Sales Invoice Correction: To Cancel an Invoice

The following activity will walk you through the process of canceling a sales invoice that was created for a sales order.

Story

Suppose that on January 28, 2025, FourStar Coffee & Sweets Shop ordered 15 pounds of apples from the main office of SweetLife. The ordered fruits were shipped from the Wholesale warehouse to the customer's location, and a sales invoice was prepared. Further suppose that you later noticed that the sales taxes had not been calculated for the sales invoice because the EXEMPT tax category had been specified in the sales order line by mistake. Acting as a sales manager, you need to cancel the incorrect invoice and create a new one with the correct information.

Configuration Overview

In the U100 dataset, for the purposes of this activity, the following tasks have been performed:

- The Inventory feature, which provides the ability to create sales and purchase orders that include stock items, have been enabled on the Enable/Disable Features (CS101000) form.

- On the Order Types (SO201000) form, the SO order type has been configured and activated.

- On the Stock Items (IN202500) form, the APPLES stock item has been defined.

- On the Customers (AR303000) form, the COFFEESHOP (FourStar Coffee & Sweets Shop) customer has been defined. Additionally, the sales documents that you need to correct have been processed in the system: a sales order to COFFEESHOP has been created, a shipment for the sales order has been prepared and confirmed, and a sales invoice has been prepared and released.

Process Overview

To correct the mistake of taxes not being charged on the sales invoice on the Invoices (SO303000) form, you will cancel the invoice. Then you will change the tax category in the sales order line on the Sales Orders (SO301000) form, and prepare a new sales invoice for the sales order with the correct information.

System Preparation

Do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. To sign in as a sales and purchasing manager, use the wiley username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button, and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

- On the Company and Branch Selection menu, also on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

Step 1: Canceling the Sales Invoice

To cancel the sales invoice with the incorrect tax category, do the following:

- On the Sales Orders (SO301000) form, open the sales order for the COFFEESHOP customer in the amount of $37.50, dated 1/28/2025.

- On the Shipments tab, click the Invoice Nbr. link to open the sales invoice on the Invoices (SO303000) form.

- Review the Taxes tab. Notice that the NYNOTAX tax code with the 0% tax rate has been applied to the sales invoice, so the tax amount is $0.00, which is incorrect.

- On the More menu, click Cancel Invoice.

The system creates a cancellation credit memo with the same settings as the invoice you were viewing, and opens it on the same form.

- On the form toolbar, click Remove Hold, and then click Release. The credit memo is assigned the Closed status, because it has been applied in full to the invoice.

- On the Financial tab, click the link in the Original Document box to open the invoice that was canceled on the Invoices form. Notice that the invoice is now assigned the Canceled status.

Step 2: Creating the New Sales invoice

To create the sales invoice with the correct tax information, do the following:

- On the Sales Orders (SO301000) form, again open the sales order for COFFEESHOP (FourStar Coffee & Sweets Shop) dated 1/28/2025.

- On the form toolbar, click Prepare Invoice. The system creates the new sales invoice for the sales order and opens it on the Invoices (SO303000) form.

- In the only line on the Details tab, change the tax category to TAXABLE and save the invoice.

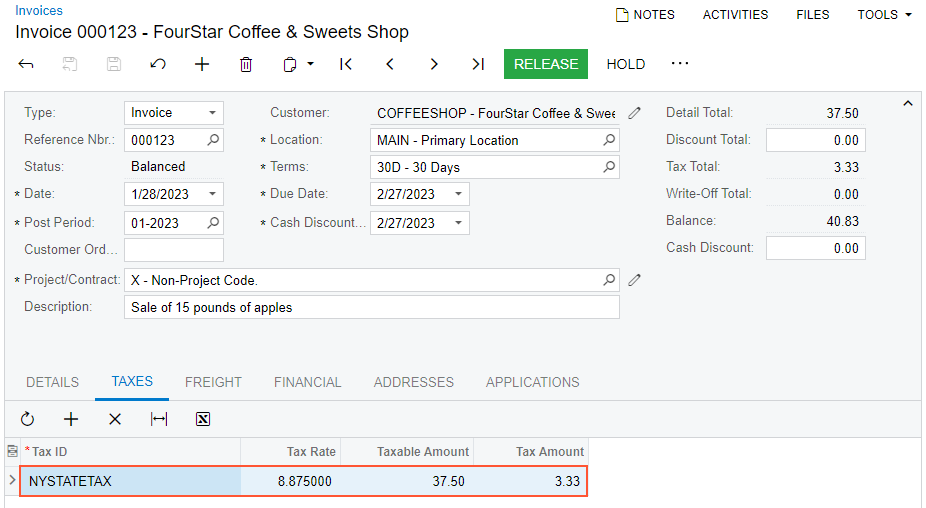

- Review the Taxes tab, and make sure that the

NYSTATETAX has been applied to the invoice and the calculated tax

amount is $3.33, as shown in the following screenshot.

Figure 1. The correct tax amounts in the corrected sales invoice

- On the form toolbar, click Release to release the invoice.

- On the Details tab, click the link in the Order Nbr. column in the only line to open the related sales order on the Sales Orders form.

- On the Shipments tab, notice that the reference number of the newly created invoice is now shown in the Invoice Nbr. column.

You have canceled the sales invoice with incorrect data and prepared a new one.