Sales with Returns: General Information

In MYOB Acumatica, you can create a mixed order to process both a sale and a return in the same order on the Sales Orders (SO301000) form.

Learning Objectives

In this chapter, you will do the following:

- Become familiar with the general settings and workflow of a mixed order

- Create a mixed order

- Process a sale with a return in a mixed order and the related documents

Applicable Scenario

You may need to perform a sale and a return through a mixed order if all or most of the following are true for your company:

- Your company sells many products at a big store, with employees processing many orders per day through counter sales.

- Some customers need to buy and return products or services (or replace the returned products) at the same time.

- The new items or items for replacement can have higher or lower prices.

- The order balance may be positive or negative.

Because you perform these sales and returns at a counter, you process no shipments. You also need to process AR documents.

Processing of a Sale with a Return

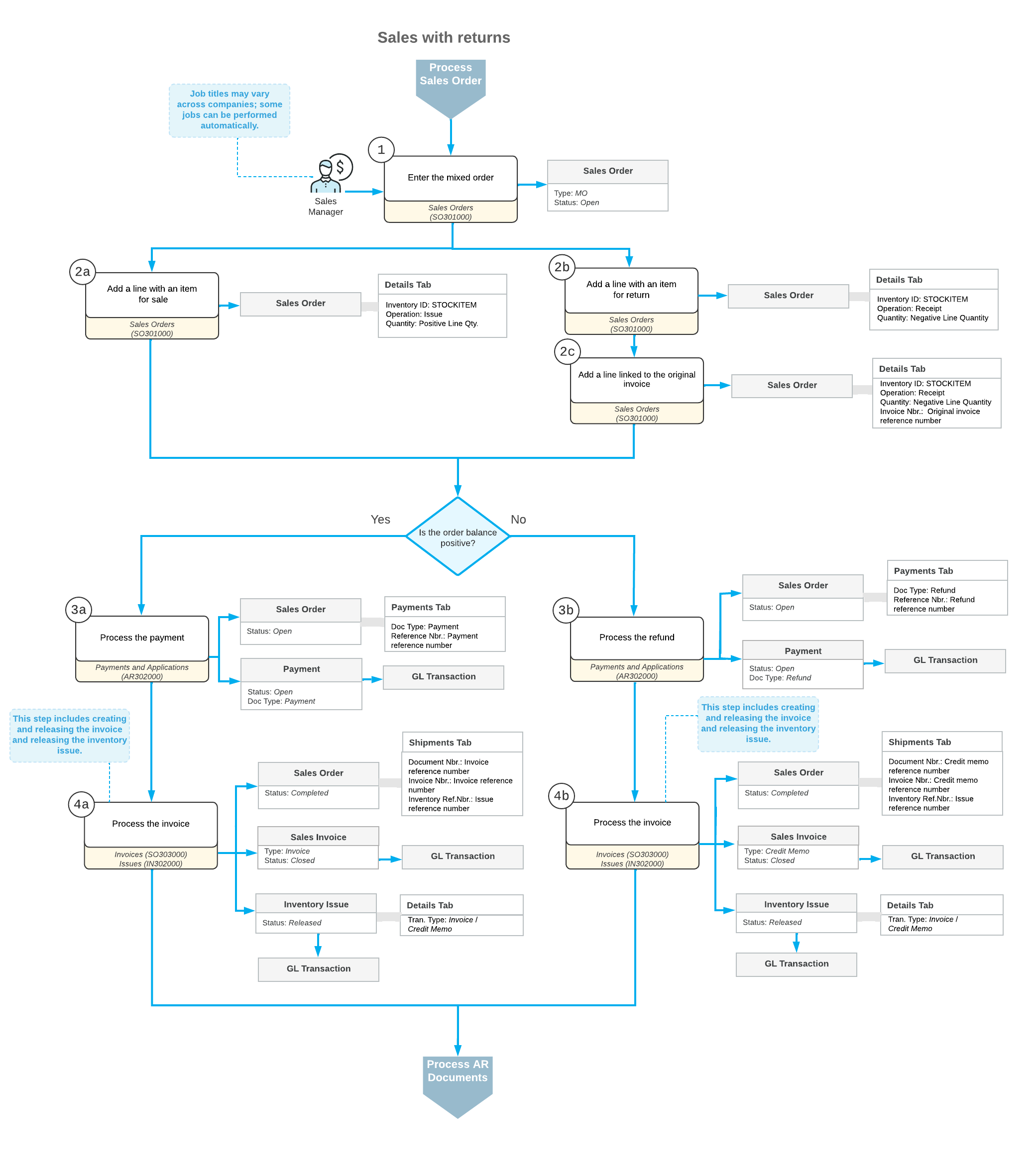

This section describes the general workflow of a sale with a return in the same order; for simplicity, a single item is returned and a single item is sold in this workflow.

To process the sale of a stock item and the return of a stock item in the same mixed order, you perform the following general steps:

- You create a mixed order (that is, an order of the MO type) on the Sales Orders (SO301000) form.

- On the Details tab, you add lines by doing any of the

following:

- You add a line with the item for sale and specify a positive quantity. Because the line has a positive quantity, the system inserts the Issue operation for the line.

- You add the stock item to be returned without linking it to the original invoice, which you may need to do if the original invoice cannot be found or if a customer is returning a part of a kit. To do this, you click Add Items on the table toolbar of the Details tab; in the Inventory Lookup dialog box, which opens, you add the needed lines and click Add & Close. Then you specify a negative quantity for these lines in the Quantity column. In the order line, because you have specified a negative quantity, the system inserts Receipt in the Operation column instead of the default setting of Issue.

- You add the stock item to be returned and include a link to the original sales

invoice (that is, the sales invoice for which the return is being performed). To do

this, you click Add Invoice on the table toolbar; in the

Add Invoice Details dialog box, which opens, you select the

line of the invoice and click Add & Close. The system adds

the selected lines to the order with the quantity specified in the Qty. to

Return column. In the order line, the system inserts the Receipt

operation in the Operation column and a negative quantity in

the Quantity column.Tip:

To specify the quantity to be returned in the Add Invoice Details dialog box, you first check the Available for Return column, which shows the maximum quantity of the item that can be returned, considering any already-returned quantities of the item from the AR document. Then you can do either or both of the following:

- Select the unlabeled check box for the line, which causes the system to automatically set the Qty. to Return to be the same as the Available for Return quantity. You can specify another quantity.

- Manually specify the Qty. to Return, which causes the system to automatically select the unlabeled check box in the line.

- Depending on the order balance (Order Total), you do either of

the following:

- You process a payment. If the Order Total is positive, you click Create Payment on the table toolbar of the Payments tab of the Sales Orders form. In the Create Payment dialog box, you specify the needed settings and click the appropriate button to create the payment. You then release the payment on the Payments and Applications (AR302000) form.

- You process a refund. If the Order Total is negative, you click Create Refund on the table toolbar of the Payments tab of the Sales Orders form. In the Create Refund dialog box, you specify the needed settings and click Refund to create the refund. You then release the refund on the Payments and Applications form.

- You prepare a credit memo or sales invoice for the mixed order by clicking

Prepare Invoice on the Sales Orders form, which results in either of the following:

- If the Order Total of the mixed order is negative, the system generates an invoice of the Credit Memo type.

- If the Order Total of the mixed order is positive, the system generates a sales invoice of the Invoice type.

When you release the document on the Invoices (SO303000) form, the mixed order is assigned the Completed status. The system automatically generates and releases inventory issues with the Credit Memo transaction type and the Invoice transaction type on the Issues (IN302000) form. On release of each inventory issue, a batch of GL transactions is generated. The inventory is updated.

When the sales invoice or credit memo is released and assigned the Closed status, you can view this invoice or credit memo as an AR invoice or AR credit memo, respectively, on the Invoices and Memos (AR301000) form.

Workflow of Processing a Sale with a Return

For a sale with a return in the same order, the typical process involves the actions and generated documents shown in the following diagram.