Purchase Receipt Correction: General Information

In MYOB Acumatica, you can modify released purchase receipts created for normal and drop-ship purchase orders—that is, purchase orders of the Normal and Drop-Ship types.

This topic focuses on the correction of normal purchase receipts. For details on purchase receipt correction for drop-ship purchase orders, see Purchase Receipt Correction: Correction of Receipts for Drop-Ship Purchase Orders.

Learning Objectives

In this chapter, you will learn how to do the following:

- Find out whether a purchase receipt can be corrected

- Create and release a correction purchase receipt

- Identify which lines of a correction purchase receipt have been changed

- Check whether a purchase receipt can be canceled

- Cancel a purchase receipt

Applicable Scenarios

You correct a purchase receipt if an error was made in its lines during processing. For example, an incorrect item quantity, lot or serial number, or expiration date was specified.

Correction of a Purchase Receipt

You can correct a purchase receipt for a normal purchase order on the Purchase Receipts (PO302000) form if this receipt has the Released status. While viewing the purchase receipt, you click Correct Receipt on the More menu. The system checks whether the purchase receipt meets all the requirements for correction. (See Requirements for the Original Purchase Receipt.)

If the purchase receipt meets all requirements, the system creates a new purchase receipt with the next sequential number.

In the original receipt, the system inserts the number of the correction receipt as a clickable link in the Correction Doc. Ref. Nbr. box on the Other tab of the Purchase Receipts form. Similarly, the correction receipt displays the original receipt number as a clickable link in the Original Doc. Ref. Nbr. box on the same tab.

The system copies all data from the original receipt to the correction receipt on the Purchase Receipts form, and you can update the correction receipt. When you save the correction receipt for the first time, the system assigns the Under Correction status to the original receipt.

If you update a purchase receipt line on the Details tab, the system automatically selects the Corrected check box in this line. If you change the date or currency exchange rate in the Summary area, the system automatically selects the Corrected check box in all lines of the purchase receipt. This column is hidden by default. For more information about what you can change in the correction receipt, see Editable Details and Settings of the Correction Purchase Receipt.

To complete the correction process, you click Release on the More menu for the correction receipt. This causes the system to validate the state of inventory, as described in Purchase Receipt Correction: Inventory Validation.

Results of Releasing the Correction Receipt

On successful inventory validation, the system generates a correction inventory issue for the correction receipt. You can find its link in the IN Ref. Nbr. box on the Other tab of the Purchase Receipts form. This issue is released automatically, regardless of the state of the Release IN Documents Automatically check box on the Purchase Orders Preferences (PO101000) form. For details on this inventory issue, see Purchase Receipt Correction: Correction Inventory Issue.

When the correction inventory issue is released, the system assigns the Released status to the correction receipt and the Canceled status to the original receipt.

Also, for each line of the correction receipt that has changes in the Receipt Qty. column on the Purchase Receipts form, the system updates the Qty. On Receipts value on the Details tab of the Purchase Orders (PO301000) form for the related purchase order. The system changes the purchase order based on whether the line’s corrected receipt quantity has increased or decreased:

- If the line quantity has decreased, the system reopens the corresponding purchase order line if it has already been completed. That is, it clears the Completed check box for the line on the Details tab. If the purchase order had the Completed status but now has at least one reopened line, the purchase order's status becomes Open.

- If the line quantity has increased and the full quantity of the item has been received, the system selects the Completed check box in the corresponding purchase order line. If all lines of the purchase order are now completed, the purchase order's status becomes Completed.

Also, if the purchase order has a related sales order with lines marked for purchase, the system updates the lines' allocated quantities in this sales order. You can view the updated quantities in the Line Details dialog box of the Sales Orders (SO301000) form.

Workflow of the Correction of a Purchase Receipt

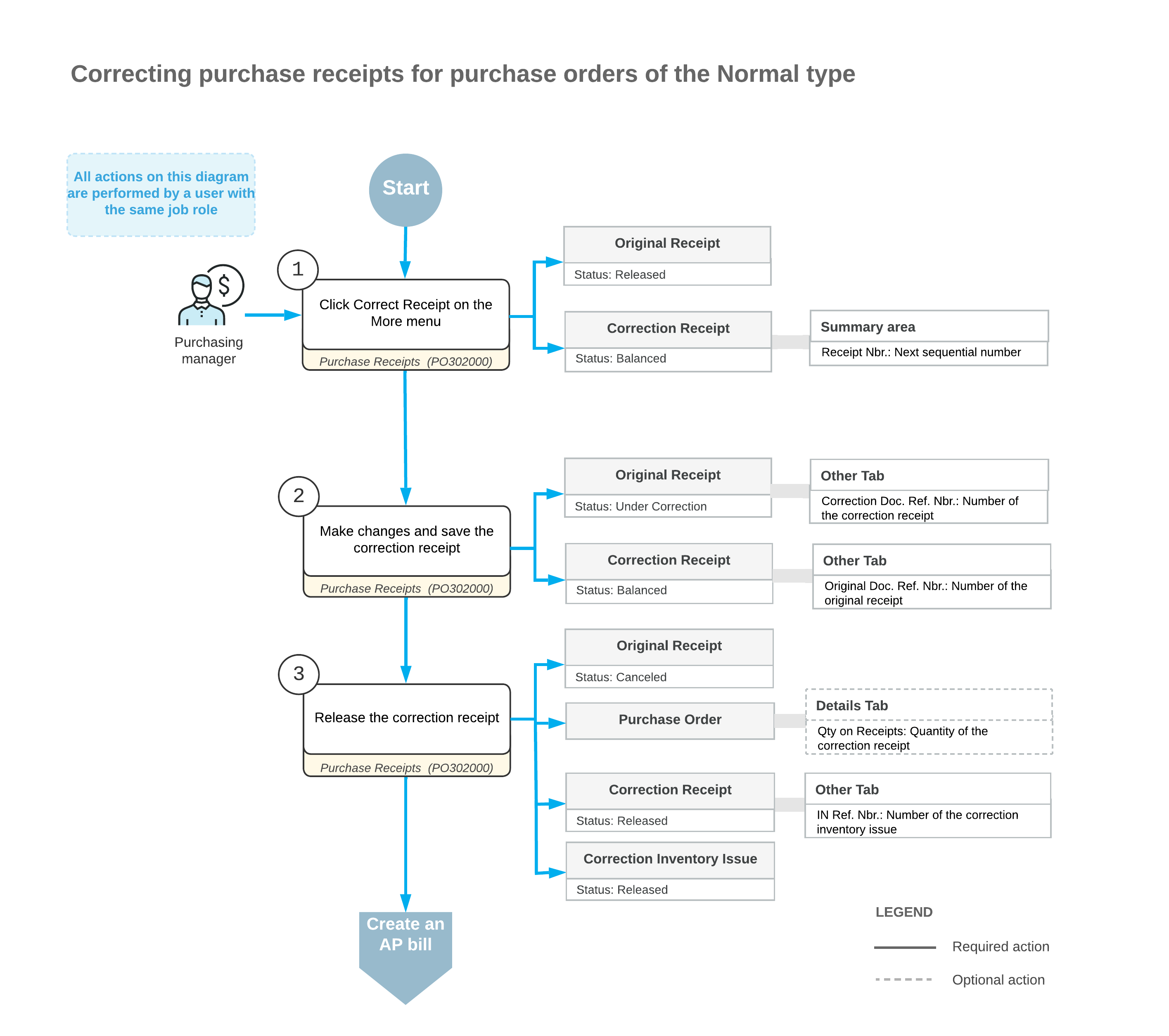

The following diagram illustrates the workflow related to the correction of a purchase receipt for a normal purchase order.

Requirements for the Original Purchase Receipt

On the Purchase Receipts (PO302000) form, you can correct a purchase receipt for a normal purchase order only if the receipt meets all of these requirements:

- It has at least one line of the Goods for IN, Non-Stock for IN, Service, or Freight type.

- It has no related AP bills, except for those that have been fully reversed.

- It contains no lines of the Goods for RP, Goods for Project, or Non Stock for Project type.

- No landed cost documents have been applied to it.

- No putaway transfers have been prepared for it

- It does not have related unreleased purchase returns.

- Its stock is not locked due to a physical inventory count.

- Its related purchase order has no related AP bills, except for those that have been fully reversed. The system checks the purchase order if it has the Allow AP Bill Before Receipt check box selected on the Other tab of the Purchase Orders (PO301000) form.

Editable Details and Settings of the Correction Purchase Receipt

In a correction receipt for a normal purchase order, you can update the following elements in the Summary area of the Purchase Receipts (PO302000) form:

- The Date box

- The Create AP Bill check box

- The Vendor Ref. box

- The Workgroup box

- The Owner box

You can also update the exchange rate in this area if both of following conditions are met:

- The vendor has the Enable Rate Override check box selected on the Financial tab of the Vendors (AP303000) form.

- The Allow Changing Currency Rate on Receipt check box is selected on the Purchase Orders Preferences (PO101000) form.

In a line of the correction receipt, you can edit the values in the following columns of the Details tab:

- Warehouse

- Location

- Transaction Descr.

- UOM

- Receipt Qty.

- Expiration Date

- Lot/Serial Nbr.

- Unit Cost

- Ext. Cost

- Account (only if the line is a non-stock item)

- Subaccount (only if the line is a non-stock item)

- Accrual Account

- Accrual Sub.

During the correction, if you accidentally make changes to a line on the Details tab, you can click Cancel for this line on the table toolbar. The system will discard all changes and revert the line to its original state at the time of document creation. Also, it will clear the Corrected check box in the line. Note that if the Corrected check box in the line is selected due to the change of Date or Exchange Rate in the Summary area, it will remain selected.

Restrictions Applied to the Original and Correction Receipts

While an original receipt has the Under Correction status, you can't do the following:

- Create an associated AP bill on the Purchase Receipts (PO302000) form

- Add it to an AP bill on the Bills and Adjustments (AP301000) form

- Recognize it on the Incoming Documents (AP301100) form

- Create a related purchase return on the Purchase Receipts form

- Apply it to a landed cost document on the Purchase Receipts or Landed Costs (PO303000) form

- Process putaway transfers for it on the Receive and Put Away (PO302020) form

In a correction receipt, you can't add lines or delete lines that were copied from the original receipt. If a line in the original receipt was added by mistake, you can specify 0 in the Receipt Qty. column for the corresponding line in the correction receipt. This prevents the line from being included in any AP bills or landed cost documents during the processing of the correction receipt.