Project Transactions: Process Activity

This activity will walk you through the process of creating project transactions from general ledger transactions and from scratch.

Story

Suppose that the Thai Food Restaurant customer has ordered training from the SweetLife Fruits & Jams company on how to use a juicer the company previously bought. Based on the agreement with the customer, SweetLife’s project accountant has created a project and has created the following tasks corresponding to the phases of training:

- PHASE1: Training is going to be provided within this task and is subject to billing. Any additional expenses incurred during the completion of this task will not be billed.

- PHASE2: If additional training is required after the initial training in the first task, it will be provided within this task and will not be billed.

In the first phase, a consultant has provided eight hours of training and spent $50 on a taxi. Then the customer requested additional training, and the consultant has provided four extra hours of training in the second phase.

Acting as the project accountant, you need to enter the general ledger transactions to directly capture the costs involved with delivering the first phase of training. The Thai Food Restaurant company covers travel expenses, so they should not affect the project budget. Then you need to enter the project transaction to capture the costs involved with delivering the second phase of training, but the costs should not affect the general ledger.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Project Accounting feature has been enabled to provide support for the project accounting functionality.

- On the Projects (PM301000) form, the TOMYUM1 project for the TOMYUM (Thai Food Restaurant) customer has been created, and the PHASE1 and PHASE2 project tasks have been created for the project.

- On the Account Groups (PM201000) form, the LABOR account group has been created. The 54100 (Project Labor Expense) account has been mapped to the account group.

- On the Non-Stock Items (IN202000) form, the TRAINING non-stock item has been configured. The 54100 (Project Labor Expense) account has been specified as the expense account of the item.

Process Overview

On the Journal Transactions (GL301000) form, you will create a batch of general ledger transactions with the project and project task specified to record the work related to the first phase of the training. You will release the batch, which will generate the corresponding project transaction. Then you will review this transaction on the Project Transaction Details (PM401000) form. Finally, on the Project Transactions (PM304000) form, you will create and release a batch of project transactions that represents the second phase of the training and does not affect the general ledger.

System Preparation

To sign in to the system and prepare to perform the instructions of the activity, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. You should sign in as Pam Brawner by using the brawner username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Creating General Ledger Transactions

To create a batch of general ledger transactions to represent the first phase of the training (the PHASE1 task), do the following:

- On the Journal Transactions (GL301000) form, add a new record.

- In the Summary area, make sure GL is selected as the Module.

- In the Description box, type A training session for the TOMYUM1 project.

- On the table toolbar, click Add Row to add the first row,

which represents your training expenses within the first phase of the project,

and specify the following settings in the row:

- Account: 54100 (Project Labor Expense)

- Project/Contract: TOMYUM1

- Project Task: PHASE1

- Cost Code: 00-000 (inserted automatically)

- Debit Amount: 320

- Transaction Description: 8 hours of training for the customer's employee

- Add the second row, which represents the non-project (travel) expenses, and

specify the following settings in the row:

- Account: 81000 (Other Expenses)

- Project: X (inserted automatically)

This transaction will not affect the project budget of the TOMYUM1 project.

- Cost Code: 00-000 (inserted automatically)

- Debit Amount: 50

- Credit Amount: 0

- Transaction Description: Travel expenses

- Add the third row, which balances the batch of transactions, and specify the

following settings in the row:

- Account: 23015 (Accrued Expenses)

- Project: X (inserted automatically)

- Cost Code: 00-000 (inserted automatically)

- Credit Amount: 370 (inserted automatically)

- Transaction Description: Project and travel expenses

- On the form toolbar, click Remove Hold to assign the

general ledger transaction the Balanced status, and then click

Release.

When you release the general ledger transaction, for the row with the specified project and project task, the system creates the corresponding project transaction. In the created project transaction, the system specifies the account group to which the account in the transaction row is mapped.

- On the Project Transaction Details (PM401000) form, in the Selection area,

select TOMYUM1 as the Project. Make sure that the

Account Group and Project Task

boxes are cleared. In the table, review the project transaction that has been

created based on the GL transaction that you have processed earlier. Notice the

following:

- The system has created only one project transaction because only one row of the general ledger transaction has the specified project and project task.

- The reference number of the corresponding batch of general ledger transactions is shown in the GL Batch Nbr. column.

- The Debit Account is 54100 (Project Labor Expense).

- The Debit Account Group of the project

transaction is LABOR.

The system selected the LABOR account group as the debit account group of the transaction because the 54100 (Project Labor Expense) account is mapped to this account group.

- The Credit Account and Credit Account Group columns are empty in the row.

Step 2: Creating a Project Transaction Without Posting to the General Ledger

To create a project transaction that does not affect the general ledger and represents the training expenses within the second phase of the training (the PHASE2 task), do the following:

- On the Project Transactions (PM304000) form, create a new record.

- In the Summary area, make sure PM is selected as the Module.

- Enter A 4-hour training session as the Description.

- In the table on the Details tab, add a new row, and

specify the following settings:

- Project: TOMYUM1

- Project Task: PHASE2

- Cost Code: 00-000

- Account Group: LABOR

- Inventory ID: TRAINING

- Quantity: 4

- Billable: Cleared

- Amount: 160

You leave the Debit Account and Credit Account columns empty, so that the corresponding general ledger transaction will not be created. The system also will not use this transaction for billing because you cleared the Billable check box in the line.

- On the form toolbar, click Save and then

Release to save your changes to the project

transaction and release it.

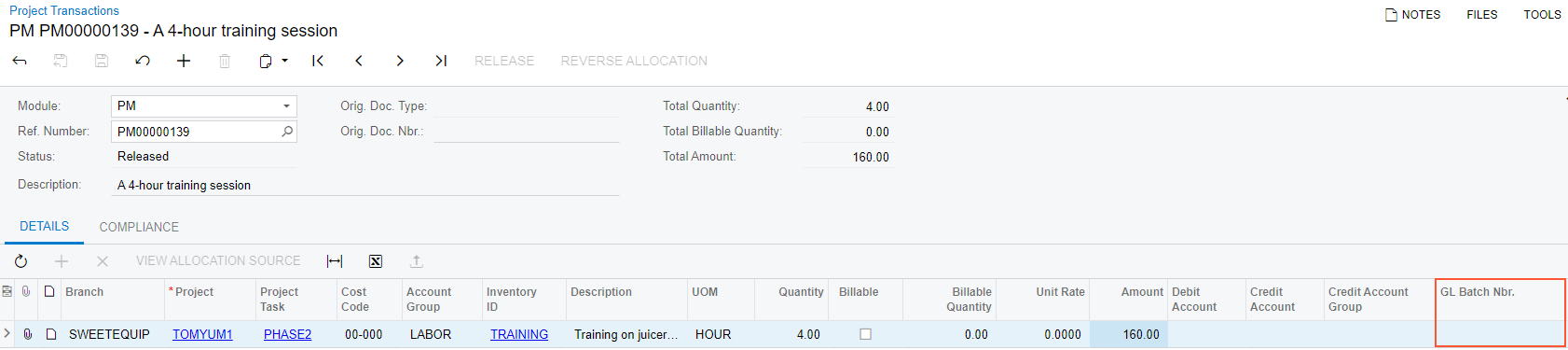

Notice that the GL Batch Nbr. column is empty, as shown in the following screenshot, indicating that no corresponding general ledger transaction has been created.

Figure 1. The project transaction that produces no GL transaction

- On the Projects (PM301000) form, open the TOMYUM1

project, and on the Cost Budget tab, notice that the cost

budget now includes two budget lines:

- The line with the PHASE1 project task and the <N/A> inventory item that has been added to the budget based on the project transaction created on release of the general ledger transaction. This line will be included in the next billing.

- The line with the PHASE2 project task and the TRAINING inventory item that has been added to the budget based on the project transaction that you created and released. This line will not be billed.

The actual values in both lines have been updated based on the project transactions that you have processed.

You have captured the costs for the project.