Assets with Depreciation: To Dispose of an Asset

The following activity will walk you through the process of disposing of an asset with accumulated depreciation.

Story

Suppose that on August 1, 2026, the management of the SweetLife Fruits & Jams company decided to sell one desktop computer for $75 to Cakeado Cafe. Acting as a SweetLife accountant, you need to dispose of the asset and create an invoice for the buyer of the computer.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Fixed Asset Management feature has been enabled.

- On the Chart of Accounts (GL202500) form, the needed GL accounts have been created.

- On the Fixed Assets Preferences (FA101000) form, the Automatically Release Disposal Transactions check box has been cleared.

Process Overview

In this activity, you will dispose of the fixed asset on the Dispose Assets (FA505000) form. On the Fixed Assets (FA303000) form, you will review the settings of the disposed asset and the generated transactions. Finally, on the Invoices and Memos (AR301000) form, you will create an AR invoice to record the sale of this fixed asset.

System Preparation

Before you begin disposing of a fixed asset with depreciation, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as an accountant by using the johnson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, click the Business Date menu button, and select 8/1/2026 on the calendar.

- In the company to which you are signed in, be sure that you have implemented the fixed asset functionality by performing the following prerequisite activities: Fixed Assets: To Configure the System for Fixed Asset Management, Fixed Assets: To Configure the Fixed Asset Functionality, and Fixed Assets: To Create Fixed Asset Classes.

- Make sure that you have created the fixed assets by performing the Conversion of a Purchase: To Convert a Purchase to Multiple Assets prerequisite activity.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, select the SweetLife Head Office and Wholesale Center branch.

Step 1: Updating the Fixed Asset Preferences

To update the fixed asset preferences so that the system releases disposal transactions, do the following:

- Open the Fixed Assets Preferences (FA101000) form.

- In the Posting Settings section, select the Automatically Release Disposal Transactions check box.

- On the form toolbar, click Save to save your changes.

Step 2: Disposing of the Fixed Asset

To dispose of the fixed asset, do the following:

- Open the Dispose Assets (FA505000) form.

- In the Selection area, specify the following settings:

- Company/Branch: HEADOFFICE

- Disposal Date: 8/1/2026 (inserted automatically)

- Disposal Period: 08-2026 (inserted automatically)

- Disposal Method: SOLD

- Total Proceeds Amount: 75

- Proceeds Allocation: Automatic

- Proceeds Account: 11010 (AR Accrual Account)

- Before Disposal: Depreciate

- Select the unlabeled check box in the row of the Desktop computer asset

in the table, and click Process on the form toolbar. The

system generates depreciation and disposal transactions and releases them

automatically.Attention: If the Automatically Release Depreciation Transactions check box had been cleared on the Fixed Assets Preferences (FA101000) form, you would have had to depreciate the asset by using the Calculate Depreciation (FA502000) form before disposing of it.

- In the Processing dialog box, click the link in the

Asset ID column, and on the Fixed Assets (FA303000) form, which the system has opened,

review the generated transactions on the Transactions

tab.

The system has automatically depreciated the asset from the 02-2025 to 08-2026 periods, and then disposed of the asset. The following transactions have been generated and released:

- Depreciation+ transactions that debit the Depreciation Expense account (64000) for the depreciation amount and credit the Accumulated Depreciation account (16300) for the same amount. The system has generated multiple Depreciation+ transactions to depreciate the asset until the disposal date.

- A Purchasing Disposal transaction that credits the Fixed Asset account (15300) and debits the Gain/Loss of Fixed Asset Disposal account (90000) in the asset's cost ($450) to record the cost disposal.

- A Depreciation Adjusting– transaction that debits the Accumulated Depreciation account in the total amount of the accumulated depreciation ($235.50) for all the depreciation periods, and credits the Gain/Loss of Fixed Asset Disposal account (90000) in the same amount.

- A Sale/Dispose+ transaction that credits the Gain/Loss of Fixed Asset Disposal account (90000) and debits the Proceeds account (11010) in the proceeds amount of $75.

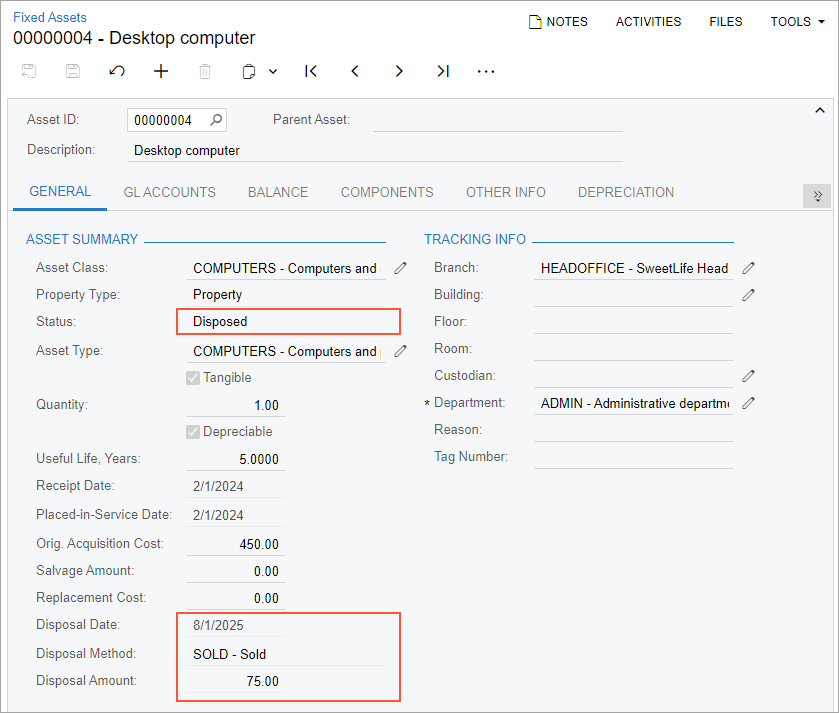

- Review the General tab (see the screenshot below). The

status of the fixed asset has changed to Disposed, and the

Disposal Date, Disposal

Method, and Disposal Amount boxes show

disposal information for this asset.

Figure 1. Asset with the Disposed status

Step 3: Creating an Invoice for the Sale of the Fixed Asset

To create an invoice to record the sale of the desktop computer, do the following:

- On the Invoices and Memos (AR301000) form, create a new record.

- In the Summary area, specify the following settings:

- Type: Invoice

- Customer: CAKEADO

- Date: 8/1/2026 (inserted automatically)

- Post Period: 08-2026 (inserted automatically)

- Description: Sale of desktop computer

- On the Details tab, click Add Row

on the table toolbar, and specify the following settings in the added row:

- Branch: HEADOFFICE

- Transaction Descr.: Sale of desktop computer

- Ext. Price: 75

- Account: 11010 (AR Accrual Account)

- On the form toolbar, click Remove Hold, and then click Release to release the invoice.