Scrap Cost Calculation: To Process a Production Order That Includes Written-Off Scrap

The following activity will walk you through the process of recording item production that includes scrapped items; the cost of scrapped items must be written off to a specific GL account.

Story

Suppose that the GoodFood One Restaurant has ordered three juicers from the SweetLife Fruits & Jams company. Initially, the production process includes the assembly and packing of the juicers but the customer does not need the juicers to be packed. Further suppose that components for the juicers are available in SweetLife Fruits & Jams's warehouse.

Suppose that during juicer assembly, a shop-floor employee assembled one of the juicers but found out that it does not work. The production manager asked the employee to record this juicer as scrap. Because the customer expects to have all three juicers at the same time, the employee assembled one extra juicer because the broken juicer must be scrapped and cannot be used to fulfill the customer's order. According to the system settings, the cost of the scrapped item will be moved to a specific GL account.

Also suppose that the system should use the Actual costing method for calculating the unit cost of produced juicers because produced items are moved to stock only when all transactions have been released and all costs have been applied to a production order.

Acting as a production manager, you will create a production order for producing three juicers and process all related transactions. In a production environment, a shop-floor employee would create labor and move transactions on their own. To streamline this activity, you will enter this transaction as a production manager.

Also, acting as a production accountant, you will review the cost of the scrapped juicer.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Warehouses (IN204000) form, the WORKHOUSE warehouse has been defined, and its locations include MGI and MTL.

- On the Stock Items (IN202500) form, the CFJFRUITBF, PULPCONT1L, JUICECUP05L, MRBASE, FNSIEVE, and GRDISC01 stock items have been defined.

Process Overview

In this activity, to process the documents and transactions related to the production of the juicers, you will do the following:

- On the Production Order Maintenance (AM201500) form, create and release the production order.

- On the Materials (AM300000) form, issue the materials required for the assembly operation.

- On the Labor (AM301000) form, record the labor spent on the juicer assembly, the produced quantity, and the scrapped quantity.

- On the Production Order Maintenance form, review the production order balance after you have completed the order and on the Journal Transactions (GL301000) form, review the GL transaction related to scrap costs.

- On the Close Production Orders (AM506000) form, close the production order.

System Preparation

Do the following:

- As a prerequisite to the current activity, complete Configuration of Production with Backflushing: Implementation Activity so that the system is ready for processing the production of juicers with labor and material backflushing.

- Launch the MYOB Acumatica website, and sign in to the company in which the prerequisite activities have been performed. You should sign in as the production manager by using the peters username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to today’s date. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Creating the Production Order

To create the production order for three juicers, do the following:

- On the Production Order Maintenance (AM201500) form, add a new record.

- In the Summary area, specify the following settings:

- Order Type: RO (selected automatically)

- Inventory ID: CFJFRUITBF

- Warehouse: WORKHOUSE (selected automatically)

- Location: MGI (selected automatically)

- Order Date: Today's date (selected automatically)

- Description: Production of 3 juicers

- On the General tab, do the following:

- In the Qty. to Produce box, specify 3.

- In the Costing Method box, select Actual.

- On the form toolbar, click Save.

- On the More menu (under Other), click Production Detail. The system opens the Production Order Details (AM209000) form with the production order selected.

- In the Operations table, remove the packing operation as follows:

- Click the row for the 0020 operation.

- On the table toolbar, click Delete Row.

- In the Scrap Action column of the row for the 0010 operation, select Write-Off.

- On the form toolbar, click Save.

- On the Production Order Maintenance form, open the production order.

- On the More menu (under Processing), click

Release Order. The order's status is changed to

Released.Tip: You open the More menu by clicking the More button (…) on the form toolbar.

Step 2: Issuing Materials for the Assembly Operation

Suppose that you have been informed that the shop-floor worker had to assemble one extra juicer because one of the assembled juicers did not work. Therefore the worker used more materials than it was planned. In this step, you will issue the needed material quantity for the assembly operation of the production order. Do the following:

- While you are still viewing the production order on the Production Order Maintenance (AM201500) form, on the More menu (under Transactions), click Release Materials. The system opens the Material Wizard (AM300020) form with the list of materials needed for the assembly operation.

- On the form toolbar, click Select All. The system creates the material transaction and opens it on the Materials (AM300000) form.

- In the Quantity column of each material line, specify 4. Notice that the system displays the warning that you are going to issue more materials than it is needed to produce the planned item quantity.

- In the Summary area, do the following:

- In the Description box, specify Materials for the assembly operation.

- Clear the Hold check box. The system changes the transaction's status to Balanced.

- On the form toolbar, click Release. The system releases the material transaction and changes the status of the transaction to Released.

Step 3: Recording the Labor, Produced Items, and Scrapped Items for the Assembly Operation

Suppose that Carlos Cruz, a worker in the work center, spent 30 minutes setting up the working environment for juicer assembly and assembled three juicers for one hour; one of the juicers does not work and must be recorded as scrap. To fulfill the production order, Carlos assembled one more juicer for 20 minutes. To record the time spent on juicer assembly, the assembled quantity of juicers, and the scrapped juicer, do the following:

- On the Production Order Maintenance (AM201500) form, open the production order you created earlier in this activity.

- On the More menu (under Transactions), click Create Labor Transaction. The system creates the labor transaction for the 0010 operation and opens it on the Labor (AM301000) form.

- In the table, make sure that the Scrap Action column is displayed. If the column is not displayed, add the column by using the Column Configurator dialog box.

- In the row that the system added for the 0010 operation, specify the

following settings:

- Employee ID: EP00000027 (Carlos Cruz)

- Shift: 0001

- Labor Time: 01:50

- Quantity: 3

- Enter the scrap quantity as follows:

- In the Scrap Action column, make sure that Write-Off is selected.

- In the Qty Scrapped column, type 1.

- In the Reason Code column, select SCRAP.

- In the Summary area, do the following:

- In the Date box, make sure that the today's date is specified.

- In the Description box, specify Recording the time for assembly of 3 juicers, the completed quantity, and the scrapped quantity.

- Clear the Hold check box. The system changes the transaction's status to Balanced.

- On the form toolbar, click Release. The system creates and releases the cost transaction to record the labor costs, creates and released the WIP adjustment transaction to move scrap costs to the scrap GL account, and releases the labor transaction.

Step 4: Reviewing the Production Order Balance and the GL Transaction for Scrap Cost

In this step, acting as a production accountant, you will review the balance of the completed production order. You will also review the GL transaction that the system created and released when the WIP adjustment transaction has been released. Do the following:

- On the Production Order Maintenance (AM201500) form, open the production order you created earlier in this activity.

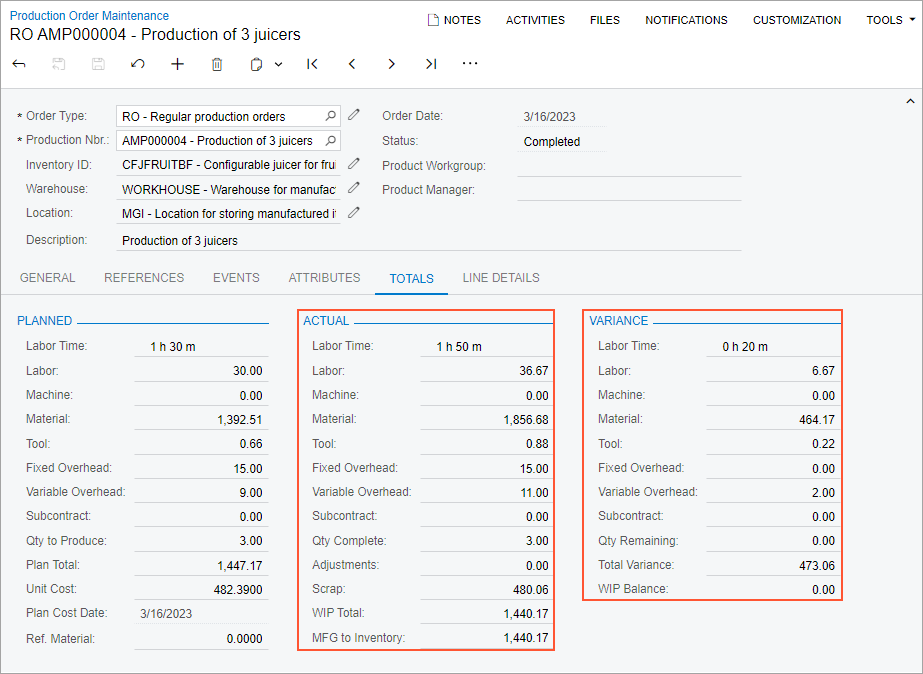

- On the Totals tab, review the production order balance as

follows (see the screenshot below):

- In the Actual section, make sure that the

following values are displayed:

- Labor Time: 1 h 50 m

- Labor: 36.67

- Material: 1856.68

- Tool: 0.88

- Fixed Overhead: 15.00

- Variable Overhead: 11.00

- Scrap: 480.06

- WIP Total: 1440.17 (which is the sum of the actual costs minus the scrap cost)

- MFG to Inventory: 1440.17

According to the Actual costing method, the system calculated the scrap cost as follows:

1920.23 (the sum of actual costs) / 4 (the sum of the completed quantity and the scrapped quantity). - In the Variance section, make sure that the

following values are displayed:

- Labor Time: 0 h 20 m

- Labor: 6.67

- Material: 464.17

- Tool: 0.22

- Variable Overhead: 2.00

- Total Variance: 473.06 (which is the sum of the variance costs)

- WIP Balance: 0.00

The variance is caused by the costs of the scrapped juicer.

Figure 1. Production order balance after the completion of the order

- In the Actual section, make sure that the

following values are displayed:

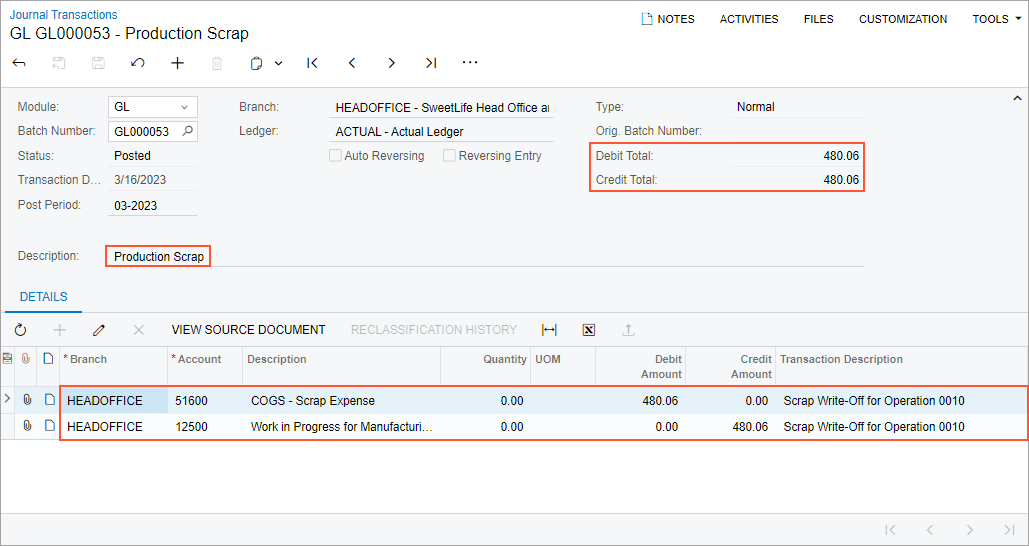

- On the Journal Transactions (GL301000) form, open the GL transaction

with the following settings:

- Module: GL

- Transaction Date: Today's date

- Description: Production Scrap

- Control Total: 480.06

- On the Details tab, make sure that the 51600 COGS -

Scrap Expense account is debited and the 12500 Work in Progress for

Manufacturing account is credited for the scrap cost.

The system created and released this transaction when the WIP adjustment transaction for the scrap cost has been released on the WIP Adjustment (AM308000) for the production order.

Figure 2. GL transaction for writing off the scrap cost

Step 5: Closing the Production Order

Now you will close the production order. Do the following:

- On the Close Production Orders (AM506000) form, select the production order.

- On the form toolbar, click Process. In the Processing dialog box, which opens, review the processing details, and when the processing is completed, click Close.

- Go to the Production Order Maintenance form, and notice that the status of the production order has changed to Closed.

You have successfully created the production order for the assembly of three juicers, processed all the transactions related to the production, recorded a scrapped item whose cost must be written off, and reviewed the costs of the production order.