Standard Pay

One of the major advantages of a computerised payroll is that it is not necessary to re-enter static information each time the payroll is processed. Each employee has a Standard Pay which represents their base payroll information including usual hours worked, pay rates, salary, allowances to be paid, deductions from the pay, PAYE, how the net pay is to be paid (cash or cheque).

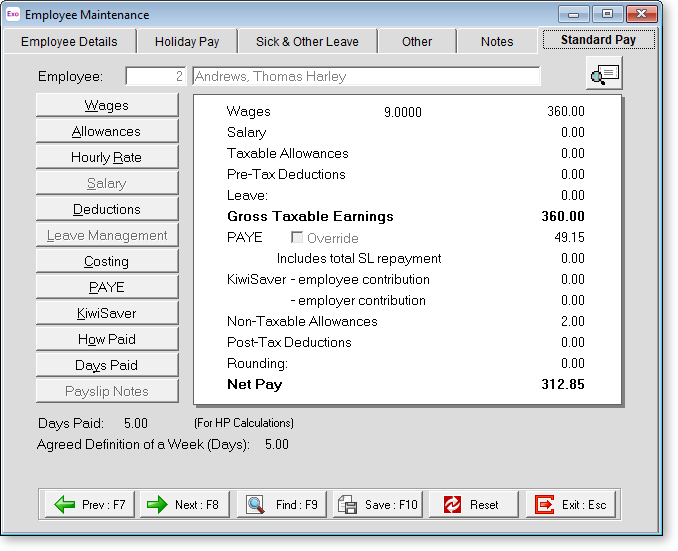

Employees' Standard Pays are set up on the Standard Pay tab of the Employee Maintenance screen.

The right side of the Standard Pay tab shows the results of all the entries as dollar values. This enables you to quickly see the actual standard pay in a similar format to a Payslip.

The following buttons are available on the left of the tab:

-

Wages - This is where the standard or default wage hours are entered. These contain as much detail as practical to make running the Current Pay as quick and easy as possible.

-

Allowances - This is where the standard or default allowances are entered. These contain as much detail as practical to make running the Current Pay as quick and easy as possible.

-

Hourly Rate - This is where the employee's standard hourly rate is entered or maintained.

-

Salary - This is where the employee's salary for their matching pay frequency is entered. This option is only enabled if the employee has been setup as Salaried in the Employee Details tab.

-

Deductions - This is where any deductions that are to be taken out of an employees pay on a regular basis are entered.

-

Leave Management - This option is not available in the Standard Pay - leave is only paid out in the Current or One-Off Pay.

-

Costing - If you wish to proportionally cost an employee's wages or salary by hours or by percentages to different cost centres then this is where it is both switched on at the employee level and set-up.

-

PAYE - If left unaltered, the computer will automatically calculate the PAYE payable on the employees' gross taxable amount, based on the tax code selected in the Employee Details Tab. If required, you do have the ability to override the PAYE with your own amounts.

-

KiwiSaver - This is where you set up an employee's KiwiSaver contributions, or opt them out of the KiwiSaver scheme.

-

How Paid - This is where we setup the way an employee's net pay is to be handled. You can setup payment by cash, cheque, direct credit or by a combination of these.

-

Days Paid / Hours Paid - For the purposes of the Standard Pay the number shown in this field is the number of days or hours that the Standard Pay represents.

-

Payslip Notes - This option is not available in the Standard Pay - it is only used in the Current or One-Off Pay.

You can click the ![]() button to generate a preview

payslip showing the employee's Standard Pay.

button to generate a preview

payslip showing the employee's Standard Pay.

If the employee's pay situation changes, you can reset the pay by clicking the Reset button at the bottom of the window. A reset operation will re-initialise all Standard Pay values to zero, set the balance of pay to Cheque, and remove all transaction lines.