Splitting of Assets: Process Activity

The following activity will walk you through the process of splitting a fixed asset.

Story

Suppose that on September 1, 2025, the management of SweetLife Fruits & Jams decided to sell a part of the land near the office building. Earlier, an accountant had recorded the land near and under the office building as a single fixed asset. To process the sale of the part of the land, acting as the SweetLife accountant, you need to split the Land fixed asset into two assets.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Fixed Asset Management feature has been enabled.

- On the Chart of Accounts (GL202500) form, the needed GL accounts have been created.

- On the Fixed Assets Preferences (FA101000) form, the Automatically Release Split Transactions check box has been cleared. Thus, split transactions are created with the On Hold status, and you will have to release these transactions manually on the Release FA Transactions (FA503000) form.

Process Overview

In this activity, you will open the original asset on the Fixed Assets (FA303000) form and initiate the splitting process; you will split it on the Split Assets (FA506000) form. You will then release the split transaction on the Release FA Transactions (FA503000) form and review the current cost of the original asset on the Fixed Assets form.

System Preparation

Before you begin splitting a fixed asset, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as an accountant by using the johnson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, click the Business Date menu button, and select 9/1/2025 on the calendar.

- In the company to which you are signed in, be sure that you have implemented the fixed asset functionality by performing the following prerequisite activities: Fixed Assets: To Configure the System for Fixed Asset Management, Fixed Assets: To Configure the Fixed Asset Functionality, and Fixed Assets: To Create Fixed Asset Classes.

- Make sure that you have created the Land fixed asset by converting a purchase by performing the Conversion of a Purchase: To Convert a Purchase to an Asset prerequisite.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, select the SweetLife Head Office and Wholesale Center branch.

Step 1: Splitting a Fixed Asset

To split the Land fixed asset, do the following:

- On the Fixed Assets (FA303000) form, open the Land fixed asset.

- On the More menu (under Processing), click Split. The system opens the Split Assets (FA506000) form with the Land asset selected.

- In the Selection area of this form, make sure that the following settings are

selected:

- Split Date: 9/1/2025

- Split Period: 09-2025

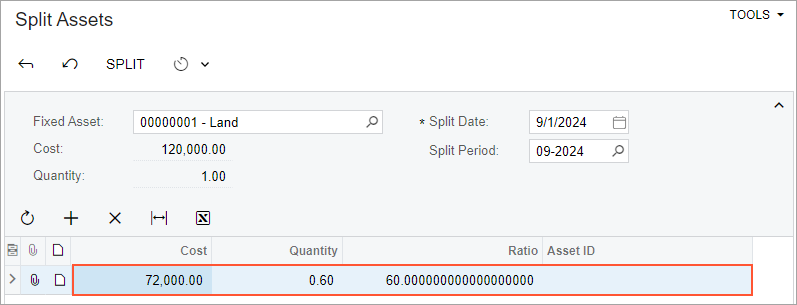

- On the table toolbar, click Add Row, and specify

72000 in the Cost column of

the added row. After you specify the cost, the system will automatically

calculate the ratio and quantity for the row (see the screenshot below). Tip: Instead of specifying the cost, you could have specified the ratio of a new asset (that is, the percentage of the original asset cost to be assigned to the new asset) or its quantity.

After the split, the cost of the original asset will be decreased by the specified cost, and a new asset with the specified cost will be created. The asset created by the split belongs to the same branch and department as those of the original asset.

Figure 1. Percentage of the asset to be split

- On the form toolbar, click Split. The system creates the new fixed asset and shows its ID in the Asset ID column. Although the asset has been created, the split transactions have not been released yet.

Step 2: Releasing the Split Transaction

To release the split transaction, do the following:

- Open the Release FA Transactions (FA503000) form.

- Click the link in the Reference Number column of the only

row, and review the generated split transaction on the Fixed Asset Transactions (FA301000) form, which the system has opened.

The generated transaction creates a new fixed asset and transfers the selected cost ($72,000) from the original asset to the new asset. The created asset belongs to the same department and branch as those of the original asset. The amount of the original asset is decreased by the specified cost. Because you have split the non-depreciable asset, no transaction has been generated to update the accumulated depreciation account.

- On the Release FA Transactions form, select the unlabeled check box for the split transaction, and click Release on the form toolbar. The account balances remain the same after the release of the transaction, which is why no GL batch is generated for this transaction. After you release the transaction, it has the Unposted status, and the Batch Nbr. column is empty.

Step 3: Reviewing the Original Asset

To review the original fixed asset, do the following:

- On the Fixed Assets (FA303000) form, open the Land fixed asset.

- On the Balance tab, review the current cost of the asset. The current cost of the asset has decreased by $72,000 and is now $48,000.