Billing Rates: To Bill a Project with Different Billing Rates

In this activity, you will bill a project with different billing rates to be used for the billing of different services provided in the project.

Story

Suppose that the Thai Food Restaurant customer has bought a juicer from the SweetLife Fruits & Jams company and ordered employee training from the company on how to use the juicer. SweetLife's project accountant, Pam Brawner, has created a project to account for the provided services. The training has taken place.

Acting as the project accountant, you need to bill the customer for the different services provided for the project with different billing rates.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Project Accounting feature has been enabled to provide the project accounting functionality.

- On the Rate Tables (PM206000) form, the STANDARD rate table, with rates for labor and materials, has been configured.

- On the Billing Rules (PM207000) form, the TIMEMATERIAL billing rule has been created. The billing rule includes the steps that have been configured for billing project transactions related to different account groups. (For an example of billing rule configuration, see Billing Rates: To Create a Billing Rule with Rates.)

- On the Customers (AR303000) form, the TOMYUM customer has been defined.

- On the Non-Stock Items (IN202000) form, the INSTALL, JUICER15, SITEREVIEW and TRAINING non-stock items have been created.

- On the Projects (PM301000) form, the TOMYUM3 project for the TOMYUM customer has been created. On the Tasks tab of this form, the PHASE1 and PHASE2 project tasks has been configured and the TIMEMATERIAL billing rule and the STANDARD rate table are assigned to these project tasks. In the project, the Create Pro Forma Invoice on Billing check box is selected to indicate that when project billing is run, pro forma invoices are generated to be sent to the customer for acceptance before the accounts receivable invoices are prepared.

- On the Project Transactions (PM304000) form, the PM00000002 project transaction related to the project has been created and released in preparation for billing.

Process Overview

You will bill the project on the Projects (PM301000) form and review the pro forma invoice amounts on the Pro Forma Invoices (PM307000) form.

System Preparation

Before you begin performing the steps of this activity, you need to perform the following instructions to prepare the system:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. You should sign in as Pam Brawner by using the brawner username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Billing the Project and Processing the Related Documents

To bill the project by using the time and material billing rule, do the following:

- Open the Project Transaction Details (PM401000) form.

- In the Selection area of the form, select TOMYUM3 as the

Project, and make sure that the other boxes are

cleared. The table lists the related project transactions:

- The line with the INSTALL item in the amount of $320

- The line with the JUICER15 item in the amount of $2000

- The line with the SITEREVIEW item in the amount of $80

- The line with the TRAINING item in the amount of $320

Notice that in all lines, the Billable check box is selected and the Billed check box is cleared, indicating that the project is pending billing.

- On the Projects (PM301000) form, open the TOMYUM3 project. Notice that the Actual Expenses box in the Summary area shows $2,720 (which is the total of the processed project transactions), while Actual Income box contains 0 because the project has not been billed yet.

- On the form toolbar, click Run Billing. The system

creates a pro forma invoice and opens it on the Pro Forma Invoices (PM307000) form. On the

Time and Material tab of this form, review the four

lines of the pro forma invoice (which have been created based on unbilled

transactions).

In each line, the system calculates Billed Quantity and Billed Amount by using the formula specified in the corresponding step of the billing rule. The following lines have been added to the pro forma invoice:

- The INSTALL and TRAINING lines have been billed by the 20 – Labor from non-stock price step, which has been configured for the LABOR account group; the billed amount for each line has been calculated based on the @Rate parameter defined in the STANDARD rate table for the LABOR rate type (which is 1.25). The calculated billing amount is $400 (320*1.25) for both lines.

- The JUICER15 line has been billed by the 10 – Material cost plus markup step, which has been configured for the MATERIAL account group; the billed amount has been calculated based on the billable quantity (1) and the @Price parameter (which is the sales price of the JUICER15 item, $2500). The calculated billing amount is $2500.

- The SITEREVIEW line has been billed by the 30 – Re-invoice subcontractors step, which has been configured for the SUBCON account group; the billed amount has been calculated by multiplying the transaction amount by the fixed coefficient (1.25). The calculated billing amount is $100 (1.25 * $80).

The unit price in each pro forma invoice line is calculated as the billed amount divided by the billed quantity.

- On the form toolbar, click Remove Hold to assign the pro forma invoice the Open status, and then click Release to release the pro forma invoice. The system closes the pro forma invoice (which is now assigned the Closed status) and creates a corresponding accounts receivable invoice based on the pro forma invoice.

- On the Financial tab, click the AR Ref. Nbr. link to open the accounts receivable invoice that was created on the Invoices and Memos (AR301000) form.

- On the form toolbar of the Invoices and Memos form, click Remove Hold to assign the invoice the Balanced status, and then click Release to release the accounts receivable invoice.

Step 2: Reviewing the Project Transactions and the Updated Project Balance

To review the project transactions and project balance, do the following:

- On the Project Transaction Details (PM401000) form, in the Summary area, select TOMYUM3 as the Project. In the table, review the project transactions that have been created based on the released accounts receivable invoice (these are the lines that have AR specified in the Module column and that have negative amounts). In the GL Batch Nbr. column, the reference number of the corresponding GL batch is shown. Also notice that the project transactions based on which you have performed billing now have the check box in the Billed column selected, indicating that these transactions have been billed.

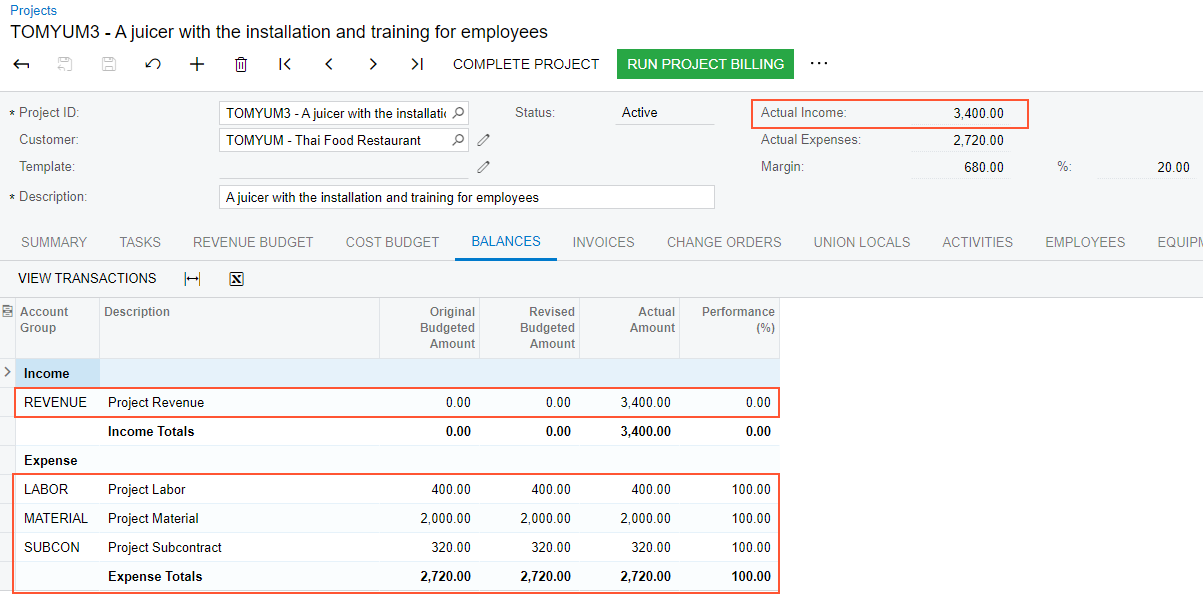

- On the Projects (PM301000) form, open the TOMYUM3 project. Notice that in the Summary area, the Actual Income box now shows $3,400, which is the total amount of the invoice that you have processed. On the Revenue Budget tab, notice that the system has automatically created two revenue budget lines (one for each project task) and filled in the Actual Amount for the rows (3,000 and 400).

- On the Balances tab (see the following screenshot),

review the project income and expenses aggregated by account groups.

Figure 1. The project balances after project billing

You have billed the project based on the different billing rates specified for different types of expenses.