Fixed Asset Lifecycle

This topic provides an overview of the lifecycle of fixed assets and their processing in MYOB Acumatica.

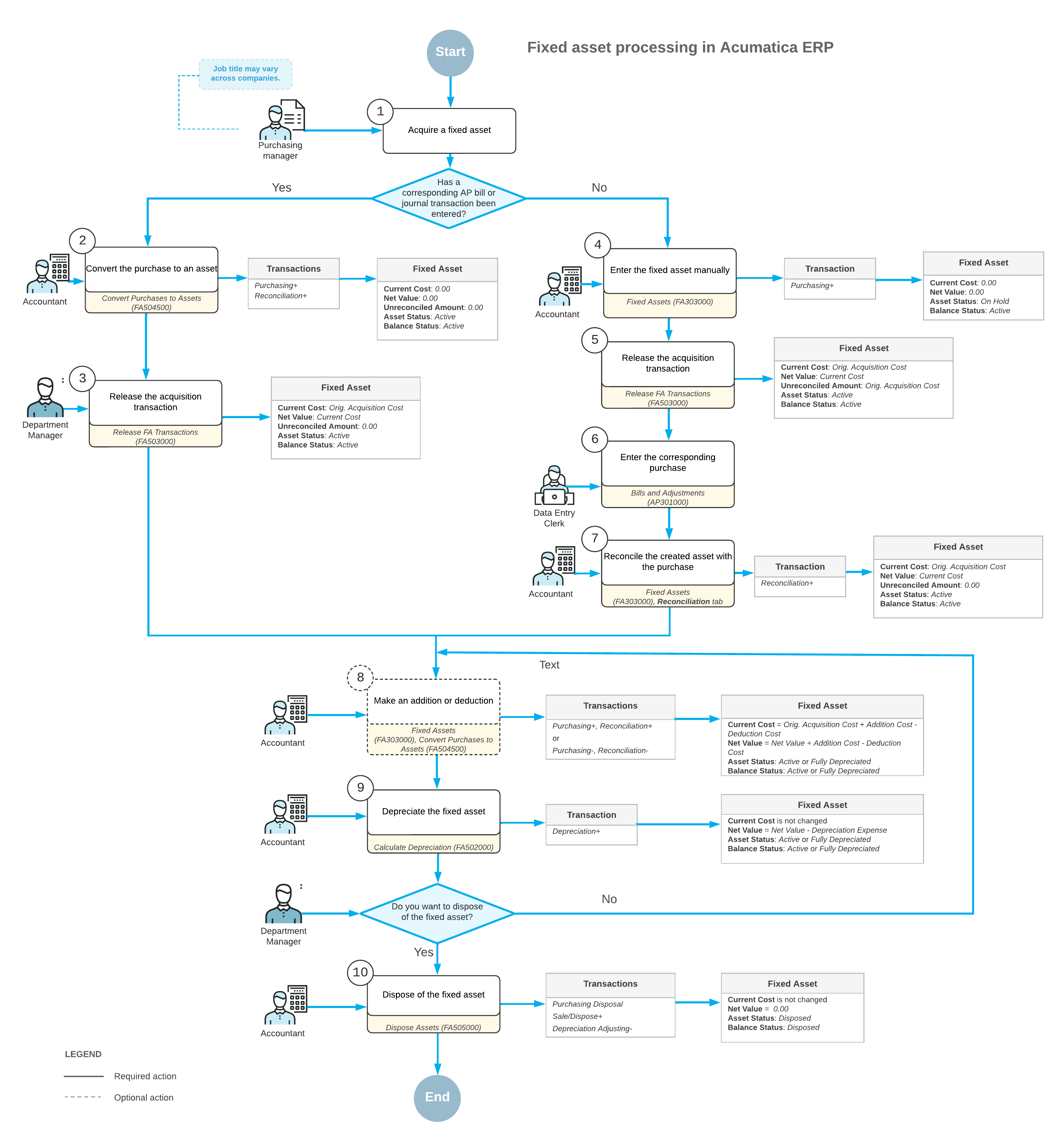

The following diagram shows the processing of a fixed asset throughout its lifecycle.

The processing of a fixed asset includes the following steps, which are also shown in the diagram above with corresponding numbers:

- The fixed asset is acquired. The original acquisition cost includes the cost of the

purchase plus the cost of the preparations to deploy the asset; the asset can later be

reconciled with the appropriate financial transactions.

You proceed to Step 4 if the purchase has not been recorded in the system with a corresponding AP bill on the Bills and Adjustments (AP301000) form or journal transaction on the Journal Transactions (GL301000) form.

- If an AP bill or a journal transaction has been entered for the purchased items, you

create an asset by converting an existing purchased item on the Convert Purchases to Assets (FA504500) form.

During the conversion, the system generates a Purchasing+ transaction that records the asset acquisition and a Reconciliation+ transaction that reconciles the converted amount and links the created asset to the appropriate purchase. Most settings for conversion are copied by default from the fixed asset class that you specify for the asset. You can change only some of the fixed asset's settings before conversion.

- On the Release FA Transactions (FA503000) form, you release the acquisition transaction that was created during the conversion. You then proceed to Step 8.

- If you have more than one transaction for a fixed asset or the needed transactions have not been entered in the system yet (for example, the AP bill has not yet been received), you create the fixed asset manually on the Fixed Assets (FA303000) form. When you create the fixed asset manually, the system generates a Purchasing+ transaction that records the asset acquisition.

- On the Release FA Transactions form, you release the acquisition transaction.

- You record the purchased fixed asset by creating one of the following: an AP bill on the Bills and Adjustments (AP301000) form for the purchased asset, or a GL transaction on the Journal Transactions (GL301000) form to directly enter a purchase transaction.

- On the Reconciliation tab of the Fixed Assets (FA303000) form, you reconcile the cost of the created asset with the appropriate GL entries. During reconciliation, the system generates a Reconciliation+ transaction. When you create fixed assets manually, you can change any of their settings before you release the acquisition transaction.

- Optional: On the Fixed Assets or Convert Purchases to Assets

form, you make additions to and deductions from the fixed asset to capitalize additional

expenses or to record the asset's impairment. (An addition increases the current cost and

the net value of the asset, and a deduction reduces the current cost and the net value of

the asset.)

The system calculates the depreciation expenses for the next periods based on the new current cost; if needed, it makes depreciation adjustments for the already-depreciated periods.

- When the asset has been placed in use, you start to depreciate the fixed asset on the

Calculate Depreciation (FA502000) form.

You can depreciate fixed assets by using different depreciation methods for different depreciation books. If the asset has been fully depreciated in a book through its entire life, its balance is assigned the Fully Depreciated status in this book.

You return to Steps 8–9 as needed until it is time to dispose of the asset.

- On the Dispose Assets (FA505000) form, you dispose of the asset when this step is needed. Reasons for disposal include the asset being taken out of service, damage to the asset, a reduction of the asset’s productivity, or the sale of the asset. After the asset is disposed of, it has a net value of 0.00 and the Disposed status.