Standard Pay - Allowances

This is where all the Standard Pay allowances are entered, both taxable and non-taxable. Allowances entered here do not have to have quantities giving dollar values. These quantities can be added in the Current Pay, so allowances entered here can signify just the ability to be paid an allowance thus saving time when doing a Current Pay.

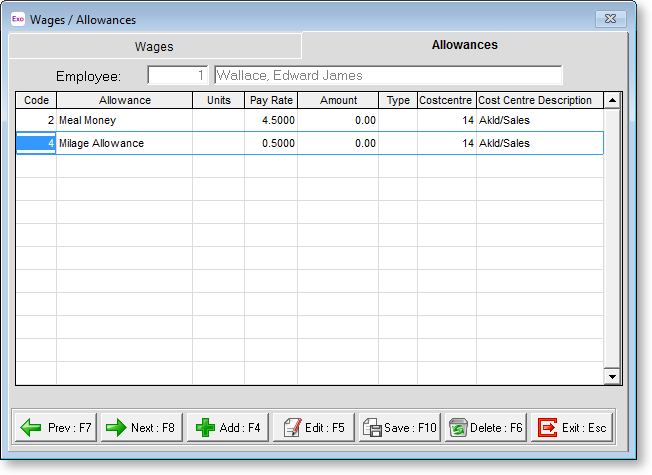

To add an allowance for an employee click on the Allowances button on the Standard Pay window. This will launch the Allowances Tab screen.

This screen is where an employee's standard Allowances are entered. It displays the allowance code, the description, the units quantity, the rate, the amount and the type.

If no allowances are entered here in the Standard Pay, then every time a pay is created, the employees allowances to be paid will have to be entered. We recommend that you enter at least the employees basic allowances or allowances they could receive from time to time, as this speeds up payroll processing on pay day, as the Standard Pay is copied and becomes the Current Pay. Therefore on payday you will only need to alter the allowances if they vary from the Standard Pay.

To alter the allowance contained in any wages line, double click on the line concerned and edit the required units/rate or highlight the line concerned and click Edit.

To manually add new allowances, press F4 or click Add.

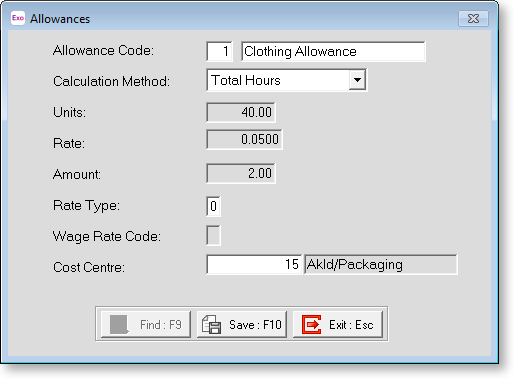

Allowance Code If you know the code for the allowance you want to add, enter it here.

If you do not know the allowance code, click Find to select it from a list. Entering a code that does not exist will cause this window to appear as well.

TIP: If you want to set up a completely new allowance or alter the structure of an existing allowance, press F2 to open the Maintenance menu. Choose Allowances to create the allowance without having to exit from the employee file.

Calculation Method This shows the method of calculation for this particular allowance, as set up on the Allowance Maintenance window.

Units Enter the number of units (number of times) that you would like this allowance to be paid. You can leave the number of units blank so that there is no amount to be paid carried in to the Current Pay, and then enter the number of units while doing the Current Pay. This field is not available for Allowances that are calculated automatically on the number of hours an employee works.

Rate Enter the rate this allowance is to paid at if there is not a default rate. This can be used as a fixed amount or a rate per unit.

Amount This is a self-calculating field.

Rate Type This field is only available if the calculation method is "Hourly Rate". Enter which pay rate type you wish to use, based on the numbers 1 through 9 in the Setup Payroll. Normally 1 means ordinary time, 2 means a form of overtime etc. Leaving this field blank will mean the Ordinary Hourly Rate is used.

Wage Rate Code Where you are using Multiple Hourly Rates this field represents the "Code" or number of the rate that is being used.

Cost Centre Use this field to enter the cost centre number if it is different from the employee's default cost centre.

Cost Centre Description This is the Cost Centre Name or Description for this Cost Centre.

Direct cost to this code This option is available if the Mixed Proportional Costing option is enabled on the Payroll Setup Page 1 window. Selecting this option means that this allowance will be costed directly to the employee's default cost centre, rather than being proportioned.