Intercompany Purchases and Returns: Intercompany Returns

For intercompany purchases, you can generate purchase returns.

In this chapter, you will learn how to create a purchase return and automatically generate a sales return based on the purchase return.

Learning Objectives

In this chapter, you will learn how to create a purchase return and automatically generate a sales return based on the purchase return.

Applicable Scenarios

You use the intercompany returns functionality if there are multiple companies defined in the same tenant and one of the companies (the purchasing company) needs to make a return of a purchased item to another company (the selling company).

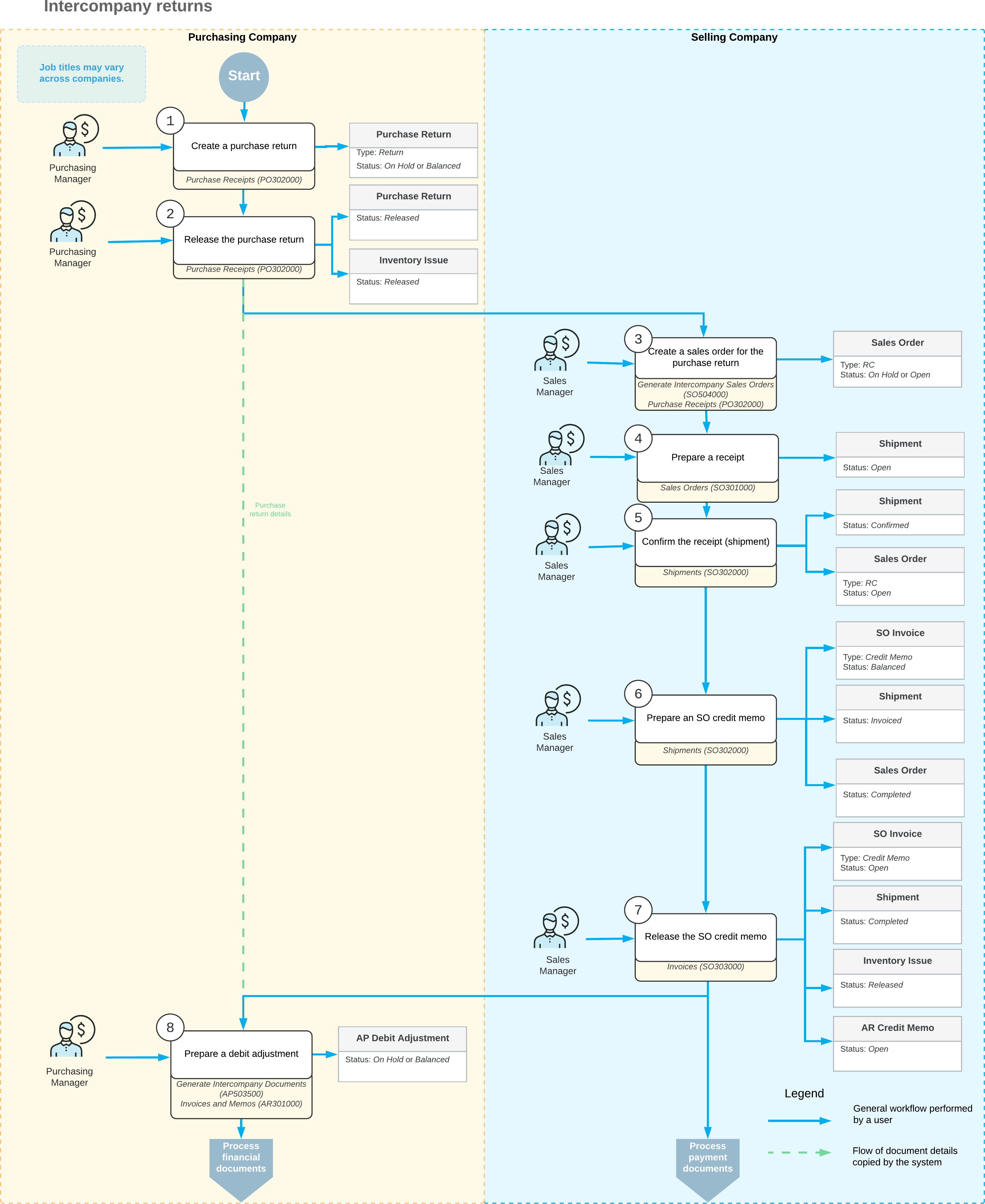

Processing an Intercompany Return

In MYOB Acumatica, to begin processing an intercompany return, on the Purchase Receipts (PO302000) form, the manager of the purchasing company creates a purchase return, which is a document of the Return type, that includes a line for each item being returned. To create a purchase return, the manager of the purchasing company opens the purchase receipt with the items to be returned, select the unlabeled check boxes on the Details tab for the lines with these items, and clicks Return on the form toolbar. The system copies the relevant information from the purchase receipt to a new purchase return on the Purchase Receipts form. In the copied lines, the purchasing manage specifies the quantity of items to be returned in the Receipt Qty. column. If no replacement required, the purchasing manager clears the Open PO check box in the lines of the purchase return. Then the manager saves the purchase return and releases the return by clicking Release on the form toolbar.

The manager of the selling company opens the Generate Intercompany Sales Orders (SO504000), selects the Purchase Return option in the Purchase Doc. Type box in the Summary area of the form, selects the unlabeled check box in the line with the purchase return and clicks Process on the form toolbar. The system generates sales return of the RC type with the Open status and automatically copies the relevant settings and the line details of the originating purchase return. The manager of the selling company opens sales return on the Sales Orders (SO301000) form and creates a shipment with the Receipt operation by clicking Create Receipt on the form toolbar. Then the manager releases the shipment by clicking Confirm Shipment on the form toolbar.

To adjust the customer's balance, the manager of the selling company create an SO credit memo on the Shipments form by clicking Prepare Invoice on the form toolbar while the manager is still viewing the shipment. The system creates a credit memo to the customer and opens it on the Invoices (SO303000) form. On the form toolbar of the Invoices form, the manager clicks Release to release the credit memo.

When the manager of the selling company releases the SO credit memo, the system automatically generates a corresponding inventory receipt for the returned items on the Receipts (IN301000) form; it also creates and releases a credit memo on the Invoices and Memos (AR301000) form. Then the manager of the purchasing company open the Generate Intercompany Documents (AP503500) form, selects the unlabeled check box in the line with the credit memo and clicks Process on the form toolbar. The system generates a debit adjustment on the Bills and Adjustments (AP301000) form. The manager of the purchasing company opens the generated debit adjustment on the Bills and Adjustments form, clicks Remove Hold on the form toolbar and then clicks Release. The system adds the details of the debit adjustment to the Billing History tab of the Purchase Receipts (PO302000) form for the initial purchase return.

Workflow of an Intercompany Return

For an intercompany return between the branches of two different companies, the typical process involves the actions and generated documents shown in the following diagram.