Purchase Returns at the Calculated Cost: Process Activity

In this activity, you will learn how to process a return of stock items from your company's inventory to the vendor, with the system calculating the items' cost.

Video Tutorial

This video shows you the common process but may contain less detail than the activity has. If you want to repeat the activity on your own or you are preparing to take the certification exam, we recommend that you follow the instructions in the steps of the activity.

Story

Suppose that on January 30, 2025 you, acting as purchasing manager at the SweetLife Fruits & Jams company Regina Wiley, notice that three packs of paper that were purchased and delivered on January 29, 2025 have been damaged during shipping. You have decided to return these packs to the Spectra Stationery Office vendor without requesting a replacement. You need to create and process a purchase return of the damaged items at the cost calculated by the system.

Configuration Overview

In the U100 dataset, for the purposes of this activity, the following tasks have been performed:

- On the Enable/Disable Features (CS100000) form, the following features

have been enabled:

- Inventory and Order Management, which provides the standard functionality of inventory and order management

- Inventory, which gives you the ability to maintain stock items by using forms related to the inventory functionality and to create and process sales and purchase documents that include stock items

- On the Vendors (AP303000) form, the STATOFFICE vendor has been created.

- On the Stock Items (IN202500) form, the PAPER stock item has been created.

- On the Purchase Orders (PO301000) form, the purchase order has been created with stationary items ordered from the STATOFFICE vendor and, on the Purchase Receipts (PO302000) form, the related purchase receipt has been created and released.

Process Overview

A purchase return document, which represents a vendor return in the system, is prepared based on the applicable purchase receipt. In this activity, to create a purchase return, you will open the purchase receipt on the Purchase Receipts (PO302000) form, and on the Details tab, you will select (by selecting the unlabeled check boxes) the lines of all items to be returned. Then on the form toolbar, you will click Return; on the same form, the system will copy the relevant information to a new document of the Return type that includes the lines selected for return.

Before you process the prepared purchase return further, on the Details tab of the Purchase Receipts form, you will correct the quantities to be returned. In the Summary area, you will specify that the items should be issued from inventory at the cost calculated by the system by selecting the Cost by Issue Strategy option in the Cost of Inventory Return From box. You will then release the purchase return and review the related documents to make sure that the return has been processed fully in the system.

System Preparation

Before you start preparing a purchase return, you should do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as purchasing manager Regina Wiley by using the wiley username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button, and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

- On the Company and Branch Selection menu, in the top pane of the MYOB Acumatica screen, make sure the SweetLife Head Office and Wholesale Center branch is selected.

Step 1: Creating a Purchase Return from the Related Purchase Receipt

The easiest way to create a purchase return is to start from the purchase receipt in which you received the items to be returned. To create the purchase return from the purchase receipt, do the following:

- On the Purchase Receipts (PO302000) form, open the purchase receipt to STATOFFICE dated 1/29/2025.

- On the Details tab, select the unlabeled check box in the line of the purchase receipt with the PAPER item.

- On the form toolbar, click Return to create a document in which you will process the return of the item. The system opens the document on the same form. It has the Return type and includes the selected line. In this line, notice that the system has inserted the number of the initial purchase receipt into the PO Receipt Nbr. column on the Details tab.

Step 2: Specifying the Settings of the Return

To define the specific settings of the return document, do the following:

- While you are still viewing the purchase return that you have created on the Purchase Receipts (PO302000) form, in the Summary area, make sure that 1/30/2025 is specified as the Date.

- In the Cost of Inventory Return From box, select the Cost by Issue Strategy option. With this option selected, the items will be issued from inventory at the cost calculated by the system.

- Select the Create Bill check box to make the system generate a debit adjustment automatically on release of the purchase return.

- In the only return line on the Details tab, change the Receipt Qty. to 3 (which is the quantity of items to be returned).

- In the line, clear the Open PO Line check box to indicate that no replacement is needed for returned items.

- On the form toolbar, click Save to save the purchase return, which has the Balanced status and can thus be released.

Step 3: Releasing the Purchase Return

To release the purchase return and to review how the return of items is processed in the system, do the following:

- While you are still viewing the purchase return on the Purchase Receipts (PO302000) form, click Release on the form toolbar.

- On the Billing tab, review the information about the debit adjustment that was prepared, and make sure that it now has the Open status (reflecting that it was released).

- On the Other tab, click the IN Ref. Nbr. link, and review the inventory issue, which is opened on the Issues (IN302000) form. Make sure the issue has the Released status. Close the Issues form.

- On the Orders tab, click the link in the Order Nbr. column. The system opens the purchase order for which the return was processed on the Purchase Orders (PO301000) form in a pop-up window.

- On the Details tab, in the Qty. on Receipts column, notice that the received quantity in the PAPER line has been decreased by the returned quantity and is now 17.

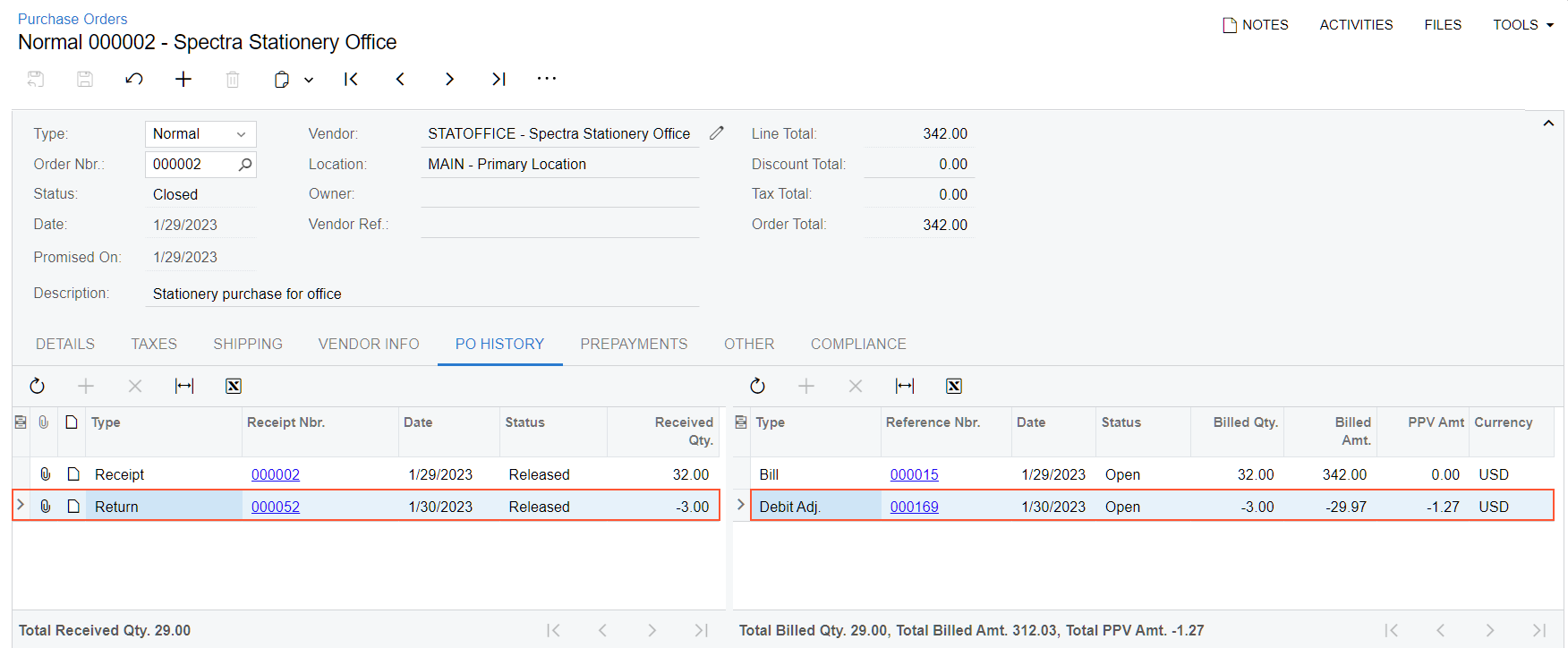

- On

the PO History tab, review the documents related to the

purchase order, as shown in the following screenshot.

The left

table shows the purchase receipt and purchase return;

the right

table shows the bill and the debit adjustment. In the line with the debit

adjustment,

notice

the nonzero purchase price variance amount in the PPV

Amount column, which shows the difference between the amounts at

which the items were purchased and at which the items were

returned.

Figure 1. Documents related to the purchase order