Fixed Asset Creation: To Create and Reconcile an Asset

The following activity will walk you through the process of manually creating and reconciling a fixed asset.

Story

Suppose that on January 10, 2025, SweetLife Fruits & Jams invested in an office building for its Head Office, which it purchased for $165,000. However, at the time of purchase, the building was not ready for use. To prepare the building, SweetLife paid $15,000 to the Frontsource Ltd. company. After the work was completed, the building was ready to be placed in use on February 15, 2025.

Acting as a SweetLife accountant, you need to manually create a fixed asset for the office building and reconcile the acquisition cost of the asset with the appropriate financial transactions for the asset acquisition (the $165,000 GL entry and the $15,000 AP bill).

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Fixed Asset Management feature has been enabled.

- On the Chart of Accounts (GL202500) form, the needed GL accounts have been created.

- On the Vendors (AP303000) form, the FRONTSRC vendor has been created.

- On the Fixed Assets Preferences (FA101000) form, the Automatically Release Acquisition Transactions check box has been cleared. With this check box cleared, acquisition transactions are created with the On Hold status. You will have to release these transactions manually on the Release FA Transactions (FA503000) form.

Process Overview

In this activity, you will first update the fixed asset preferences on the Fixed Assets Preferences (FA101000) form. On the Bills and Adjustments (AP301000) form, you will create an AP bill for the vendor that prepared the acquired building. On the Fixed Assets (FA303000) form, you will create the BUILDING asset and reconcile it with two GL transactions on the Reconciliation tab.

System Preparation

Before you begin creating a fixed asset, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as an accountant by using the johnson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, click the Business Date menu button, and select 1/12/2025 on the calendar.

- In the company to which you are signed in, be sure that you have implemented the fixed asset functionality by performing the following prerequisite activities: Fixed Assets: To Configure the System for Fixed Asset Management, Fixed Assets: To Configure the Fixed Asset Functionality, and Fixed Assets: To Create Fixed Asset Classes.

- Be sure that you have performed the Conversion of a Purchase: To Convert a Purchase to an Asset prerequisite activity to create a purchasing transaction for the building.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, select the SweetLife Head Office and Wholesale Center branch.

Step 1: Updating the Fixed Asset Preferences

To update the fixed asset preferences, do the following:

- Open the Fixed Assets Preferences (FA101000) form.

- In the Posting Settings section, select the Automatically Release Acquisition Transactions check box to make the system automatically release the acquisition transactions that you will create later.

- On the form toolbar, click Save to save your changes.

Step 2: Creating an AP Bill

To create an AP bill for the building preparation, do the following:

- On the Bills and Adjustments (AP301000) form, add a new record.

- In the Summary area, specify the following settings for the AP bill:

- Type: Bill

- Vendor: FRONTSRC

- Date: 1/12/2025 (inserted automatically)

- Post Period: 01-2025 (inserted automatically)

- Description: Preparing building for use (materials and work)

- On the Details tab, click Add Row

on the table toolbar, and specify the following settings in the added row:

- Branch: HEADOFFICE (inserted automatically)

- Transaction Descr.: Preparing building for use (materials and work)

- Ext. Cost: 15000

- Account: 15010 (Accrued Purchases: Fixed Assets)

- On the form toolbar, click Save.

- On the form toolbar, click Remove Hold, and click Release to release the AP bill.

Step 3: Creating a Fixed Asset

To create the BUILDING fixed asset, do the following:

- On the Fixed Assets (FA303000) form, add a new record.

- In the Summary area, specify Head Office Building in the Description box.

- On the General tab, specify the following settings:

- Asset Class: BUILDING

- Asset Type: BUILDING (inserted automatically based on the fixed asset class settings)

- Useful Life, Years: 39.0000 (inserted automatically based on the fixed asset class settings)

- Receipt Date: 1/10/2025

- Placed-in-Service Date: 2/15/2025

- Orig. Acquisition Cost: 180000

- Branch: HEADOFFICE (the current branch is inserted by default)

- Department: ADMIN

You can change any asset setting except for the state of the Tangible check box until the acquisition transaction is released.

- On the form toolbar, click Save to save the asset.

The system has generated the acquisition transaction and saved it with the Balanced status. (You can review the transaction on the Transactions tab.)

- Review the Balance tab. Notice that the system has

inserted the depreciation method (Straight-Line) and averaging convention

(Mid Period), which it has copied from the settings of the fixed

asset class.

Depr. From Period is the period when the asset has been placed in service and starting from which the asset will be depreciated. By default, this period is calculated by using the Placed-in-Service Date according to the book calendar. You can change the Depr. From date and the Placed-in-Service Date before the first depreciation transaction is generated for the asset. The Depr. to Period is the last period for which depreciation is calculated for the asset.

- On the form toolbar, click Remove Hold to remove the fixed asset from hold, and save it.

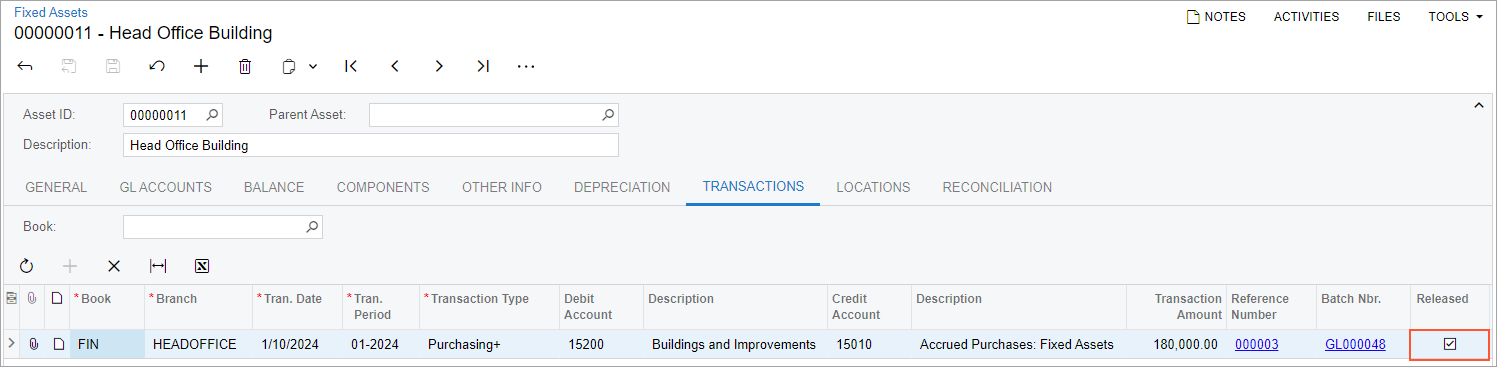

- Review the Transactions tab, shown in the following

screenshot. Because you have configured the system to automatically release

acquisition transactions, the system automatically released the acquisition

transaction when you released the asset from hold and saved your changes.

Figure 1. The generated acquisition transaction

The GL accounts to be used in transactions were copied from the fixed asset class when the asset was created. You can review the GL accounts specified for the asset on the GL Accounts tab of the Fixed Assets form. The Fixed Asset account can be changed for a fixed asset with the Active status before a Purchasing+ transaction is released; the Accumulated Depreciation account can be changed for an asset before the first Depreciation+ transaction is released. Also, income and expense accounts can be changed for an asset at any time.

Step 4: Reconciling the Created Fixed Asset

To reconcile the created fixed asset, do the following:

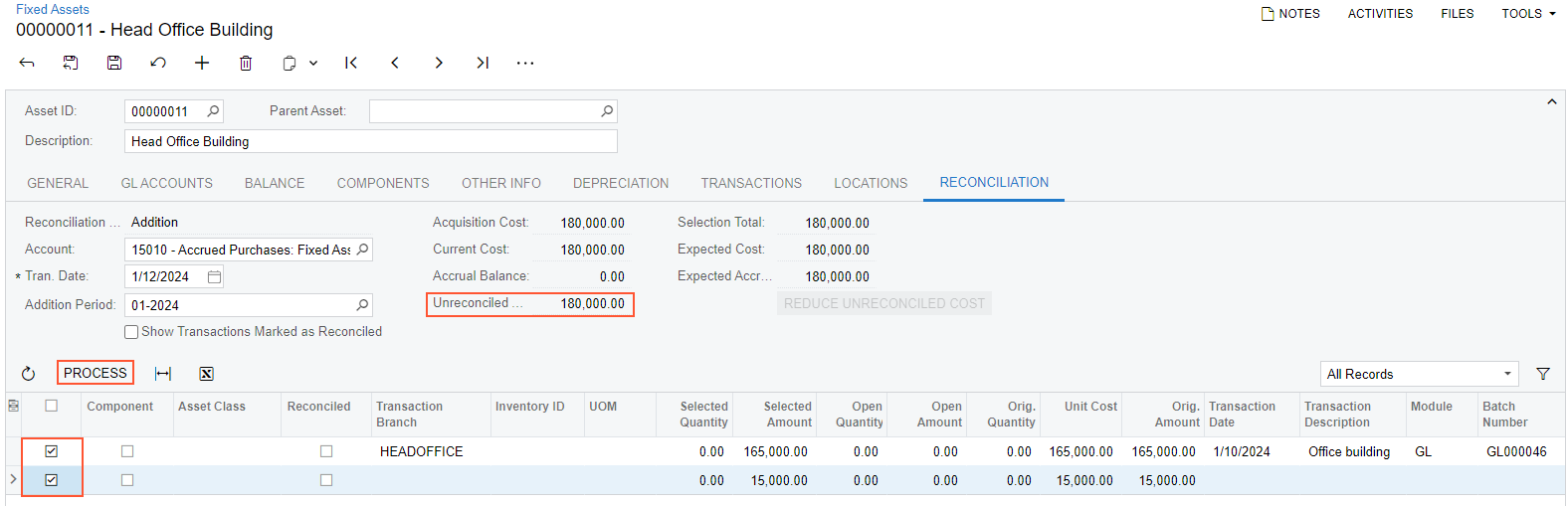

- While you are still viewing the fixed asset on the Fixed Assets (FA303000) form, go to the Reconciliation tab.

- In the Account box, make sure that 15010 (Accrued Purchases: Fixed Assets) is selected.

- In the table, select the unlabeled check boxes in the rows with Orig. Amount values of 165,000.00 and 15,000.00, as shown in the following screenshot.

- On the table toolbar, click Process to generate the

reconciliation transactions.

Figure 2. The fixed asset cost before reconciliation

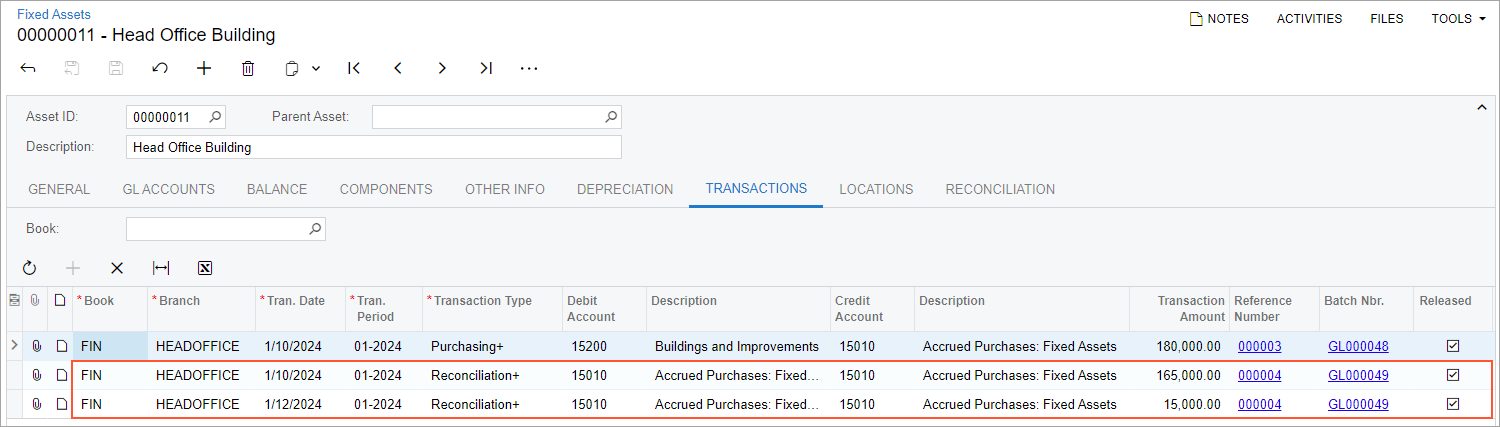

- On the form toolbar, click Save to save the created

reconciliation transactions, and review them on the

Transactions tab (see the screenshot below). The

generated Reconciliation+ transactions were automatically released

because the Automatically Release Acquisition

Transactions check box (which is selected) also applies to the

reconciliation transactions that correspond to asset acquisition. The

Batch. Nbr. box displays the number of the

corresponding GL batch.

Figure 3. The reconciliation transactions generated for the fixed asset

- On the Reconciliation tab, review the

Unreconciled Amount. It is now 0.00—that is,

the full amount of the asset has been reconciled.Tip:If the amount of the received bill is less than the acquisition cost of the fixed asset, you could click the Reduce Unreconciled Cost button on this tab to decrease the asset's cost on the unreconciled amount. If you clicked the button, the system would generate the Purchasing– transaction, which sets the cost of the fixed asset to the reconciled amount.