Standard Pay - PAYE

There is a provision in the Standard Pay to override the PAYE calculated by the program to meet any special needs of the employee. This function is not normally used.

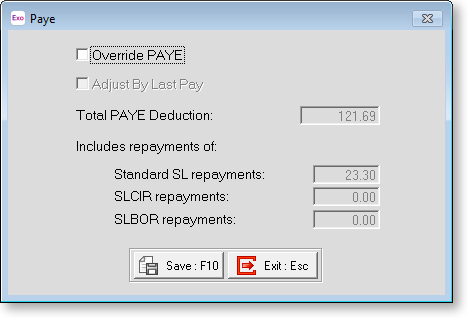

Click the PAYE button on the left of the Standard Pay tab to open the PAYE window:

Override PAYE Click on this checkbox to turn the override on.

NOTE: If your organisation uses payroll giving, overriding an employee's PAYE means that they will not receive a payroll giving tax credit.

Adjust By Last Pay This option is only accessible via a One-Off Pay. If this option is disabled (the default setting), the One-Off gross taxable earnings will be taxed according to the appropriate tax tables for that employee's tax code and pay frequency.

If this option is enabled, the gross taxable earnings for the last 2 pays (inclusive of the One-Off Pay and previous Current Pay) are combined. Then, Exo Payroll ascertains the correct amount of PAYE on the combined gross earnings. The combined PAYE is then subtracted from the current pay PAYE, with the remainder of PAYE to pay being declared as the One-Off Pay PAYE.

You would enable this option if you are doing a correction for a previous current pay period, usually in the case of an underpayment, and you want the one off pay earnings taxed as if it were paid in the last current pay.

Total PAYE Deduction Enter the amount to deduct. This field is only available if you selected the Override PAYE option.

Includes repayments of If the employee is on a student loan repayment scheme, you can also enter a new repayment amount when the Override PAYE option is selected. The amounts of additional Student Loans repayments made under the SLCIR and SLBOR tax codes are also displayed.

Click Save or press F10 to save and return to the Standard Pay screen.