Exception Certificate Management: Configuration Workflow

Before you start to add customers to the Avalara exception certificate management (ECM) account and request exempt certificates for them, you should be sure that the needed feature has been enabled in MYOB Acumatica, settings have been specified, and entities have been configured, as described in the following sections of this topic.

Configuring the Integration with the Avalara ECM Provider

To configure the Avalara exemption certificate management in MYOB Acumatica, you perform the following general steps:

- You enable the Exemption Certificate Management feature on the Enable/Disable Features (CS100000) form.

- You configure the Avalara ECM provider on the Tax Providers (TX102000) form.

- You specify the Avalara ECM provider in the ECM Provider box on the Tax Preferences (TX103000) form.

These steps are described in detail in the following sections of this topic.

Once all the listed steps are completed, you can add the MYOB Acumatica tax-exempt customers to the ECM provider account and request the exemption certificates from the customers. For details, see Exception Certificate Management: General Information.

Enabling the Exemption Certificate Management Feature

On the Enable/Disable Features (CS100000) form, the Exemption Certificate Management feature should be enabled. To enable the feature, you click Modify on the form toolbar and then select the Exemption Certificate Management check box, which is located under External Tax Calculation Integration in the Third-Party Integrations group of features. On the form toolbar, you click Enable.

Once the Exemption Certificate Management feature is enabled, all UI elements related to the exemption certificate management become available for users with the appropriate access rights, such as Admin, Acumatica Support, TX Admin, AR Admin, and AR Clerk.

Configuring the Tax Provider

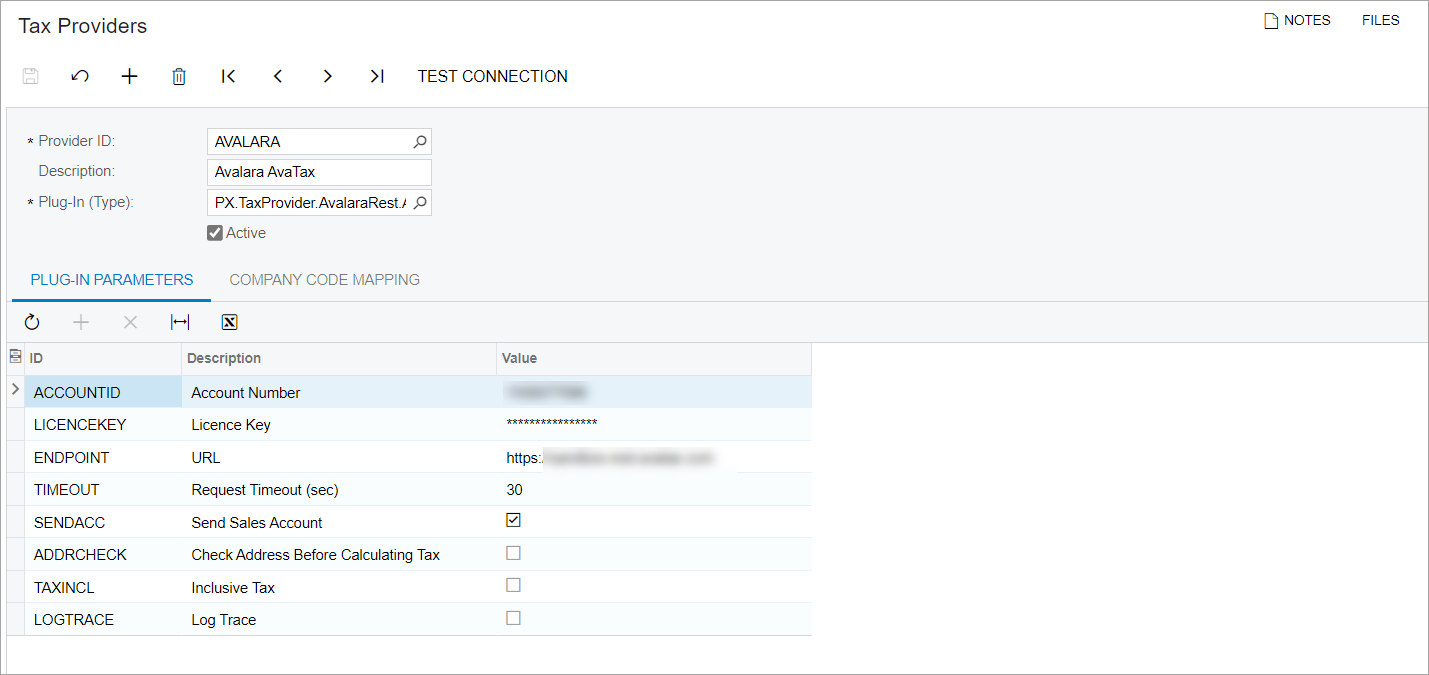

On the Tax Providers (TX102000) form, the Avalara tax provider has to be configured, as shown in the following screenshot. See Setup of Online Integration with Avalara AvaTax for information about how to perform this configuration.

In the Summary area of the form, in the Plug-In (Type) box, the PX.TaxProvider.AvalaraRest.AvalaraRestTaxProvider plug-in type should be selected for the Avalara ECM tax providers.

Specifying the ECM Tax Provider in Acumatica ERP

On the Tax Preferences (TX103000) form, the Avalara ECM tax provider should be specified in the ECM Provider box of the ECM Settings section.