Standard Pay - KiwiSaver

KiwiSaver is part of a government initiative designed to increase the level of savings by New Zealand households and support New Zealanders in retirement.

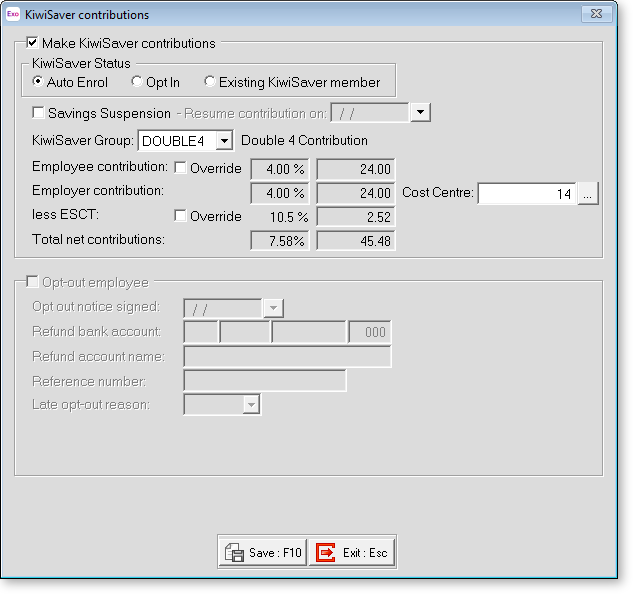

Click the KiwiSaver button on the left of the Standard Pay tab to open the KiwiSaver Contributions window:

Make KiwiSaver contributions Select this option if the employee is enrolled in a KiwiSaver scheme. If the employee chooses to opt out, deselect this option.

NOTE: If the employee was automatically enrolled in KiwiSaver, you must select the Opt out employee option and fill out the settings in that section.

KiwiSaver Group Select the KiwiSaver scheme that the employee is enrolled in. Employers may choose a KiwiSaver scheme for employees who do not select their own scheme. If the default scheme is not suitable, the list of groups can be added to by way of the KiwiSaver Groups Maintenance window.

The KiwiSaver Act 2006 gives KiwiSaver members the ability to choose their own KiwiSaver scheme and investment risk-profile, but employees will be allocated to a default scheme with a default investment product if no choice is made.

Savings Suspension Employees can cease contributions for a period by applying to Inland Revenue for a savings suspension after an initial membership period of 12 months. The suspension will be for a period of between three months and five years and can be renewed at the end of the period.

To set a savings suspension, select this option and enter the date on which the suspension will end. KiwiSaver contributions will resume when a pay is created with a Pay Period End Date on or after this date.

Employee Contribution Employees contribute at 2% (prior to 1 April 2013), 3% (after 1 April 2013), 4%, 6% (after 1 April 2019), 8% or 10% (after 1 April 2019) of gross salary or wages. The definition of gross salary or wages includes paid leave and allowances liable for superannuation. The contribution comes out of the employees pay, after PAYE, and will appear on the KiwiSaver and IR348 reports as a form of deduction. The contribution rate is derived from the KiwiSaver Group rule. To change the employee's contribution, tick the Override box and enter a new amount.

Employer Contribution From 1 April 2009, employer contributions of 2% are required. From 1 April 2013, employer contributions of 3% are required. Employers can still contribute voluntarily at a higher rate of employees' salaries. All employer contributions are liable for Employer Superannuation Contribution Tax (ESCT).

When the calendar rolls into a new financial year, you will be prompted to review your KiwiSaver Group settings.

NOTE: If the Gross-up Employer Contribution option for the employee's KiwiSaver Group is ticked, the Employer Contribution will be grossed-up to offset the ESCT amount. The name of this field changes to Employer Contribution (grossed up) to indicate that the amount displayed is the grossed-up amount.

Cost Centre Enter a Cost Centre code here to cost the employer's contribution to that Cost Centre, or leave the field blank to cost to the employee's default Cost Centre.

NOTE: The KiwiSaver Setup window contains options that affect how KiwiSaver contributions are costed to Cost Centres.

Direct cost to this code This option is available if the Mixed Proportional Costing option is enabled on the Payroll Setup Page 1 window. Selecting this option means that the employer's contribution will be costed directly to the specified Cost Centre, rather than being proportioned.

less ESCT Employer Superannuation and Employer KiwiSaver are classified as superannuation contributions, on which a tax (on schedular payments) is levied: Employer’s Superannuation Contribution Tax (ESCT). ESCT amounts are reported on the KiwiSaver, IR345, and Superannuation reports. This value is automatically calculated by the system (unless the Override option is ticked), based on the ESCT rate set up on the Employee Details tab.

This value also takes into account any ESCT exemption that may be applicable. The ESCT exemption is a historic setting which took effect from 1 July 2007 to 31 March 2011. For those historic pay periods, it is automatically calculated by the system, as follows:

A tax exemption from ESCT was available to the extent that the superannuation contribution is for an employee's KiwiSaver scheme and is not more than the Compulsory Employer Contribution to either the Complying Superannuation fund or the KiwiSaver fund (2%).

As of 1 April 2012, there is no longer a tax exemption from ESCT. All compulsory and/or voluntary Employer contributions to either the Superannuation fund or the KiwiSaver fund are fully taxable.

Total net contributions This value will be automatically calculated by the system, from the Employer's KiwiSaver contribution less ESCT, and will be displayed on the IR345, IR348, KiwiSaver, and Superannuation reports.

Opt out new employee Tick this box if the employee was automatically enrolled in KiwiSaver (i.e. if they were employed after the introduction of KiwiSaver) and they want to opt out of the KiwiSaver scheme within the Opt Out period.

Opt out notice signed Enter the date that the employee signed their New Employee Opt-Out Request form.

Refund bank account / Refund account name / Reference number Enter bank account details for the employee so that their initial contributions can be refunded.

Late opt-out reason Employees can opt out of KiwiSaver between the ends of the second and eighth weeks of their employment (i.e. between days 14 and 56). To opt out after the end of this period, the employee must send their KS10 to IRD or apply online. IRD will let you know if they’ve approved the late opt out reason and when to stop deductions and contributions. Use this dropdown to specify the reason for a late opt-out. Choose from:

- INFO – Employer didn’t provide a KiwiSaver information pack within seven days of starting employment

- IRIS – Inland Revenue didn’t send an investment statement upon allocation to a default scheme

- ERIS – Employer didn’t send an investment statement for the employer’s chosen scheme

- EVNT – Events outside of control meant that the opt-out application was unable to be submitted within the eight week time limit.

- CRIT – Employee did not meet the criteria to join KiwiSaver

- INER – Employee was incorrectly enrolled under the age of 18

- OTHR – Other explanation

When “OTHR” is selected, you must enter the reason into the Other late opt-out reason field.