Standard Pay - Deductions

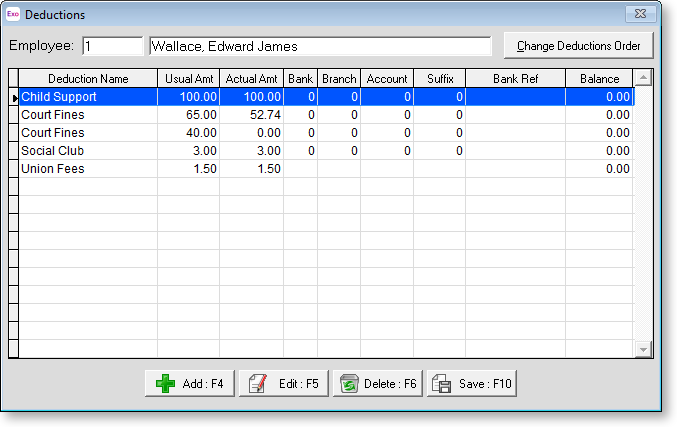

The Deductions window lets you load deductions in one-by-one to complete the deductions required for the employee's Standard Pay. To enter standard pay deductions, select the Deductions button from the Standard Pay tab. The Deductions window is then shown.

TIP: If you want to set up a new deduction or alter the structure of an existing deduction, you can press F2 to open the Maintenance menu. Choose Deductions to create the deduction without having to exit from the employee file.

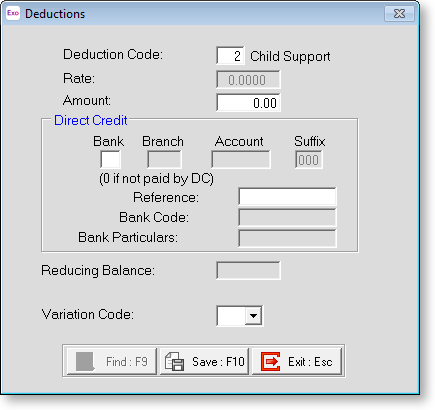

To add a new Deduction click the Add button or press F4, and the following screen will appear:

Deduction Code If you know the code for the deduction you want to add, enter it here.

If you do not know the deduction code, click Find to select it from a list. Entering a code that does not exist will cause this window to appear as well.

Rate If the deduction has a fixed rate it will appear here.

Amount This field is only available if there is a dollar value to be entered for this deduction. If there is, enter the amount required to be deducted here. This field is only able to be edited if no rate has been set up in the Deduction masterfile.

NOTE: If the deduction is a donation for payroll giving, the amount cannot exceed the employee's Net Pay.

Direct Credit If this deduction is to be direct credited to a bank account on behalf of the employee, enter the account details here.

Reducing Balance If this deduction has been setup as a Reducing Balance type deduction then this field will be enabled. Enter the opening or remaining balance here, and in the Amount field enter the dollar amount to be deducted per pay period.

NOTE: If this field is left empty then the deduction will not actually come out. The deduction will reduce this amount each pay period until it gets to zero and then it will stop deducting.

Once you have completed this screen click Save or press F10 to save and return to the Deductions screen. If further deductions are to be loaded for this employee, click Add or press F4 and repeat the process until all the deductions have been entered.

Deduction Ordering

As per IRD directions, Child Support deductions are always deducted from employees' pay first, then any deductions with the "Attachment Order" type, then any other deductions. This means that if an employee's pay is not enough to cover all deductions that have a Protected Pay Amount or Protected Pay % before the threshold is reached, the deductions will be taken from the employees pay in the order they appear on the Deductions window until the funds run out.

NOTE: If a pay contains one ore more deductions that will not be paid (or will be partially paid) due to the employee's pay not having enough funds for them, a warning icon will appear on the Deductions button on the Standard Pay and Current Pay windows.

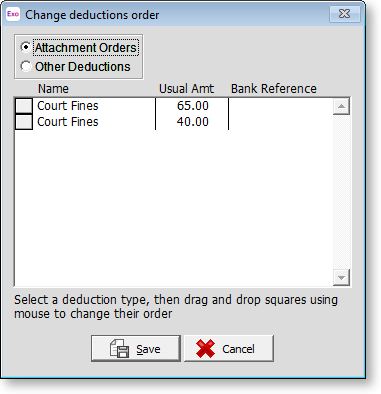

If the employee has more than one "Attachment Order" deduction, or more than one voluntary deduction of any type, a Change Deductions Order button is available on the Deductions window. Clicking this button opens a window that lets you set the order in which deductions will be deducted.

Click on the square next to a deduction and drag it up or down to change the order. Deductions are separated into attachment orders and any other deductions, as attachment order deductions are always ordered ahead of any other deductions.

NOTE: Child Support deductions do not appear on this window, as they are always ordered ahead of all other deductions.

Before making changes to the order in which deductions are made, carefully consider the employee's financial situation, and keep clear and accurate records of:

- Notices of assessment for child support

- Attachment Orders as per the District Court Act 2016

- Notices to deduct amounts owed to Inland Revenue

- Notices to deduct amounts for WINZ purposes

- Other Voluntary deductions, e.g. for repayment of loans that you have made to your employees

- Other after-tax disbursements made using the How Paid window, i.e. amounts that are already being direct-credited to specific accounts partially or fully, in a pre-configured priority order.

Setting up deductions in the Standard Pay correctly will save time and effort when creating Current and/or One-Off pays in the future.