Depreciation Configuration

You have to select an appropriate depreciation method and select certain depreciation settings for each fixed asset you add to the system. In the topics of this section you can find information on the depreciation methods available in MYOB Acumatica and the details on setting up asset depreciation.

Using Depreciation Methods

The depreciation method determines how the asset cost is allocated over the useful life of the asset. MYOB Acumatica provides multiple built-in depreciation methods, and you can create custom methods. You use the Depreciation Methods (FA202500) form to manage formula-based methods and the Depreciation Table Methods (FA202600) form to manage table based methods.

For details on the calculation methods available in the MYOB Acumatica, see Predefined Depreciation Methods, Dutch Depreciation Methods, Australian Depreciation Methods, and New Zealand Depreciation Methods. For details on the averaging conventions that determine how fixed assets must be depreciated for the financial period within which they are acquired or disposed of, see Averaging Conventions. For more information on the methods that are permitted by law in the United States, see U.S.-Based Fixed Asset Depreciation.

Using Accelerated Depreciation for the Straight-Line Depreciation Method

If you change the settings for an asset—for example, you revalue the asset or change its useful life—the system uses the revalued amount as the basis for the depreciation in periods after revaluation.

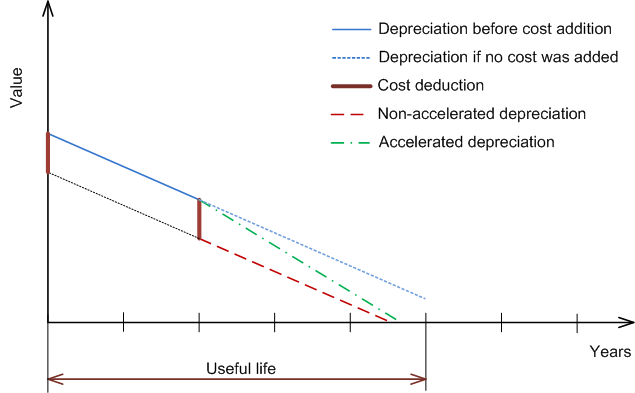

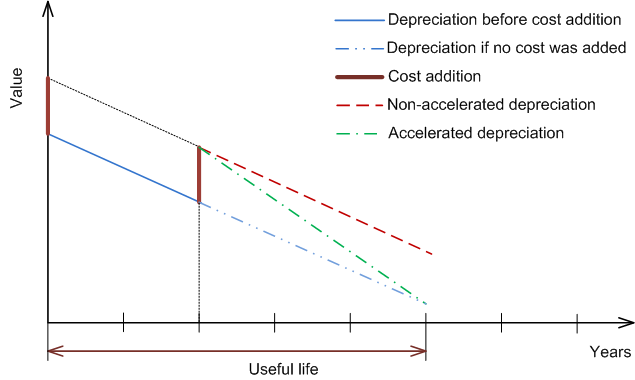

You can configure the system to accelerate the depreciation for the assets that use the Straight-Line method, or you can use the Remaining Value method. In this case, the asset depreciation will be reported throughout the entire life of the asset, as shown in the following graphics below.

You can switch on the accelerated depreciation for an asset class, and the setting will be applied to all the assets of the class.

To switch on the accelerated depreciation for the assets that use the Straight-Line method, select the Accelerated Depreciation for SL Depr. Method check box on the General tab of the Fixed Asset Classes (FA201000) form.

For the asset's net value to become zero at the end of its useful life, you should change the depreciation method to a method based on the Remaining Value calculation method. To do this, you change the option in the Depreciation Method column on the Balance tab of the Fixed Assets form for every needed asset.

Configuring the Depreciation of an Asset

The choice of a depreciation method depends on what your company policy is and how accurately the method reflects the physical depreciation of an asset. MYOB Acumatica supports assigning multiple books to one asset, with each book using its own depreciation method for different purposes. For more information about setting up books, see Fixed Assets: To Configure the Fixed Asset Functionality. You assign a class to the asset, and then specify the books to be assigned to the asset from the books associated with the asset class. Note that the asset must be assigned to the book that updates the general ledger. Additionally, after you assign a book to an asset, you can change the default depreciation method of the book for the selected asset by using the Fixed Assets (FA303000) form.