Expense Receipts with Corporate Cards: To Claim Expenses for a Project

This activity will walk you through the process of creating and processing expense receipts with corporate cards.

Story

Suppose that the West BBQ Restaurant customer ordered the installation service for previously bought juicers from the SweetLife Fruits & Jams company. The project accountant of SweetLife created a project to account for the provided services.

Jon Waite, a SweetLife employee, worked in the customer's restaurant installing a juicer on January 29, 2025, and realized that there was not enough electric cable. Jon went to a construction store and bought 20 meters of electric cable for $27, which he paid for with a company corporate card. He also bought a cup of coffee in a cafe near the store and paid $6 for it by using the same corporate credit card. Then Jon took a taxi, for which he paid $10 in cash, to return to SweetLife. The next day, January 30, another SweetLife employee, Alberto Jimenez, went to a meeting with the customer to discuss the project. He took a taxi and paid $25 by using a corporate card.

Acting as Jon Waite, you will enter all related expenses into the system and file a claim for the reimbursement of expenses.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- The Expense Management feature has been enabled on the Enable/Disable Features (CS100000) form.

- On the Projects (PM301000) form, the WESTBBQ7 project has been created, and the INSTALL project task has been created for the project and specified as the default task. The cost budget of the project includes a single line with 12 hours of installation.

- On the Non-Stock Items (IN202000) form, the CABLE, MEAL, and TAXI non-stock items with the Expense type have been created.

- On the Employees (EP203000) form, the accounts for Jon Waite and Alberto Jimenez have been created.

Process Overview

First, you will create an expense receipt for Jon Waite paying for electric cable on the Expense Receipts (EP301010) form. You then will create an expense claim, which will also include expenses for the taxi and coffee, on the Expense Claim (EP301000) form. As the last step, you will create the second expense receipt, for Alberto Jimenez paying for the taxi, on the Expense Receipts form.

System Preparation

To sign in to the system and prepare to perform the instructions of the activity, do the following:

- As a prerequisite activity, create a corporate card as described in Corporate Cards: To Configure a Corporate Card.

- Launch the MYOB Acumatica website, and sign in as Jon Waite by using the waite username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/29/2025. If a different date is displayed, click the Business Date menu button, and select 1/29/2025 from the calendar. For simplicity, in this activity, you will create and process all documents in the system during this business date.

Step 1: Creating the First Expense Receipt

To create an expense receipt to enter the purchase of electric cable, do the following:

- Open the Expense Receipts (EP301010) form.

- On the form toolbar, click Add New Record. The system opens the Expense Receipt (EP301020) form.

- In the Summary area, select CABLE in the Expense Item box.

- Make sure that the expense date is 1/29/2025 and EP00000003 - Jon Waite is selected in the Claimed by box.

- On the Details tab, specify the following settings:

- Description: Electric cable

- Unit Cost: 27.00

- Project/Contract: WESTBBQ7

- Project Task: INSTALL (inserted automatically)

- Cost Code: 00-000

- Paid With: Corporate Card, Company Expense

- Corporate Card: 000001 - USD Corporate Card (inserted automatically)

- Save the receipt, and notice that it has the Open status.

Step 2: Processing an Expense Claim for the Expense Receipt

To claim the expense receipt you have created, along with the cost of coffee and a taxi, do the following:

- While you are still viewing the expense receipt on the Expense Receipt (EP301020)

form, on the form toolbar, click Claim.

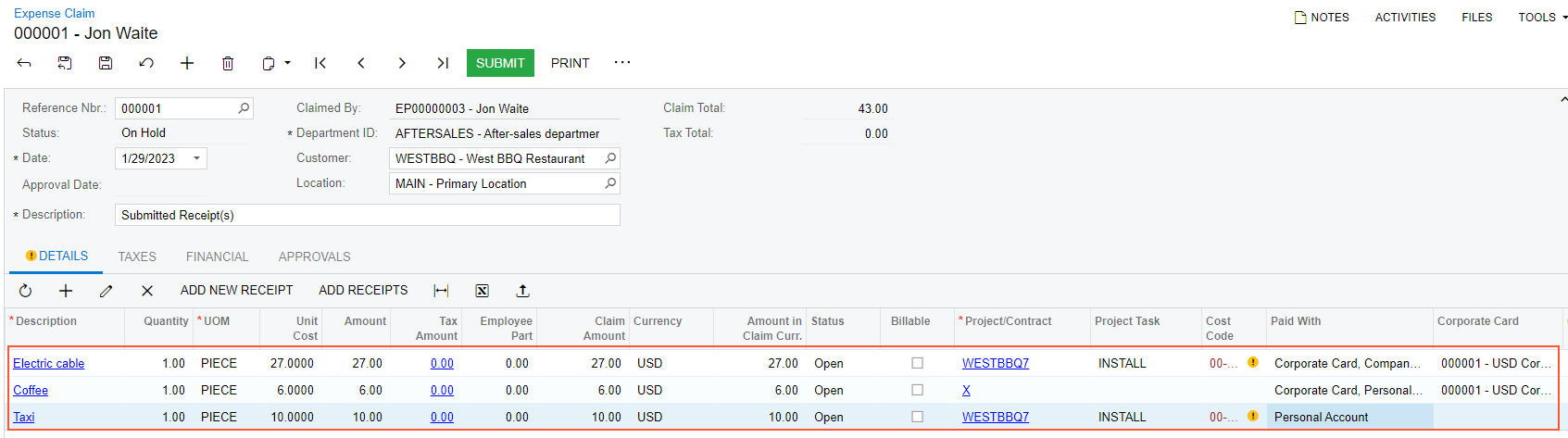

The Expense Claim (EP301000) form opens. On the Details tab, notice the line for the electric cable.

- On the table toolbar of the Details tab, click

Add Row, and specify the following settings in the

new row (see the screenshot below):

- Date: 1/29/2025

- Expense Item: MEAL

- Description: Coffee

- Quantity: 1

- Unit Cost: 6

- Paid With: Corporate Card, Personal

Expense

Notice that when you select Corporate Card, Personal Expense in the Paid With column, the system automatically populates the Project/Contract column with the non-project code (X) and clears the Project Task, Cost Code, Customer, and Location columns.

- Corporate Card: 000001 - USD Corporate Card (inserted automatically)

- Click Add Row, and specify the following settings in the

new row:

- Date: 1/29/2025

- Expense Item: TAXI

- Description: Taxi

- Quantity: 1

- Unit Cost: 10

- Project/Contract: WESTBBQ7

- Project Task: INSTALL (inserted automatically)

- Cost Code: 00-000

- Paid With: Personal Account

Figure 1. The expenses to be claimed

- In the Summary area, make sure that the claim total is $43.

- Save the expense claim.

- On the form toolbar, click Submit.

The system assigns the Approved status to the claim.

- On the form toolbar, click Release.

The system assigns the Released status to the claim.

In the Link to AP table on the Financial tab, review the documents that the system has generated for the claim: a $27 cash purchase for the cable, a $6 debit adjustment for the coffee, and a $10 bill for the taxi.

Step 3: Creating the Second Expense Receipt

To create an expense receipt to enter the amount spent on the taxi by Alberto Jimenez, do the following:

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, set the business date to 1/30/2025.

- Open the Expense Receipts

(EP301010) form, and on the form toolbar, click Add New

Record.

The system opens the Expense Receipt (EP301020) form.

- In the Summary area, specify the following settings:

- Expense Item: TAXI

- Claimed by: EP00000004 - Alberto Jimenez

- On the Details tab, specify the following settings:

- Description: Taxi to the customer's site

- Unit Cost: 25.00

- Project/Contract: WESTBBQ7

- Project Task: INSTALL (inserted by default)

- Cost Code: 00-000

- Paid With: Corporate Card, Company Expense

- Corporate Card: 000001 - USD Corporate Card (inserted automatically)

- Save the expense receipt.

- On the Projects (PM301000) form, open the WESTBBQ7

project.

On the Cost Budget tab, notice that the following lines have been added to the budget when the expense claim that you have processed in this activity has been released. (Alberto Jimenez's expenses on the taxi have not been recorded to the project budget because these expenses have not been claimed yet.)

- The line with the CABLE item has an actual amount of 27.00

- The line with the TAXI item has an actual amount of 10.00

You have recorded corporate card expenses to the project budget.