- In the left pane, click the $724 transaction.

- Optional: On the Create Payment tab of the right pane, clear the Create check box.

- On the Match to Invoices tab of the right pane, select the Match to Multiple Documents check box.

- In

the Business Account box, select FRONTSRC.

In the table, the system loads all AP documents for the specified business account, regardless of the document amount.

- Select

the Matched check box in the rows of the two bills with

the amounts of $130.00 and

$619.00 and the debit adjustment with the amount of

–$25.00, as shown in the following screenshot.

Figure 4. Multiple AP documents matched to a bank transaction

- Notice that the Transaction Amount and Matched Amount values are now equal ($724).

- On the form toolbar, click Save.

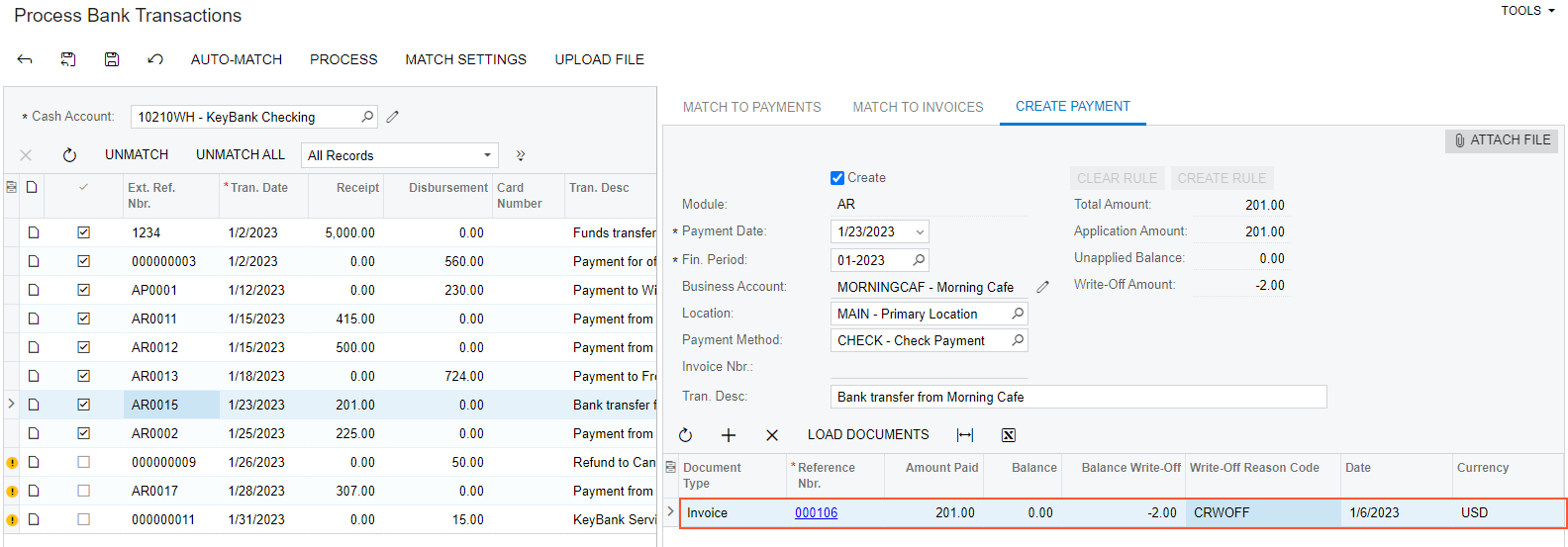

Step 6: Processing a Payment from a Customer and Creating a Write Off

To process a payment from a customer and create a write off, while remaining on the Process Bank Transactions (CA306000) form, do the following:

- In the left pane, select the $201 transaction.

- On the Create Payment tab of the right

pane, specify the following settings to match the bank transaction to a

customer's invoice:

- Create: Selected

- Module: AR

- Payment Date: 1/23/2025 (inserted by default by the bank transaction information)

- Business Account: MORNINGCAF

- On the table toolbar, click Add Row.

- In the Reference Nbr. column, click the magnifier button and select a $199 invoice dated 1/6/2025.

- In the row with the $199 invoice, specify the following settings:

- Amount Paid: 201 (the amount from the bank statement)

- Balance Write-Off: -2 (the overpaid amount to be written off)

- Write-Off Reason Code: CRWOFF - Credit Write Off

The following screenshot illustrates the AR payment with a credit write off.

Figure 5. AR payment with a write off matched to a bank transaction

- On the form toolbar, click Save.

Step 7: Matching a Bank Transaction to an Invoice and Creating a Charge

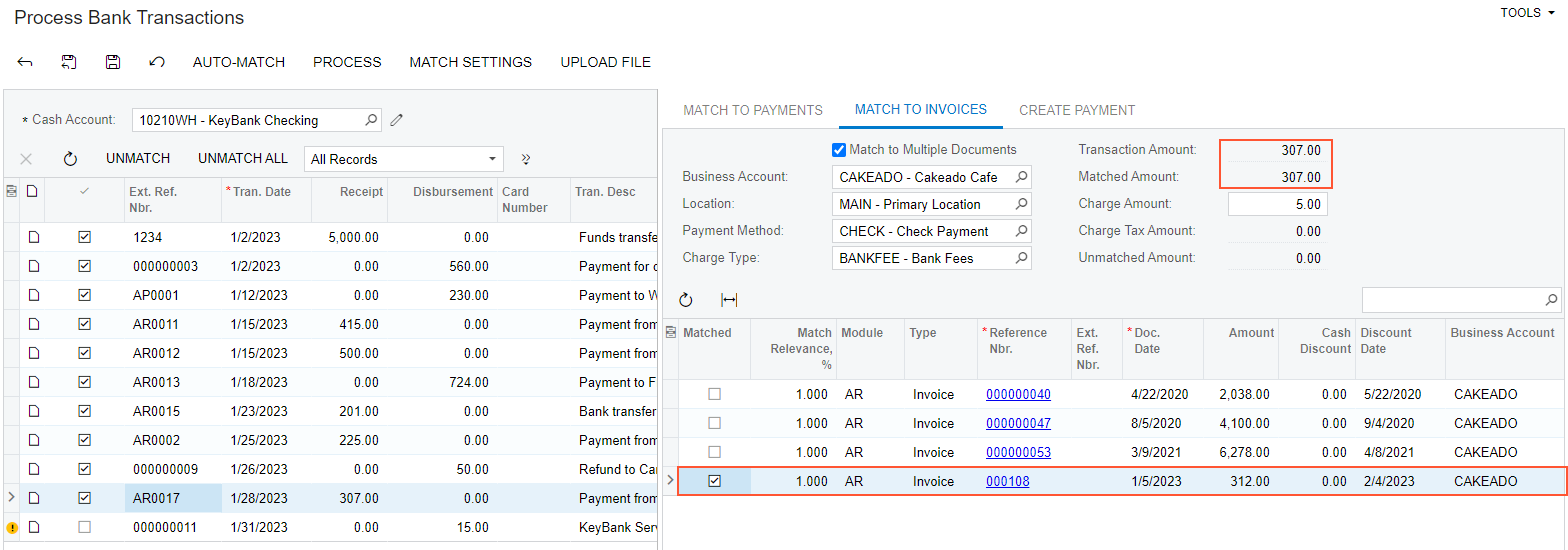

To match a bank transaction to a customer invoice and create a bank charge, while remaining on the Process Bank Transactions (CA306000) form, do the following:

- In the left pane, select the $307 transaction.

- On the Create Payment tab of the right pane, clear the Create check box.

- On the

Match to Invoices tab, specify the following

settings:

- Match to Multiple Documents: Selected

- Business Account: CAKEADO

- Charge Type: BANKFEE

- Charge Amount: 5.00

- In

the table, select the Matched check box in the row of the

$312 invoice to match it to the selected bank transaction.

Notice that the amounts in the Transaction Amount and Matched Amount boxes in the Summary area of the Match to Invoices tab are equal, as shown in the following screenshot.

Figure 6. An invoice with a charge matched to a bank transaction

- On the form toolbar, click Save.

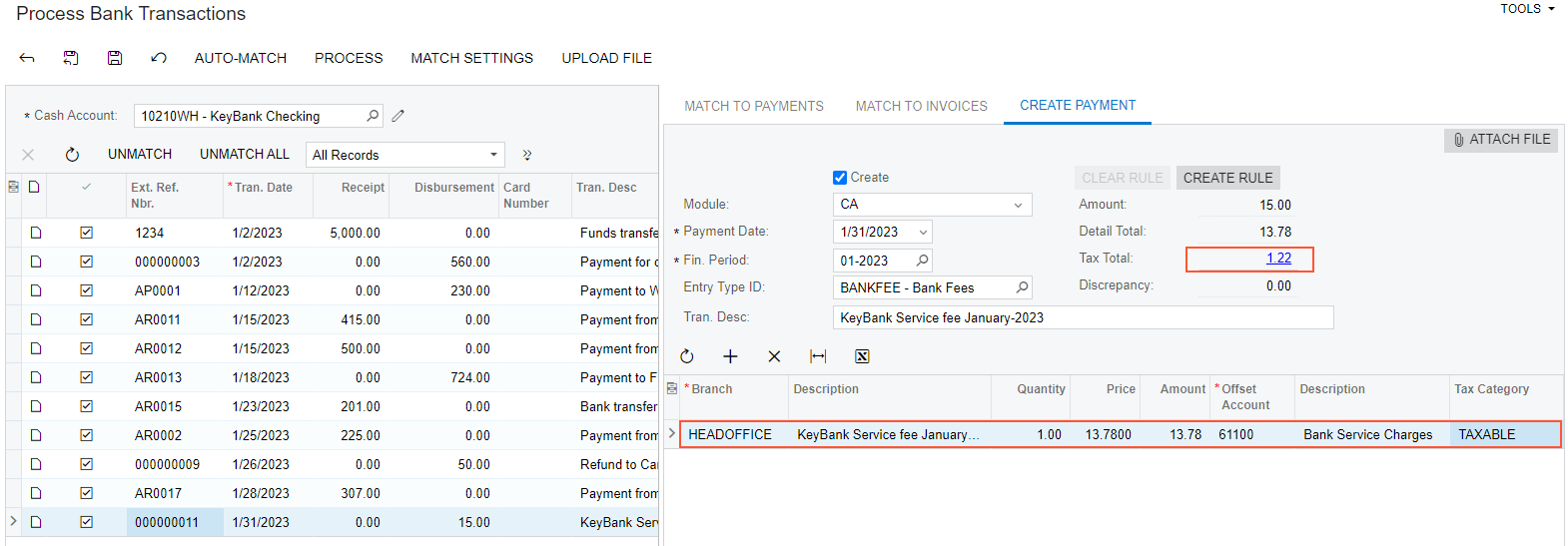

Step 8: Creating a Disbursement Cash Transaction with a Tax

To create a disbursement cash transaction with a tax automatically applied to it, while remaining on the Process Bank Transactions (CA306000) form, do the following:

- In the left pane, select the $15 transaction.

- On the Create Payment tab of the right

pane, specify the following settings to create the cash transaction in the

system:

- Create: Selected

- Module: CA

- Payment Date: 1/31/2025 (inserted by default from the bank transaction information)

- Fin. Period: 01-2025

- Entry Type ID: BANKFEE

- In

the table with the only row, select Taxable in the Tax

Category column.

Once you specify the tax category for the document line, the system automatically applies the tax. The $15 amount now includes the tax amount, as shown in the following screenshot.

Figure 7. A cash transaction with a tax matched to a bank transaction

- Click

the link in the Tax Total box of the Summary area to

review the applied tax.

The Tax Details dialog box shows the tax zone of the selected entry type and the tax applied to the document line.

- Click OK to close the dialog box.

- On the form toolbar, click

Save to save your changes.

The $15 bank service fee transaction is no longer marked with a warning icon because you have specified the information the system will use to create the document when you run the processing of transactions.

Step 9: Preparing Bank Transactions for Reconciliation

To process the bank transactions in preparation for reconciliation, while remaining on the Process Bank Transactions (CA306000) form, do the following:

- On the form

toolbar, click Process.

The system creates cash transactions, AR payments, and AP payments based on the information you specified in the previous steps. The system then releases the document and the transactions, and selects the read-only Cleared check box for every created document and transaction on the Reconciliation Statements (CA302000) form.

Important: The results of the bank transaction processing cannot be reverted or changed. Although you can unmatch bank transactions, the documents that were created during processing will remain in the system. - In the left pane of the Process Bank Transactions form, notice that the transactions have been marked as processed.

- On the Import Bank Transactions (CA306500) form, open the bank statement for the 10210WH - KeyBank Checking cash account, and review the transactions. Notice that all transactions have been processed; for these transactions, the Processed check box is selected.

- On the Cash Transactions (CA304000) form, open the disbursement cash entry that was created from the $15 bank fee transaction and the disbursement cash entry for the $5 bank charge, and make sure these transactions have been released.

- On

the Checks and Payments

(AP302000) form, open the document with the

Payment type that is dated 1/18/2025 and has an amount of $724.

On the Application History tab, notice that three documents have been fully applied to this payment—two bills and a debit adjustment.

- On the Bank Transactions History

(CA402000) form, specify the following settings, and

review the bank transactions that appear in the table:

- Cash Account: 10210WH

- From Date: 1/1/2025

- To Date: 1/31/2025

Attention: In the Reference Nbr. column, you can find the reference numbers of the documents to which the bank transactions have been matched. If you have matched several documents to one bank transaction, the table displays a line for each document matched to that transaction specifying the matched amounts in the Matched Receipt and Matched Disbursement columns.

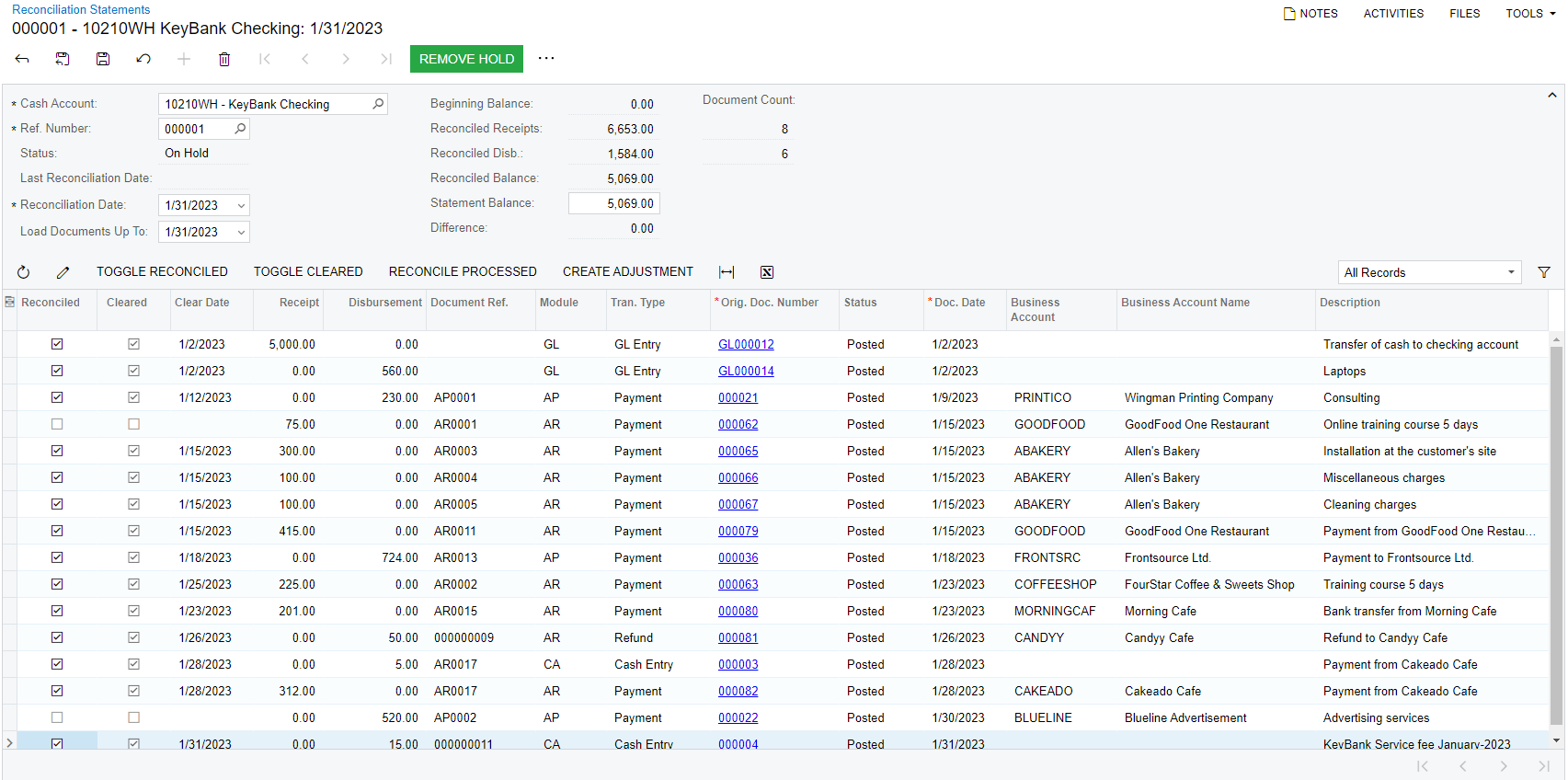

Step 10: Preparing the Reconciliation Statement

To prepare the reconciliation statement for January 2025, do the following:

- Open the Reconciliation Statements (CA3020PL) list of records, and click New Record on the form toolbar. The system opens the Reconciliation Statements (CA302000) form.

- In the Cash Account box, select 10210WH - Key Bank Checking.

- Specify the following settings in the Summary area:

- Reconciliation Date: 1/31/2025

- Statement Balance: 4704.00

- On the form toolbar, click Save to save the reconciliation statement.

- Select the

Reconciled check box for the AP, AR, and cash

documents that have the Cleared check box

selected. Alternatively, you can click Reconcile

Processed and all cleared documents will have the

Reconciled check box selected.Tip: You can select and clear the Cleared check box for transactions until they are involved in bank transaction processing on the Process Bank Transactions (CA306000) form. After you have processed a bank transaction, the Cleared check box is selected and read-only for the corresponding document or transaction in the system. Therefore, once you have processed all transactions from a bank statement, reconciliation with the bank statement becomes easy: You select the Reconciled check box for all transactions that have the Cleared check box selected in the reconciliation statement, and the bank reconciliation is complete.Attention: The cash account balance in the system is not affected by the result of the processing of bank transactions.

The Reconciled Balance is equal to the Statement Balance, as shown in the following screenshot; now you can release the reconciliation statement.

Figure 8. Reconciled bank transactions for January

- On the form toolbar, click Save to save the reconciliation statement.

- On the form toolbar, click Remove Hold, and then click Release to release the reconciliation statement.