Asset Migration: To Create a Partially Depreciated Asset

The following activity will walk you through the process of manually creating a partially depreciated fixed asset while migrating assets from a legacy system.

Story

The accountant of SweetLife Fruits & Jams wants to start using MYOB Acumatica for production use on 7/1/2025. Before this date, multiple fixed assets of SweetLife Fruits & Jams were maintained in the legacy system from 1/1/2024 through 6/30/2025 and data should be migrated through this date.

Acting as the SweetLife accountant, you need to migrate the existing assets with accumulated depreciation without updating the general ledger. You have decided to manually create the asset for the SweetLife office building, which has been in use since 1/1/2024. It has an acquisition cost of $117,000 and accumulated depreciation of $4,375.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Fixed Asset Management feature has been enabled.

- On the Chart of Accounts (GL202500) form, the needed GL accounts have been created.

Process Overview

In this activity, you will turn on initialization mode on the Fixed Assets Preferences (FA101000) form. On the Fixed Assets (FA303000) form, you will create a fixed asset and specify the accumulated depreciation amount for it. You will then calculate depreciation for the asset on the same form. On the Fixed Assets Preferences form, you will select the Show Accurate Depreciation check box and review the calculated depreciation amounts for the asset. Finally, you will clear the Show Accurate Depreciation check box on the Fixed Assets Preferences form.

System Preparation

Before you begin creating a partially depreciated fixed asset, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as an accountant by using the johnson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, click the Business Date menu button, and select 1/1/2024 on the calendar.

- In the company to which you are signed in, be sure that you have implemented the fixed asset functionality by performing the following prerequisite activities: Fixed Assets: To Configure the System for Fixed Asset Management, Fixed Assets: To Configure the Fixed Asset Functionality, and Fixed Assets: To Create Fixed Asset Classes.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, select the SweetLife Head Office and Wholesale Center branch.

Step 1: Turning On Initialization Mode

To turn on initialization mode, do the following:

- Open the Fixed Assets Preferences (FA101000) form.

- In the Posting Settings section, clear the Update GL check box.

- On the form toolbar, click Save.

Step 2: Creating a Fixed Asset

To create a partially depreciated fixed asset, do the following:

- On the Fixed Assets (FA303000) form, create a new record.

- In the Summary area, specify the following settings for the new asset:

- Asset ID: Inserted automatically

- Description: SweetLife office building

- Asset Class: BUILDING

- Asset Type: BUILDING (inserted automatically based on the fixed asset class)

- Useful Life, Years: 39 (inserted automatically based on the fixed asset class)

- Receipt Date: 1/1/2024

- Placed-in-Service Date: 1/1/2024

- Orig. Acquisition Cost: 117000

- Branch: HEADOFFICE

- Department: ADMIN

- On the Balance tab, specify the following settings in the

row for the FIN book:

- Last Depr. Period: 06-2025

- Accum. Depr.: 4375

- On the form toolbar, click Save to save the asset.

- On the form toolbar, click Remove Hold and then click Save to save the asset with the Active status.

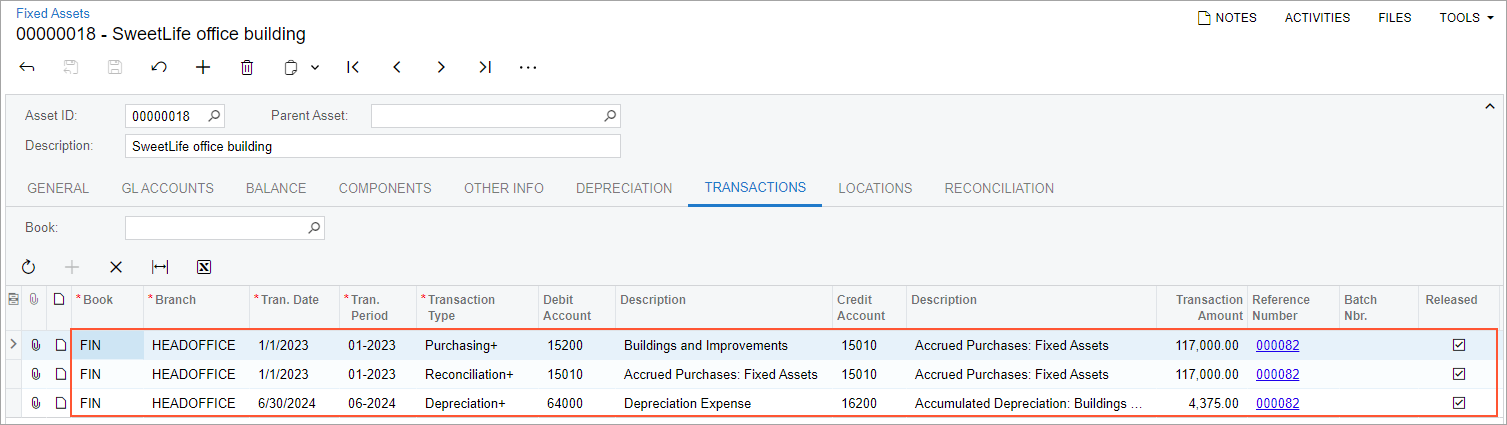

- Review the Transactions tab, which is shown in the

screenshot below.

The system has generated the Purchasing+ and Depreciation+ transactions to register the asset's acquisition cost and the accumulated depreciation amount, and the Reconciliation+ transaction to set the unreconciled cost to 0. Although the transactions are marked as released, they do not update the general ledger, so the Batch Nbr. column is empty.

Figure 1. Transactions generated for the partially depreciated asset

Step 3: Calculating Depreciation for the Fixed Asset

To calculate depreciation for the fixed asset, do the following:

- While you are still reviewing the asset on the Fixed Assets

(FA303000) form, click Calculate Depreciation on the More

menu.

The system calculates the depreciation by using the depreciation method and recovery period specified for the asset. If the entered accumulated depreciation does not equal the calculated value, the system calculates the depreciation adjustment to be posted in the first open period.

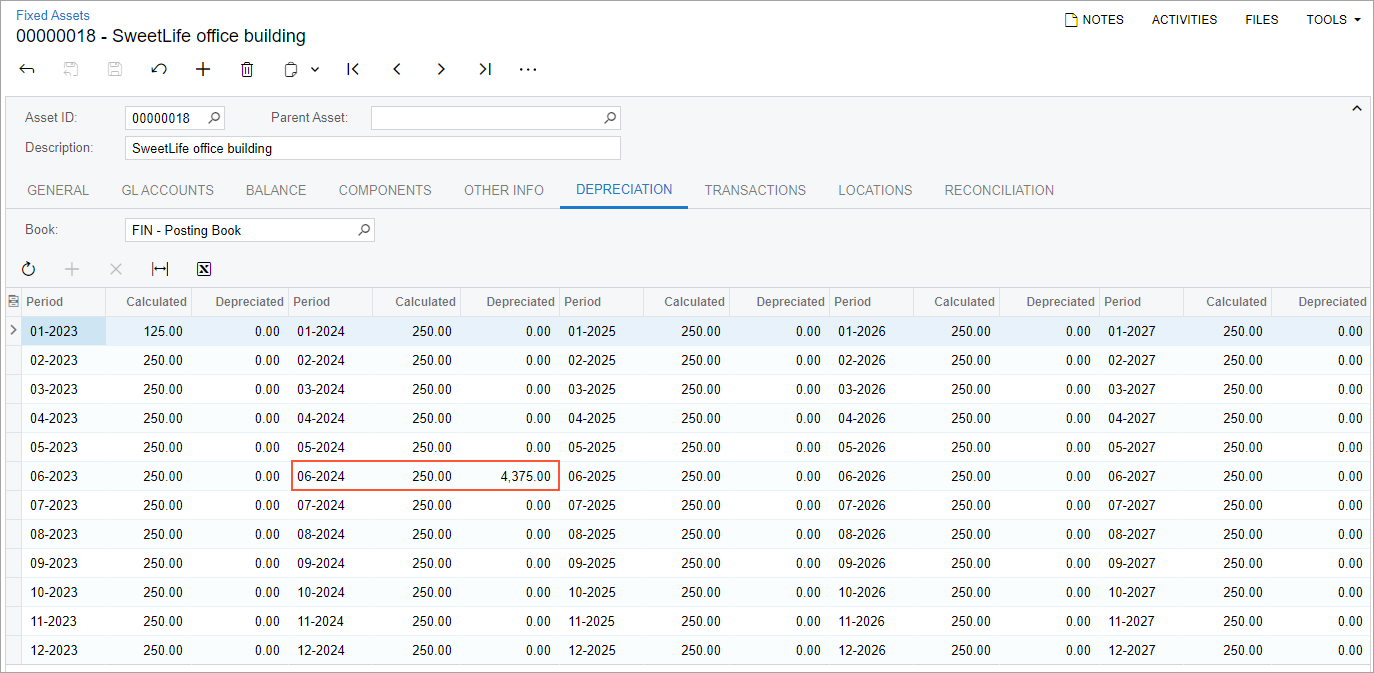

- On the Depreciation tab, select FIN in the

Book box, and review the calculated depreciation

amounts (see the screenshot below).

The Calculated column displays the calculated depreciation amounts for the periods. The total calculated depreciation for the periods from 01-2024 through 06-2025 is $4,375 ($125 + $250 * 17). The Depreciated column shows the recorded depreciation amounts. For the periods from 01-2024 through 06-2025, the recorded depreciation is $0.00. The accumulated depreciation that you have entered ($4,375) is recorded to the last depreciation period (06-2025).

Figure 2. The depreciation calculated for the partially depreciated asset

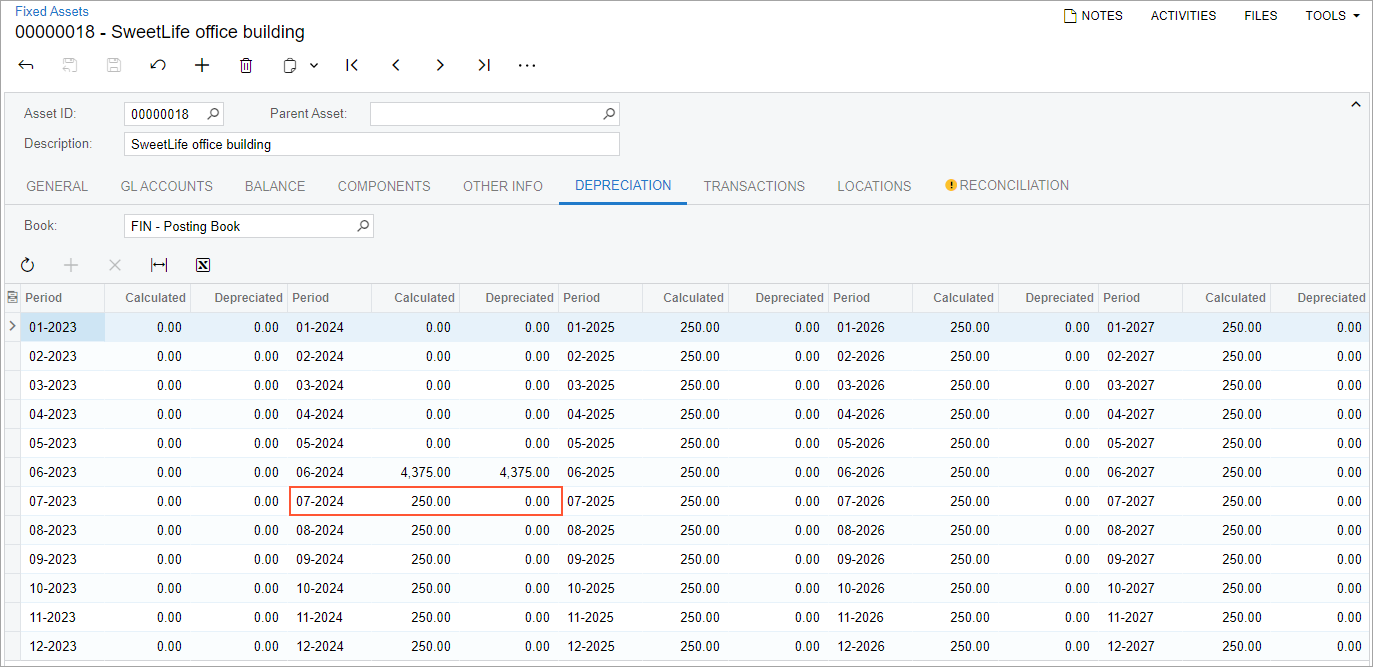

- Open the Fixed Assets Preferences (FA101000) form.

- Select the Show Accurate Depreciation check box in the

Other section, and save your changes.

When this check box is selected, on the Depreciation tab of the Fixed Assets form, the system shows the depreciation amounts recorded for the previous financial periods, along with the depreciation adjustment calculated for the current period.

- On the Fixed Assets form, open the SweetLife office

building asset, and review the Depreciation tab,

as shown in the screenshot below.

For the periods listed before the current period, in the Depreciated column, the system shows the depreciation amounts that have been recorded to the Accumulated Depreciation account for the asset: $0.00 for the periods through 05-2025, and $4,375 for the last depreciation period (06-2025). For the current period (07-2025), in the Calculated column, the system shows the calculated depreciation plus the calculated depreciation adjustment. Because the calculated depreciation amount ($4,375) is equal to the entered accumulated depreciation, no adjustment is needed for the asset in 07-2025. For the periods after the current period, in the Calculated column, the system shows the depreciation amounts calculated according to the settings of the asset. If no changes to the asset's cost are made, when the asset is depreciated, these amounts will be posted to the Accumulated Depreciation account.

Figure 3. Accurate depreciation shown for the fixed asset

- On the Fixed Assets Preferences form, clear the Show Accurate Depreciation check box, and click Save to save your changes.