Prepayment Invoices for Sales Orders: General Information

If prepayments are subject to tax reporting in the country where your company is operating, you can create prepayment invoices, when your company requires prepayments for sales orders.

In MYOB Acumatica, you can create any number of prepayment invoices for a sales order with the tax and taxable amounts stated in the prepayment invoice.

To avoid manual entry of a prepayment invoice on the Invoices and Memos (AR301000) form, you can create a prepayment invoice from the sales order. This prepayment invoice will include the same items as the sales order has, with taxes calculated based on the specified prepayment amount.

For details on manually entering a prepayment invoice, see Prepayment Invoices: General Information.

Learning Objectives

In this chapter, you will learn how to do the following:

- From a sales order, create a prepayment invoice that covers the full sales order amount

- From a sales order, create a prepayment invoice that partially covers the sales order amount

- Create two or more prepayment invoices for a sales order

- Link an already-created prepayment invoice to a sales order

Applicable Scenarios

- Your company produces goods and requires a deposit that is typically 50% of the order amount before starting the production job. In this case, your company sends a prepayment invoice to the customer for 50% of the order amount; the invoice includes a detailed list of the items to be produced along with their quantities and prices. Upon receipt of the payment for this prepayment invoice, your company initiates work on the order. The remaining payment is settled upon shipment of the order.

- Your company distributes goods and typically requests a 20% prepayment before delivery, with the remaining 80% due upon receipt of the shipment. Goods are not dispatched without prepayment. Your company creates a prepayment invoice for 20% of the order amount and sends it to the customer. Upon receiving the prepayment, the order is delivered to the customer.

- A customer placed an order, and your company sent a prepayment invoice for 20% of the total order amount. Later, the customer requested that additional items be added to the order. In response, your company issued another prepayment invoice, covering 20% of the updated total amount.

- Your company requires a full prepayment before shipping the ordered goods to a customer. When multiple shipments are expected for an order, you need to create a separate prepayment invoice for each shipment.

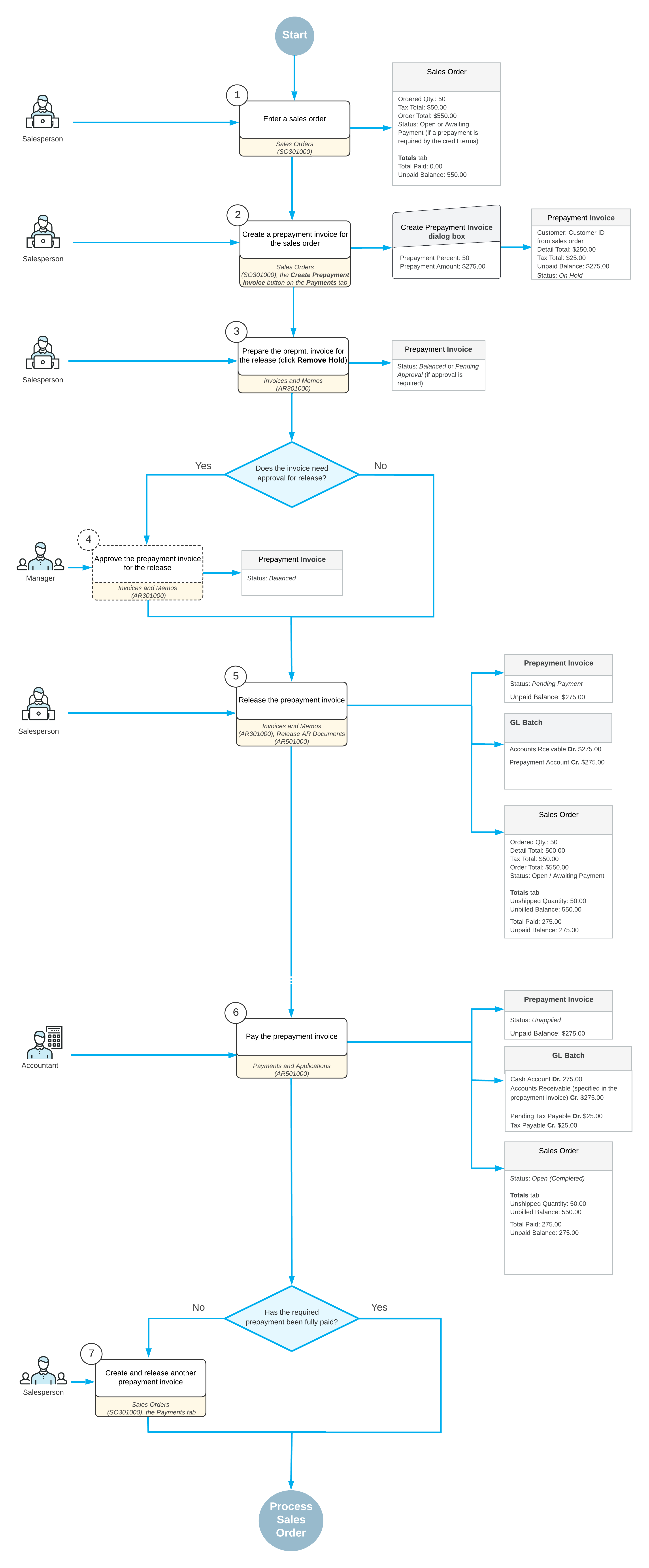

Workflow of a Prepayment Invoice Created from a Sales Order

- The tax total is calculated based on tax settings that define the calculation of the tax amount on a per-document basis when the tax is not included in the document amount.

- The company requires a prepayment of 50% of the order total.

In the next sections of this topic, the main steps of the process are described in detail.

Creating a Prepayment Invoice from a Sales Order

When a sales order is created and saved on the Sales Orders (SO301000) form, you can create a prepayment invoice to request a full or partial prepayment for the sales order. On the Payments tab of the form, you click the Create Prepayment Invoice button.

In the Create Prepayment Invoice dialog box, which opens, the Prepayment Percent and the Prepayment Amount boxes are populated depending on the state of the Prepayment Required check box in the customer's credit terms specified on the Credit Terms (CS206500) form:

- If the check box is cleared, the following values are specified:

- Prepayment Percent: 100 for the first prepayment invoice created for the sales order; the percentage calculated proportionally to the specified prepayment amount for subsequent prepayment invoices

-

Prepayment Amount: The unpaid balance of the sales order for

the first prepayment invoice created for the sales order; the unpaid balance of the

sales order for subsequent prepayment invoices (if the prepayment percentage or

prepayment amount was changed for the first prepayment invoice)

You can either keep these values unchanged (thus creating a prepayment invoice covering the order total) or specify a required prepayment percent or amount, which causes the other to be calculated automatically.

- If the check box is selected and the prepayment percent is defined in the customer's

credit terms, the following values are specified:

- Prepayment Percent: The percent defined by the credit terms for the first prepayment invoice; the percentage calculated proportionally to the specified prepayment amount for subsequent prepayment invoices

- Prepayment Amount: The amount calculated according to the

prepayment percent for the first prepayment invoice; the unpaid balance of the sales

order for subsequent prepayment invoices

You can either keep these values unchanged (thus creating a prepayment invoice covering the required prepayment amount) or change the prepayment percent or amount. If you reduce the prepayment percent, an additional prepayment invoice or multiple invoices will be required.

After reviewing the prepayment percentage and amount, and making any necessary changes, you click Create. The system closes the dialog box and opens the prepayment invoice on the Invoices and Memos (AR301000) form with most of the settings populated from the sales order. The reference number of the prepayment invoice is assigned according to the numbering sequence specified in the Prepayment Invoice Numbering Sequence box on the Accounts Receivable Preferences (AR101000) form.

On the Details tab of the Invoices and Memos form, the system has added only the unbilled lines of the sales order to the prepayment invoice that is created. The following settings are specified in the corresponding columns:

- Prepayment Percent: The prepayment percent specified in the dialog box during the creation of the invoice

- Prepayment Amount: The prepayment amount calculated for the line, which it determines by applying the prepayment percentage to the line's Ext. Price minus the line’s Discount Amount (if any)

- Order Type: The sales order type

- Order Nbr.: The reference number of the sales order from which the prepayment invoice has been created.

On the Discounts tab of the Invoices and Memos form, the system has added group or documents (or both) discounts, if they have been applied to the sales order. For details, see Applying Group and Document Discounts to the Prepayment Invoice.

You can edit the settings of the prepayment invoice (excluding the Customer and Currency settings) before you release the document.

- On the Payments tab, adds a row with the following settings of

the created prepayment invoice:

- Doc. Type: Prepmt. Invoice

- Reference Nbr.: The reference number of the prepayment invoice

- Applied to Order: The Unpaid Balance of the prepayment invoice

- On the Totals tab, updates the Total Paid and the Unpaid Balance boxes

For details of how to process prepayment invoices, see Prepayment Invoices: General Information.

Applying Group and Document Discounts to the Prepayment Invoice

If group or document (or both) discounts have been applied to a sales order and listed on the Discounts tab of the Sales Orders (SO301000) form, the system applies these discounts to the created prepayment invoice. The discount amount is recalculated proportionally to the prepayment amount and inserted in the Document Discount box in the Summary area of the Invoices and Memos form. These discounts are also added to the Discounts tab of the Invoices and Memos form. If you edit any details copied from the sales order in the prepayment invoice, the system recalculates the discount amount accordingly.

If a sales order includes multiple discounts, the system aggregates these discounts by type (group or document) and adds one consolidated line for all group discounts and another line for all document discounts (including the external document discount) to the created prepayment invoice to the Discounts tab of the Invoices and Memos form leaving the Discount Code and Sequence ID columns empty in these lines.

If you add a line or lines to the prepayment invoice on the Details tab of the Invoices and Memos form and any added item is eligible for a group or document discount, the system applies the corresponding discount to the prepayment invoice. On the Discounts tab, the system adds a line with that discount with the Discount Code and Sequence ID columns filled in. This does not affect the original sales order, and the discounts from the sales order are not recalculated.

If the Customer Discounts feature is disabled on the Enable/Disable Features form, the discount specified in the Document Discount box in the Summary area of the Sales Orders form is used for the prepayment invoice. Upon creating the prepayment invoice, the system recalculates the discount amount based on the prepayment amount and inserts the value in the Document Discount box in the Summary area of the Invoices and Memos form. In that case, no lines are added to the Discounts tab.

Payment of a Sales Order

If a prepayment invoice has been created for a total amount of a sales order and then paid in full, when you create a sales invoice for the sales order, the system automatically applies the prepayment invoice to the sales invoice. In the sales invoice, on the Applications tab of the Invoices and Memos (AR301000) form, the system adds a line with the prepayment invoice. Once you release the sales invoice, it is assigned the Closed status and the sales order is assigned the Completed status.

If a prepayment invoice has been created for a part of an order total amount and then paid, when you create a sales invoice for the sales order, the system automatically applies the prepayment invoice to the sales invoice on the Applications tab of the Invoices and Memos form. Once the sales invoice has been released, in the Balance box of the Summary area of the Invoices and Memos form, the system specifies the invoice balance, from which it has subtracted the amount paid by the prepayment invoice. The sales invoice remains open and you will need to pay the amount that has not been covered by the prepayment invoice.

If a particular prepayment percent is required based on the customer's credit terms settings on the Credit Terms (CS206500) form, then a sales order retains the Awaiting Payment status until you pay the full required prepayment amount. You can create a prepayment invoice that covers 100% of the required prepayment amount. In that case, after the prepayment invoice has been paid, the sales order is assigned the Open status and you can prepare a sales invoice for the remaining amount of the order. You can also create two or more prepayment invoices that in total will cover the required prepayment percent.