Expense Receipts with Corporate Cards: General Information

MYOB Acumatica supports the use of corporate credit cards on the Expense Claim (EP301000) and Expense Receipt (EP301020) forms. This helps employees to categorize and track the expenses, including the expenses related to a project. For example, while in the field, your employees can buy something that they want to charge on a project and pay for it with a corporate card. Employees can still have out-of-pocket expenses that are reimbursed through the standard process.

Learning Objectives

In this chapter, you will learn how to do the following:

- Create a GL account, cash account, and payment method for a corporate credit card

- Create a corporate credit card in the system

- Create an expense receipt for company's expenses paid by the corporate credit card

- Process an expense claim for the expense receipt paid with the corporate credit card

- Process personal expenses paid with the corporate credit card

- Process company's expenses paid with a personal account

Applicable Scenarios

You process an expense receipt with a corporate credit card if you are an employee who wants to record expenses paid by a company credit card.

You process an expense claim for expense receipts, including receipts paid with corporate credit cards, if you are an accountant who wants to process the recorded expenses.

Configuration of Corporate Cards

You configure corporate credit cards on the Corporate Cards (CA202500) form. You enter the card number for matching transactions on a bank statement. Multiple employees can use a single corporate card; you add these employees to the table on the form.

In order to create corporate cards on the Corporate Cards form, GL accounts, cash accounts, payment methods, and employees must be configured as described below.

- The Clearing Account check box is cleared.

- The Restrict Visibility with Branch check box is cleared.

- The Use for Corporate Cards check box is selected.

- Only one payment method can be associated with the cash account.

- Optionally, the Requires Reconciliation check box is selected; if it is, a numbering sequence must be specified in the Reconciliation Numbering Sequence box. The predefined CARECON numbering sequence can be selected.

- The cash account must be associated with the same branch as the corporate card.

Although the cash account that is used for a corporate card must have only one associated payment method, this payment method can be selected for multiple cash accounts. If a payment method is selected for a cash account that is used for a corporate card, in the Summary area of the Payment Methods (CA204000) form, the Use in AP check box is selected. Also, on the Settings for Use in AP tab of the form, this payment method should have the following settings:

- Not Required (Additional Processing section): Selected

- Require Unique Payment Ref. (Payment Settings section): Cleared

If the card currency differs from the currency of an employee who uses the corporate card, for this employee, the Enable Currency Override and Enable Rate Override check boxes must be selected on the General Info tab (Employee Settings section) of the Employees (EP203000) form. (This section of the form also contains the Currency ID box, where the employee currency is specified.)

Payment of Expense Receipts with Corporate Cards

On the Expense Receipt (EP301020) form, you create expense receipts to the employee that is associated with your user. You can also create expense receipts for any subordinates of that employee. In the Paid With box (in the Expense Details section of the Details tab), you select how the expense receipt has been paid. The following options are available:

- Personal Account: The company's expenses that the employee paid with his or her own funds and the company will need to reimburse this amount to you. This is the default option if the employee has no active corporate card assigned.

- Corporate Card, Company Expense: The company's expenses that are paid with a corporate card. This is the default option if the employee has an active corporate card assigned.

- Corporate Card, Personal Expense: The employee's personal expenses that are paid with a corporate card.

In the Corporate Card box, you select a corporate card associated with the employee. The default corporate card, if any, is selected as follows:

- The corporate card used in the employee's most recent expense receipt is selected, if it is available. The most recent receipt is determined by the receipt's creation date.

- If the corporate card that was used most recently is unavailable—that is, inactive, deleted, or no longer assigned to the employee—the employee's only active card or the first active card the system finds for the employee. The first corporate card is the first card in the employee's card list; this list is sorted alphabetically by name.

Corporate card expenses cannot be split. That is, on the Expense Receipt form, in the Expense Details section of the Details tab, the Employee Part of an expense receipt paid with a corporate card must be zero.

In the Ref. Nbr. box, you enter the reference number that usually matches the number of the original receipt.

Claiming of Expense Receipts Paid with Corporate Cards

On the Expense Claim (EP301000) form, you can claim with a single expense claim all the employee's expense receipts paid with corporate cards as long as they have the same card currency. Each expense claim line on the Details tab refers to an expense receipt. If you create a new expense claim line on the form that does not originate from any expense receipt, on release of the expense claim, the system creates the corresponding expense receipt for that expense claim line.

On release of an expense claim, the system creates documents as follows for the expense claim lines, depending on the value in the Paid With column:

- Personal Account: A single AP bill is created on the Bills and Adjustments (AP301000) form for all the expense claim lines with positive amounts and a single AP debit adjustment is created on the same form for all the expense claim lines with opposite amounts.

- Corporate Card, Company Expense: A cash purchase is created on the Cash Purchases (AP304000) form for each expense claim line if

the Post Summarized Company Expenses by Corporate Card check box is

cleared on the General tab of the Time and Expenses Preferences (EP101000) form.

If the Post Summarized Company Expenses by Corporate Card check box is selected, the system creates a separate cash purchase for each group of the expense claim lines with the same date, corporate card, and reference number.

- Corporate Card, Personal Expense: A single AP debit adjustment is created on the Bills and Adjustments form for all the expense claim lines.

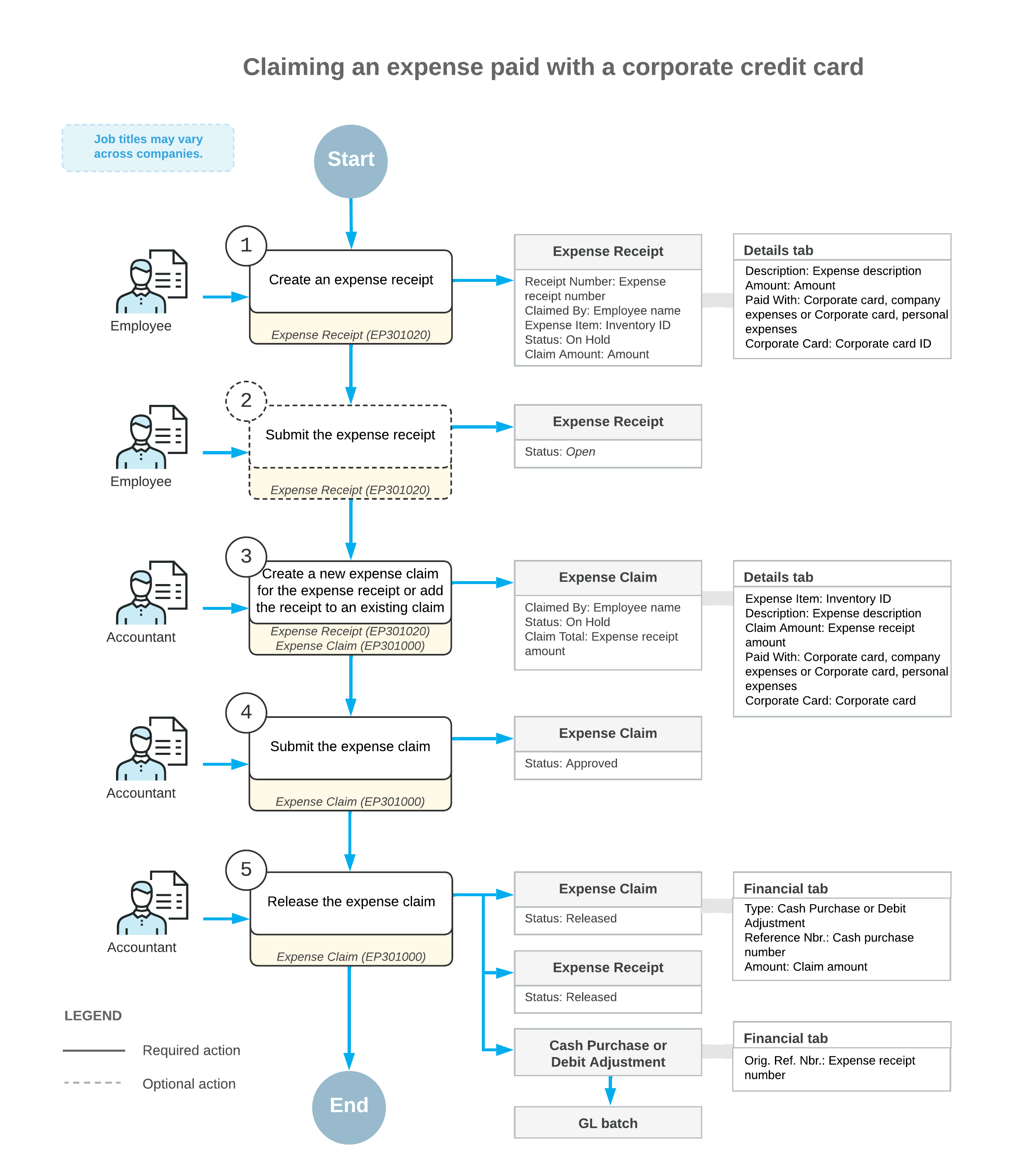

Workflow of Claiming Expenses Paid with Corporate Cards

The following diagram illustrates the workflow of an employee claiming an expense paid with a corporate credit card.