Cash Entries: To Create a Receipt Cash Entry

In this activity, you will learn how to create a cash entry of the Receipt type.

Video Tutorial

This video shows you the common process but may contain less detail than the activity has. If you want to repeat the activity on your own or you are preparing to take the certification exam, we recommend that you follow the instructions in the steps of the activity.

Story

On January 31, 2025, SweetLife earned $25 in bank interest on the 10300WH (Cathay Bank Savings) account. As a SweetLife accountant, on January 31, you need to create a cash entry of the Receipt type to account for this amount.

Process Overview

In this activity, you will first create the Receipt cash entry for interest earned on the Cash Transactions (CA304000) form. Then you will post the created document to the general ledger and review the generated GL transaction on the Journal Transactions (GL301000) form.

System Preparation

To prepare the system, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. To

sign in as an accountant, use the following credentials:

- Username: johnson

- Password: 123

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/31/2025. If a different date is displayed, click the Business Date menu button and select 1/31/2025. For simplicity, in this activity, you will create and process all documents in the system on this business date.

- On the Company and Branch Selection menu, also on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu button to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

- On the Cash Management Preferences (CA101000) form, in the Posting and Release Settings section, select the Automatically Post to GL on Release check box. On the form toolbar, click Save to save your changes.

Step 1: Creating and Releasing a Receipt Cash Entry

To create a receipt cash entry for $25 interest earned on the Cathay Bank Savings account on January 31, 2025, do the following:

- Open the Cash Transactions (CA304000) form.

- On

the form toolbar, click Add New Record, and in the

Summary area, specify the following settings:

- Cash Account: 10300WH (Cathay Bank Savings)

- Tran. Date: 1/31/2025

- Fin. Period: 01-2025

- Entry

Type:

INTEREST

Notice that the value in the Disbursement/Receipt box is Receipt. This is because you have selected a receipt entry type.

- Document Ref.: 20250131

- Description: $25 Interest Earned on Cathay Savings Account in January

- On the Details tab,

click Add

Row on the table toolbar, and specify the following settings for

the added row:

- Branch: HEADOFFICE (inserted by default)

- Amount: 25.00

- Offset

Account: 49300 (Interest

Income)

The offset account specifies the account to be credited on release of the cash transaction. The default value is automatically inserted from the INTEREST cash entry type. You can override the default offset account for the cash account, if needed.

- On the form toolbar, click Remove Hold.

- On

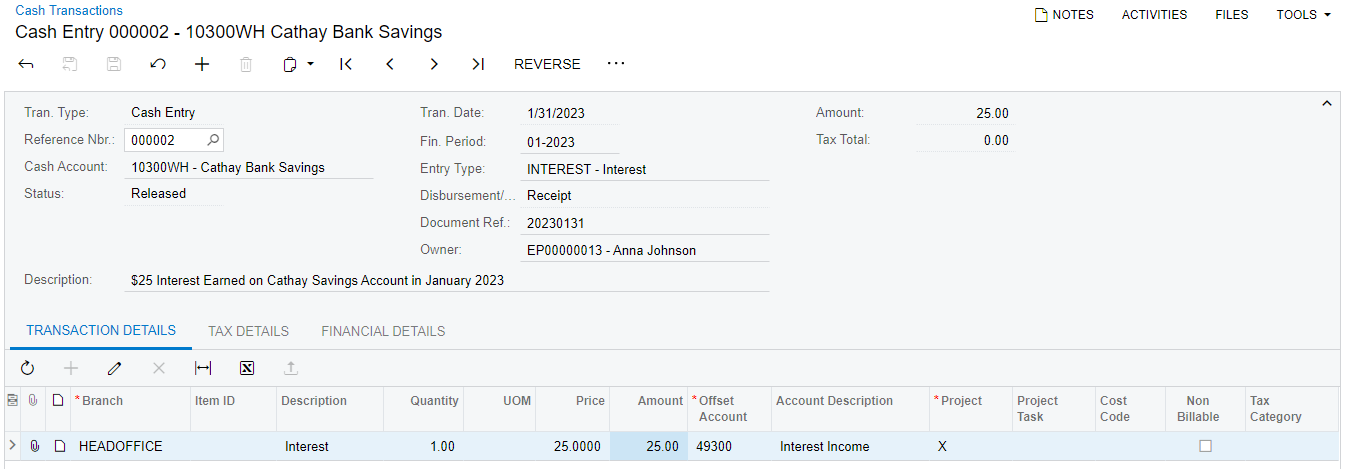

the form toolbar, click Release to release the cash

entry. The system creates a batch to be posted to the general

ledger. The released cash entry is shown in the following

screenshot.

Figure 1. The released Receipt cash entry

Step 2: Reviewing the Generated GL Transaction

To review the GL transaction generated by posting the cash entry you have created in Step 1, do the following:

- While you are still on the Cash Transactions (CA304000) form, open the Financial tab, and click the batch number to open the GL transaction for review.

- On the Journal Transactions

(GL301000) form, which opens, review the batch that

the system has generated in the general ledger.

The batch contains two journal entries that update GL accounts: Company Savings Account is debited for $25, and Interest Income is credited for the same amount. The batch was posted immediately on release of the cash entry document and now has the Posted status. You can navigate to the cash entry document from which the batch was generated by clicking View Source Document on the table toolbar.